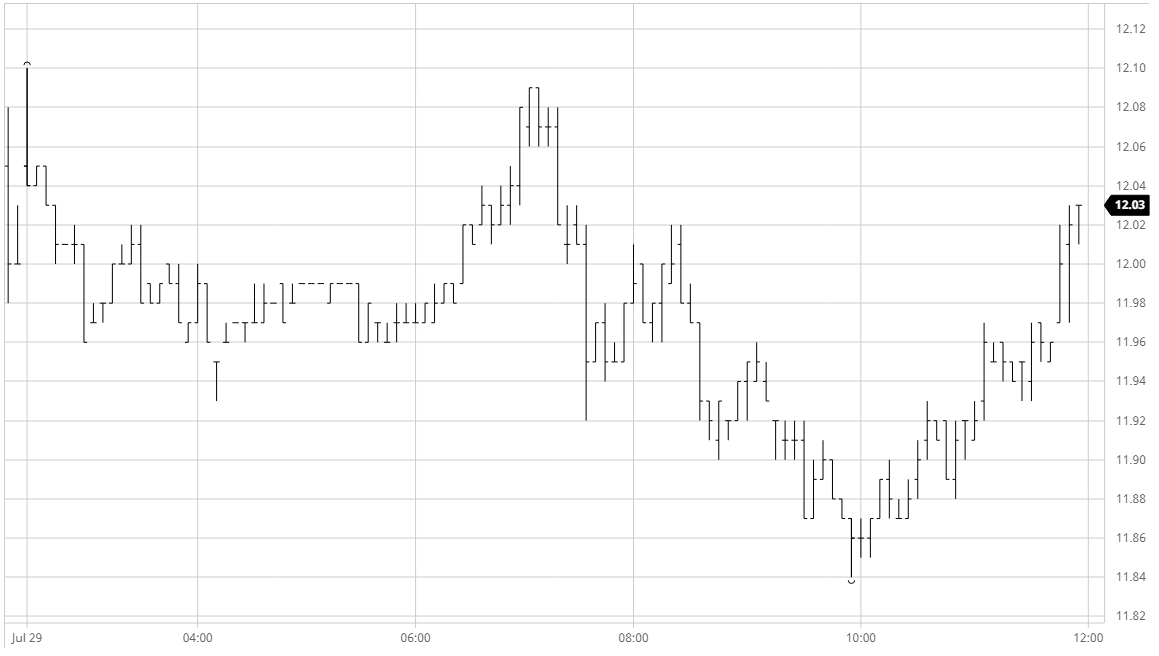

An uneventful start to the day saw Oct’20 slip from an initial 12.10 high to spend a long period edging sideways just beneath 12c on low volumes as dull range bound trading resumed following the recent excitement. With no fresh news we only broke out of this narrow band as US traders began to come online with a little light buying taking the prices back towards opening highs, though this proved to be a half-hearted effort and values soon slipped to new session lows. There was slightly better buying showing up for the London whites as the No.11 stuttered and this took the V20 white premium out towards $101 while the No.11 slumped to a session low 11.84. Oct’20 spreads were meantime giving back a chunk of the gains made on Monday with the lower outright values contributing to a fall in Oct/March to -0.65 points. Defensive buying from longs over the final two hours helped nearby values to pull back up towards overnight levels, and appropriately given the quiet nature of the day Oct’20 settled unchanged at 12.01.

SB Oct – Sugar No.11

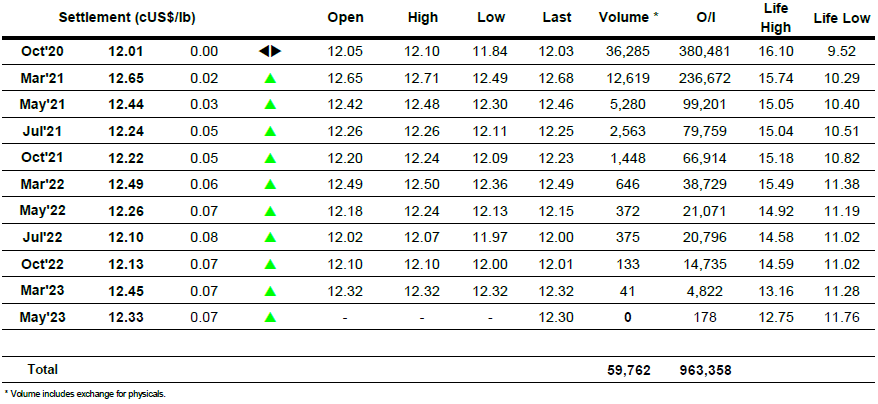

ICE Futures U.S. Sugar No.11 Contract

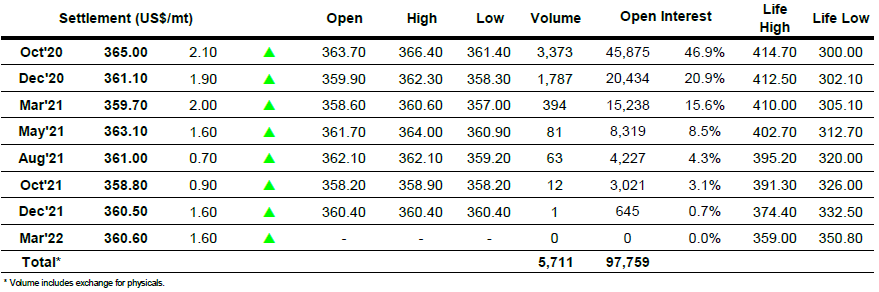

ICE Europe White Sugar Futures Contract