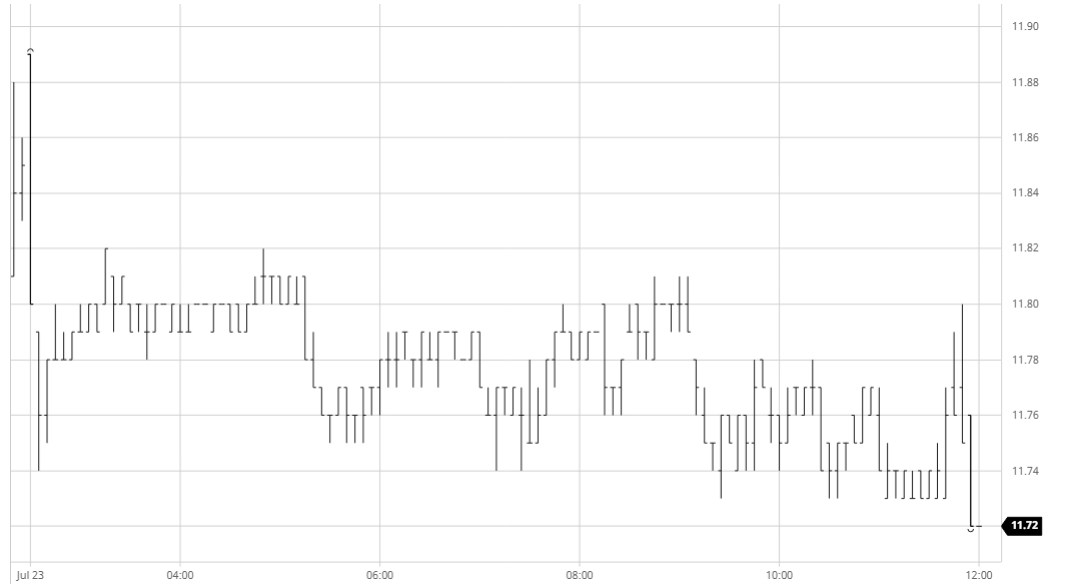

Initial higher prints were extremely short-lived and within minutes of the opening Oct’20 was trading down to 11.74. This undid all the gains made late yesterday and given the recent turgid nature of the market it set the tone for another day of slow toil. The rest of the morning saw prices edge along in a tight band at the lower end of the initial range, and with spread volumes also low (Oct/March is stuck around -0.70) the time began to drag. USDBRL opened a little weaker and moved back to 5.19, however in keeping with recent times this was disregarded by the market and outright values continued their monotonous trudge sideways. The afternoon was mostly played out at the lower end of the range and despite some late short covering to ensure settlement away from the lows at 11.77 we ended poorly with final trades at the session low mark of 11.72, though there is nothing in this to suggest that it will in any way alter the current range bound situation.

SB Oct – Sugar No.11

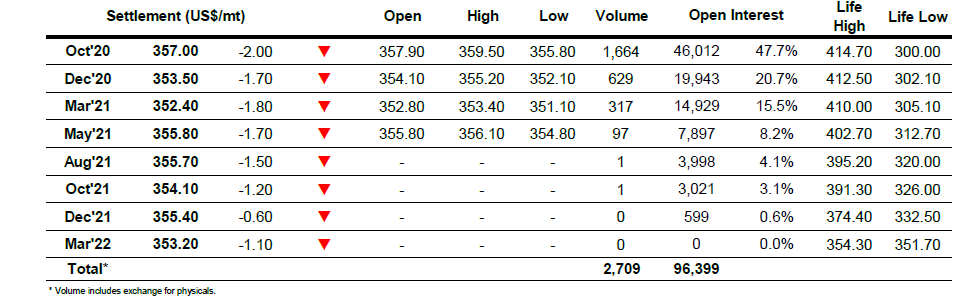

ICE Futures U.S. Sugar No.11 Contract

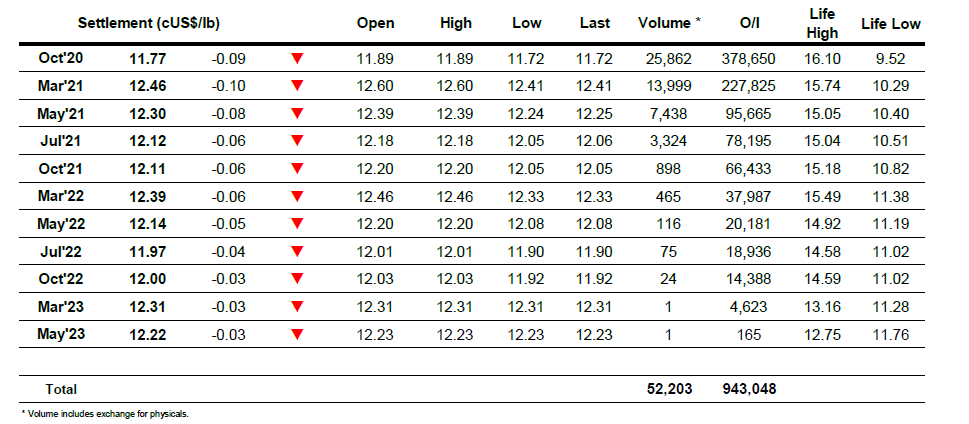

ICE Europe White Sugar Futures Contract