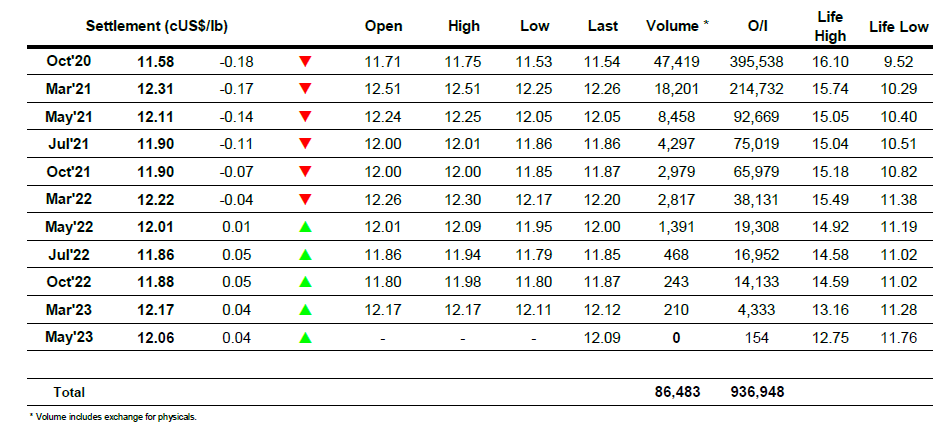

Poor performances over the second half of last week have left the market looking more vulnerable, and Fridays COT report showing further growth in the fund long to 82,059 lots will do little to allay concerns with much of the long position established above current levels. Initial trades around unchanged levels were not sustained however in quiet conditions we spent the morning holding a narrow range either side of 11.70, hoping for a spark to generate some interest. Even the arrival of US based traders failed to generate this spark and it was not until mid-afternoon that we saw prices move to fresh ground with some with a little spec/algo selling appearing as we broke beneath Fridays 11.68 low mark to send Oct down to 11.57. A short covering rally followed to instigate a recovery back to opening levels however it could not be sustained and prices started to erode once again during the final hour. A burst of aggressive spec selling as we headed into the closing call sent values to new session lows and ensured a weak settlement at 11.58. The recent low of 11.40 (29th June) is now back in focus for day traders and algo’s who will be looking to generate momentum and trigger stops and long liquidation from funds should they be able to break beneath.

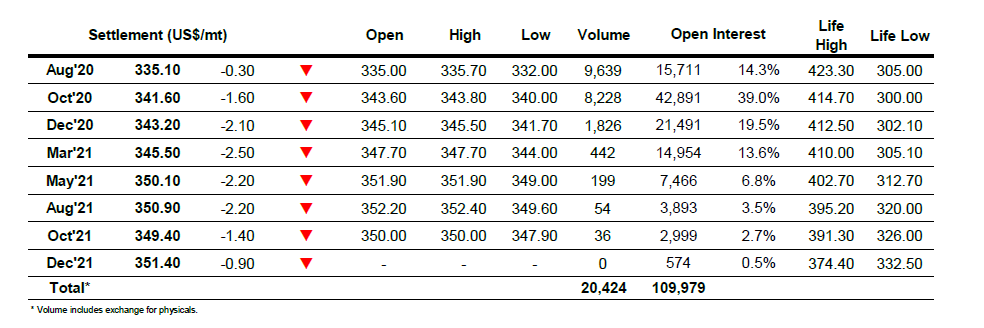

SB Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract