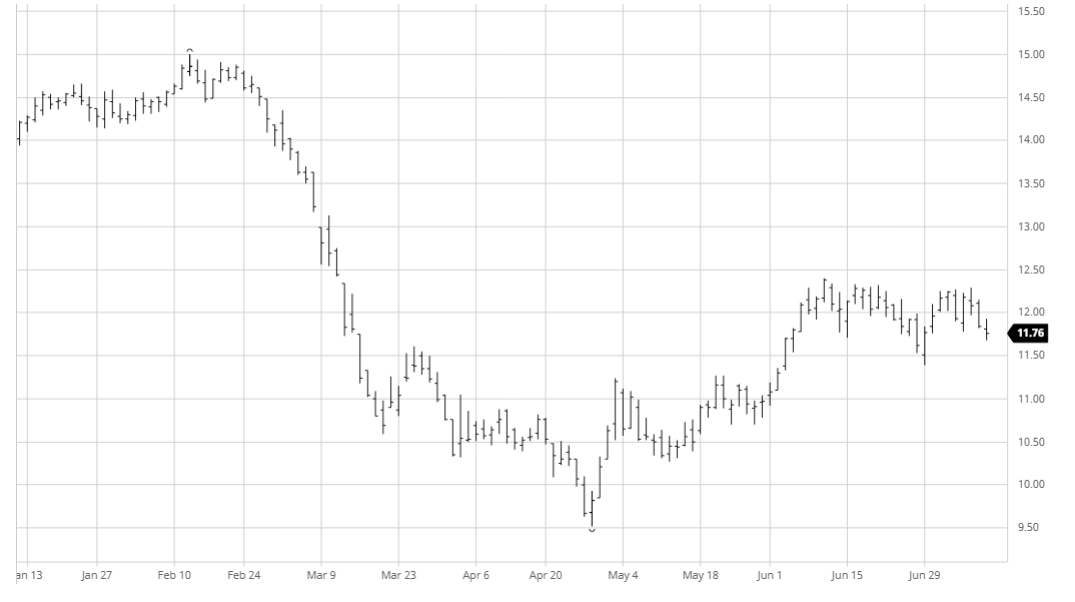

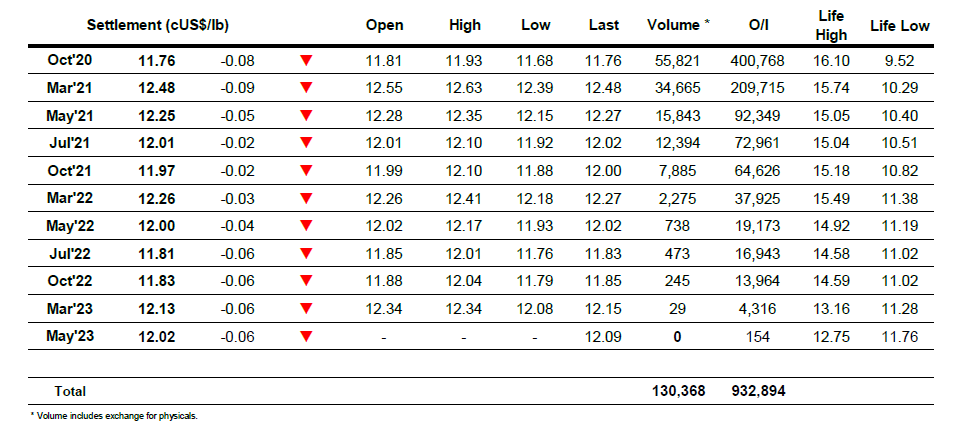

Early activity saw initial losses swiftly reversed on the back of a slightly firmer whites opening, however values for both then began to slide and moved into slight debit where the remained for the rest of the morning. There was however some stability for Oct’20 spread values during this period with some buying emerging for Oct/March to bring the differential back to -0.69 points, stemming the recent losses having fallen to the support area that held during April and May. The start of the US morning initially brought some selling which pushed Oct’20 down to 11.68 however the decline was short-lived and a remarkable turnaround followed as the price shot back to a session high of 11.93 fuelled by spec and algo buying. This coincided with the energy sector having recovered its early losses, however the rally was not maintained and despite the wider macro remaining firm prices slipped back to again visit the earlier session lows. The final hour did see some stabilisation in front of the lows to leave Oct’20 concluding the week at 11.76, still resolutely stuck within the broad recent range.

SB Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

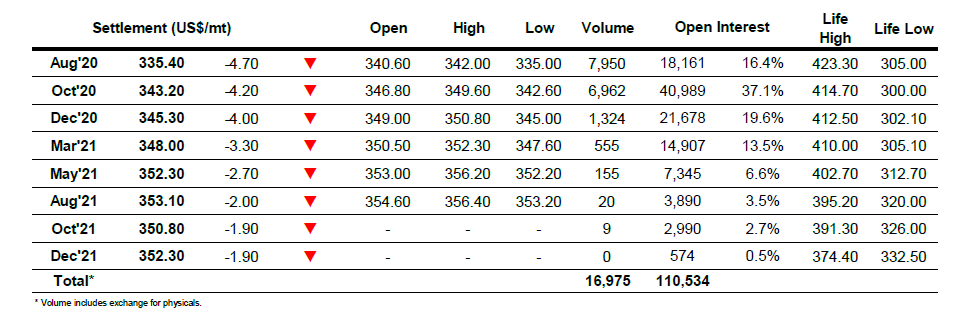

ICE Europe White Sugar Futures Contract