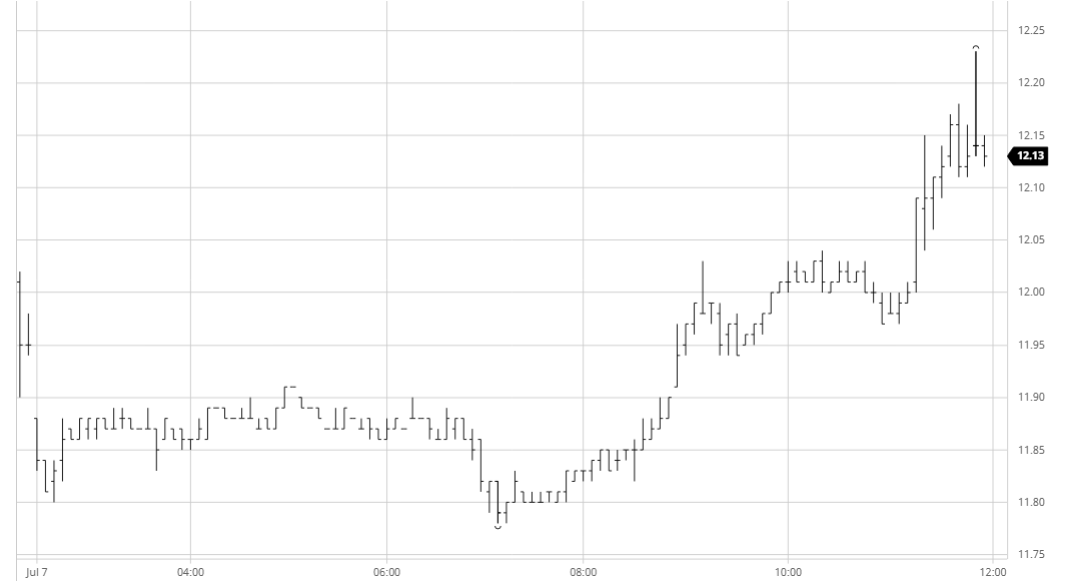

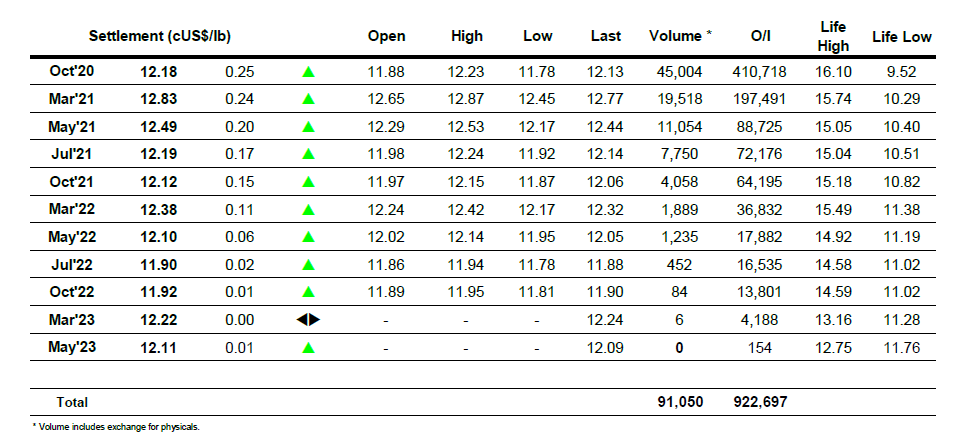

Early trading saw values suffering from a hangover from yesterday disappointing performance, losing a little more ground against a disappointing macro background to trade down to 11.78 for Oct’20 by the end of a slow morning. The arrival of Americas based traders heralded a turnaround in fortunes for the wider commodity sector and while we were initially slow to join this general recovery the specs gradually became more interested and pushed nearby values back through 12c once again. In still quiet conditions the initial rally was not sustained with the market enjoying yet more quiet consolidation, however this then formed a basis for specs to push aggressively upwards during the final hour. Session highs were recorded at 12.23 with a settlement price of 12.18 to reverse the damage done yesterday and placing Sugar at the upper end of the commodity basket for the day, a fairly impressive recovery given the generally quiet nature of the day. Whether it can be the catalyst to finally break the wall which has formed in the region of 12.30 and lead to an exit from this ongoing range remains to be seen, however the prospect is certainly renewed.

SB Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

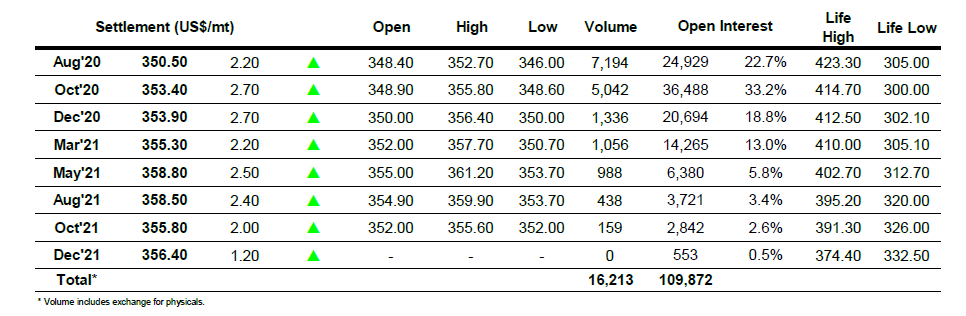

ICE Europe White Sugar Futures Contract