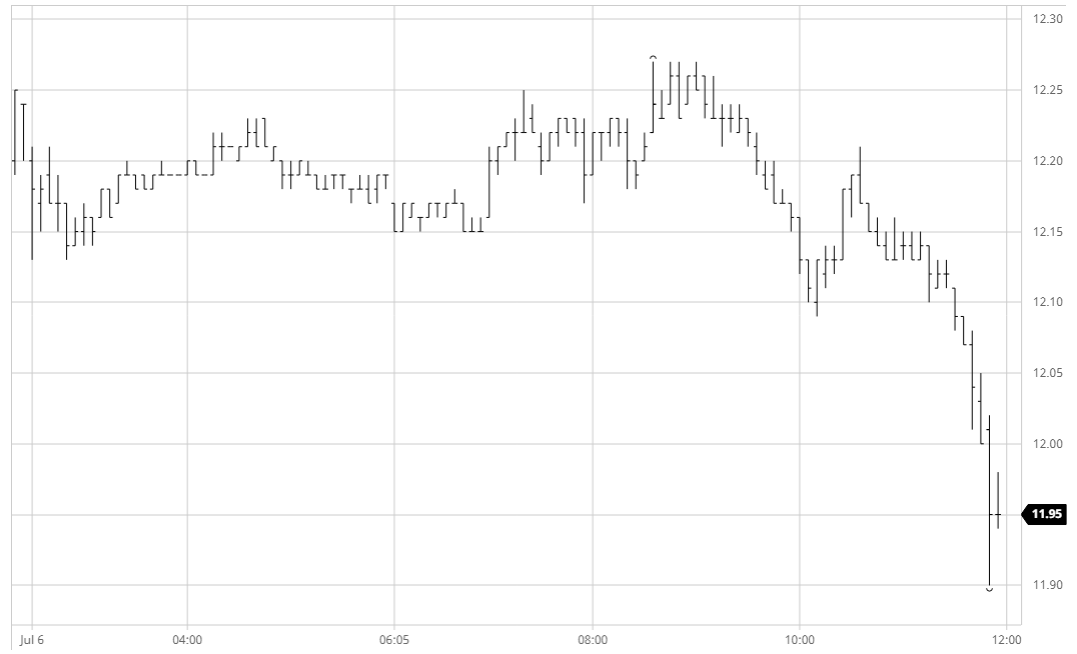

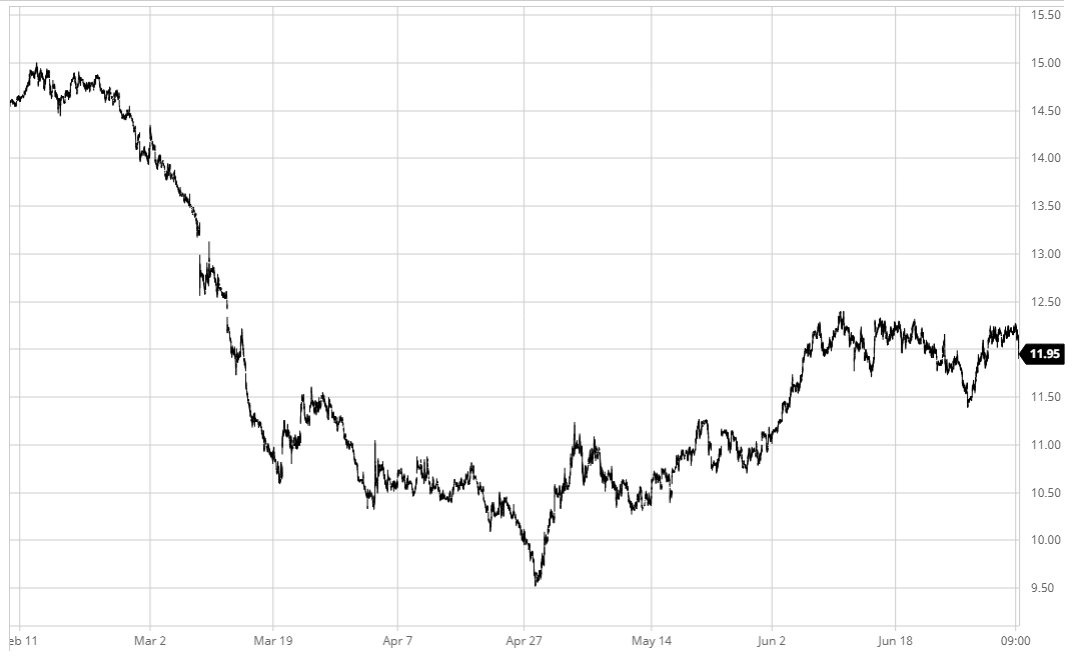

Resuming after the extended US holiday weekend the market was rather subdued with early trading taking place a little beneath Thursdays closing values. This was despite a slightly firmer macro picture, though it was fair to say that with crude values struggling to make further gains above $40 its influence upon the specs has shown signs of diminishing. Still the market refused to fall back by very far and following a long laborious period of sideways trading the arrival of US based specs into the fray did at least encourage a push back upwards into credit with the spot month trading up to 12.27. Heavier scale selling continues to start from this area, and with today marking the third successive session at which we have tested the area that provided such good resistance last month the specs soon lost their appetite with some light liquidation sending values down the narrow range to fresh session lows. A brief period of respite followed however the damage was done and the remainder of the session saw further liquidation at an increasing pace, sending Oct’20 back below 12c during the latter stages. Late position squaring did ensure that final trades were a few points away from the lows, however a settlement price at 11.93 following the latest failure to break upward appears weak and failing a spark from the macro we seem set to retreat back down into the lower reaches of the recent range once more.

SB Oct – Sugar No.11

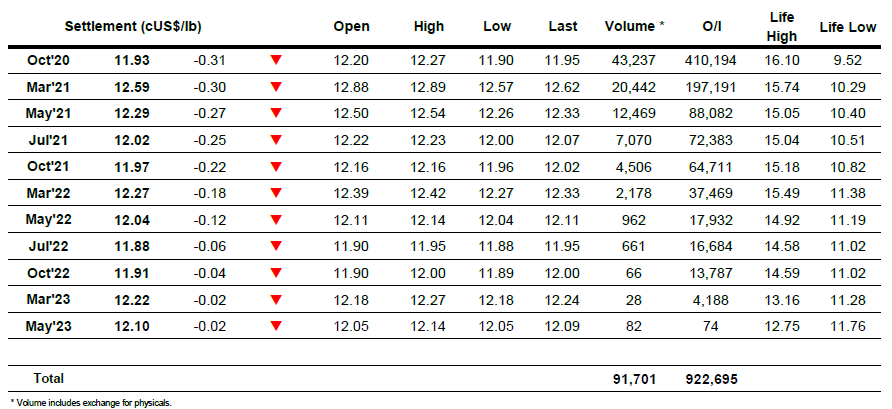

ICE Futures U.S. Sugar No.11 Contract

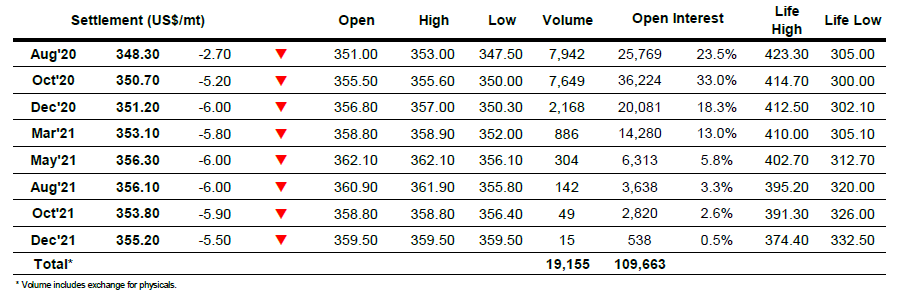

ICE Europe White Sugar Futures Contract