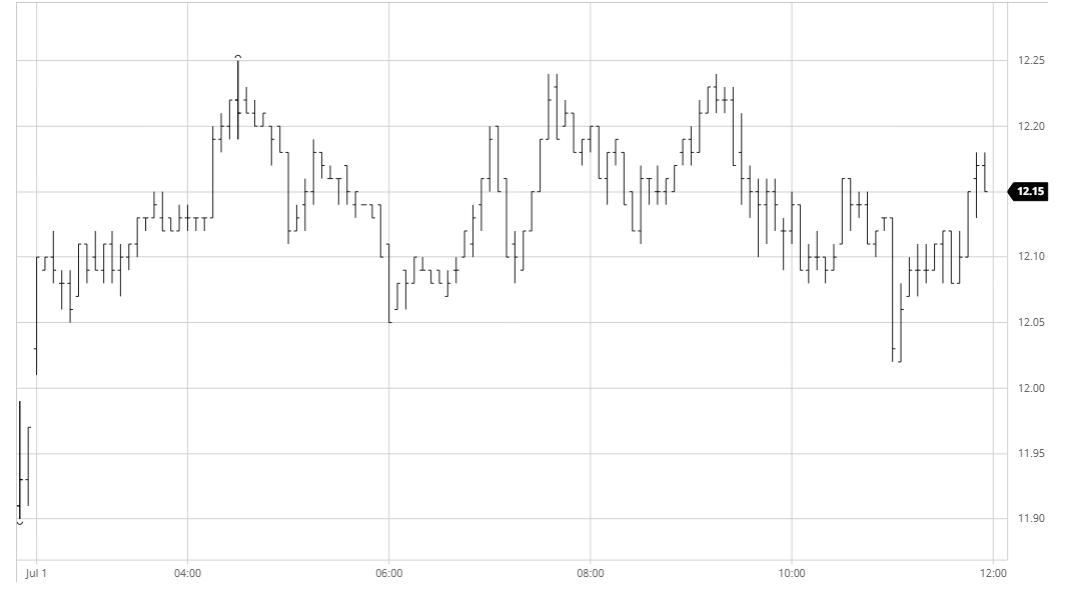

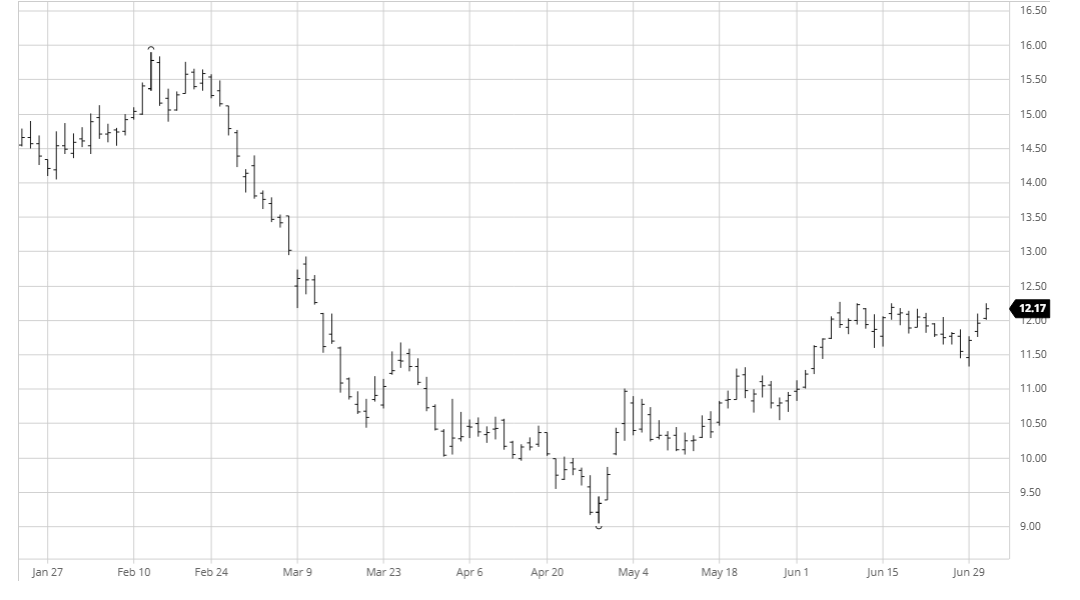

- Last week’s woes are a distant memory as the market today continued its recovery and worked back beyond 12c to the recent highs. An immediate gap up from the closing 11.96 level to 12.01 acted as the basis for prices to quickly work above 12.10 which provided the platform for the market to challenge upward and record a morning high at 12.25. The strength was again being generated by specs with the recovery in crude/energy values providing macro support that they seemingly require before trying to push ahead, and their buying continued into the afternoon as a couple of renewed bursts of buying saw successive peaks made just a point beneath the mornings high mark. With the macro having fallen away from its earlier highs there was a fall to 12.02 against long liquidation, however buying returned for the close to ensure a constructive settlement at 12.17. This keeps last month’s 12.40 high in focus though whether it can be reached will likely remain in the hands of the macro picture.

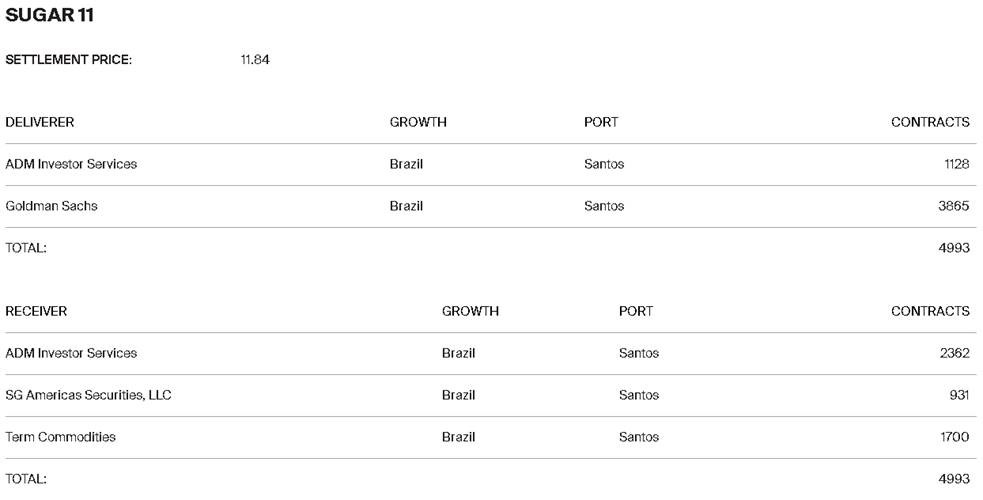

- The Jul’20 tender has seen 4,993 lots (253,657t) tendered, with formal details shown below. Delivering were ADM (Sucden Paris) and Goldman Sachs (Raizen). Receivers are ADM (Czarnikow), SG (Wilmar) and Term (Dreyfus).

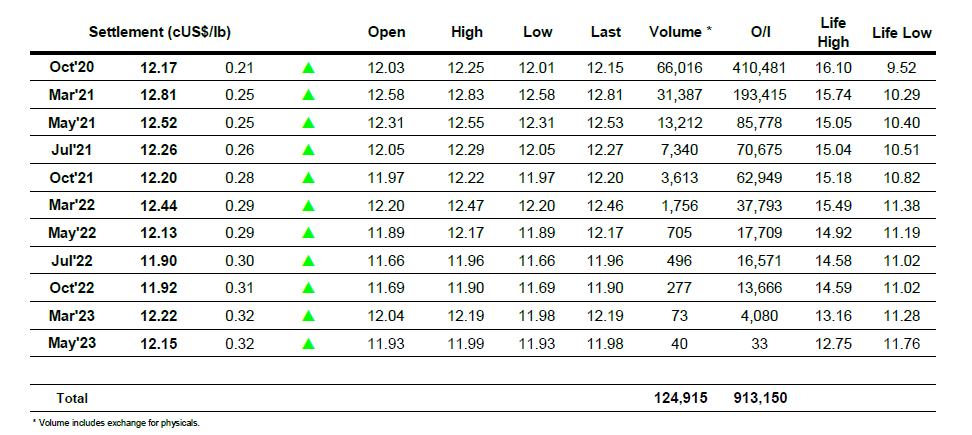

SB Oct- Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

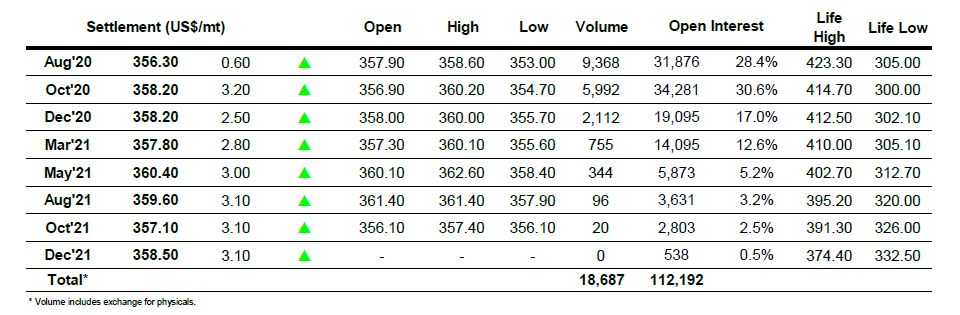

ICE Europe White Sugar Futures Contract