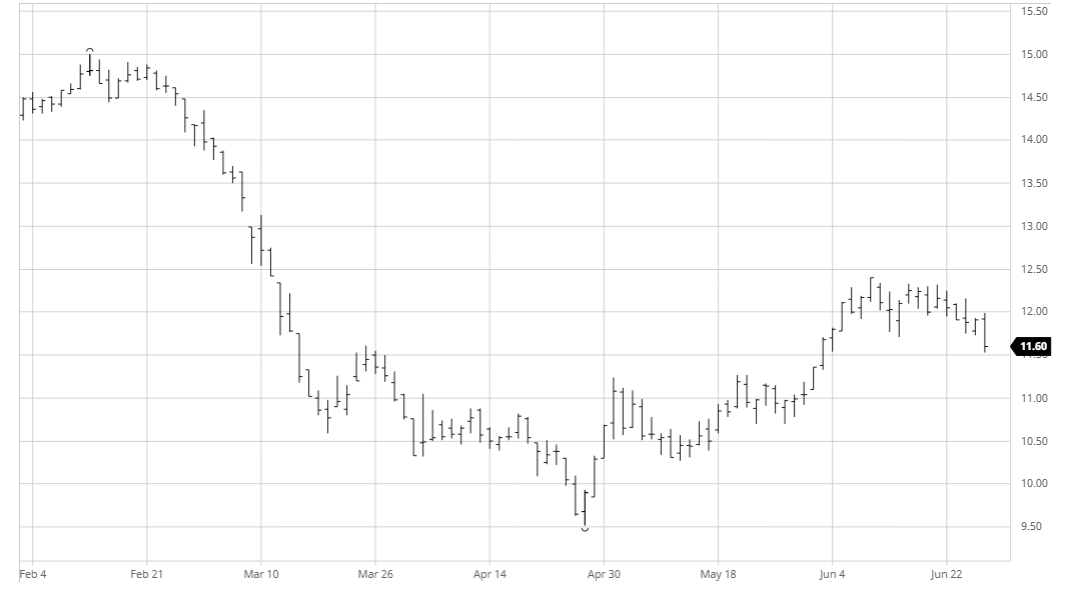

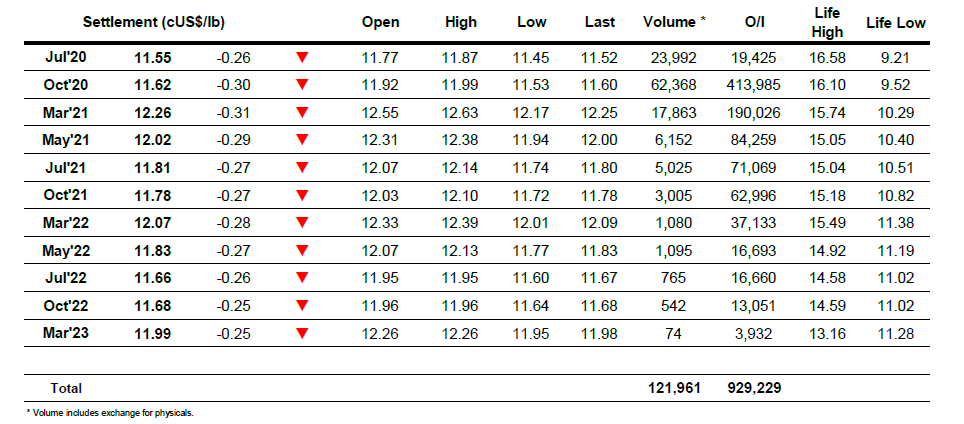

Initial stability proved to be short-lived as the market soon slipped back beneath overnight levels to maintain its recent morning pattern of moderate losses. Unlike previous days the decline was a little more steady and by the end of the morning we had slipped below 11.80 in a shallow downtrend, with the macro by now also showing increasing signs of weakness. This seemed to unnerve specs who have continued to sit on their longs and the start of the US morning brought renewed selling from this sector as the move below the recent 11.71 low triggered off sell stops to send prices down to the lows 11.60’s. A whole cluster of factors including continued whites weakness / weaker USDBRL in the 5.40’s / a broadly lower CRB and macro then combined to encourage further selling which extended through the afternoon as we traded to 11.53. There were signs of some consumer pricing at the lower levels and this provided support and enabled a base to be formed from which some final hour short covering took place. In contrast to whites which saw a recovery to erase the earlier WP losses (Aug/Jul’20 back to $97 having earlier printed sub $90) the bounce was more modest, reaching only 11.65 with the settlement level of 11.62 representing a weak technical close.

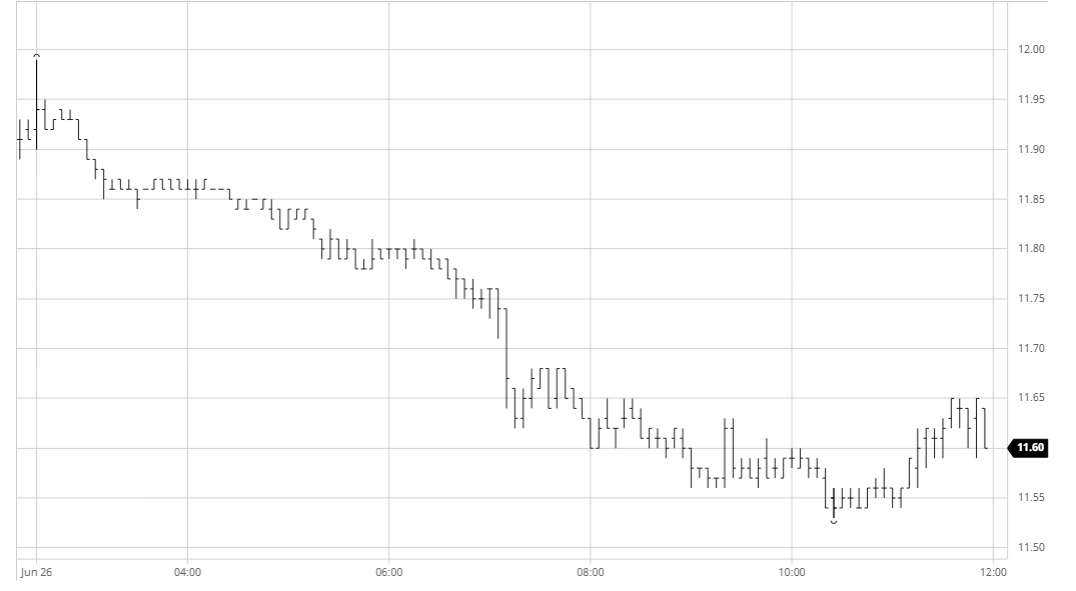

SB Oct- Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

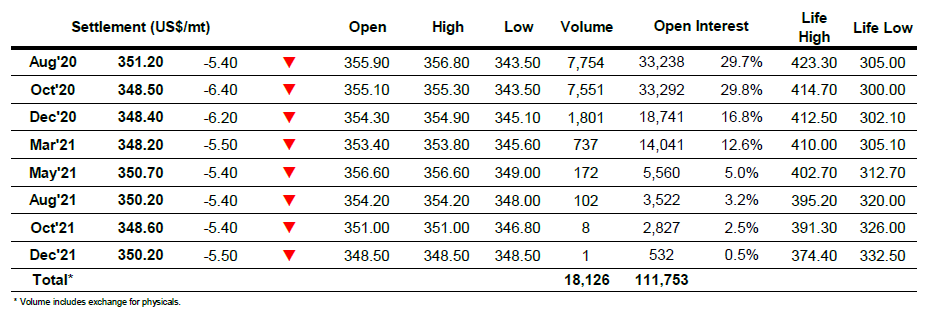

ICE Europe White Sugar Futures Contract