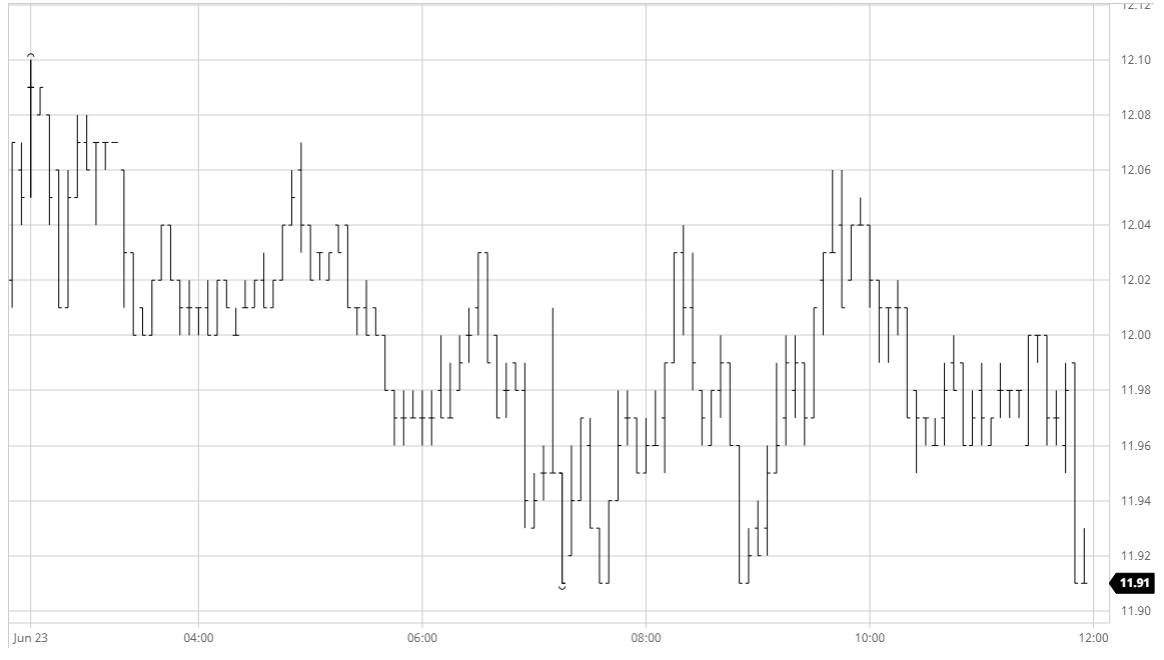

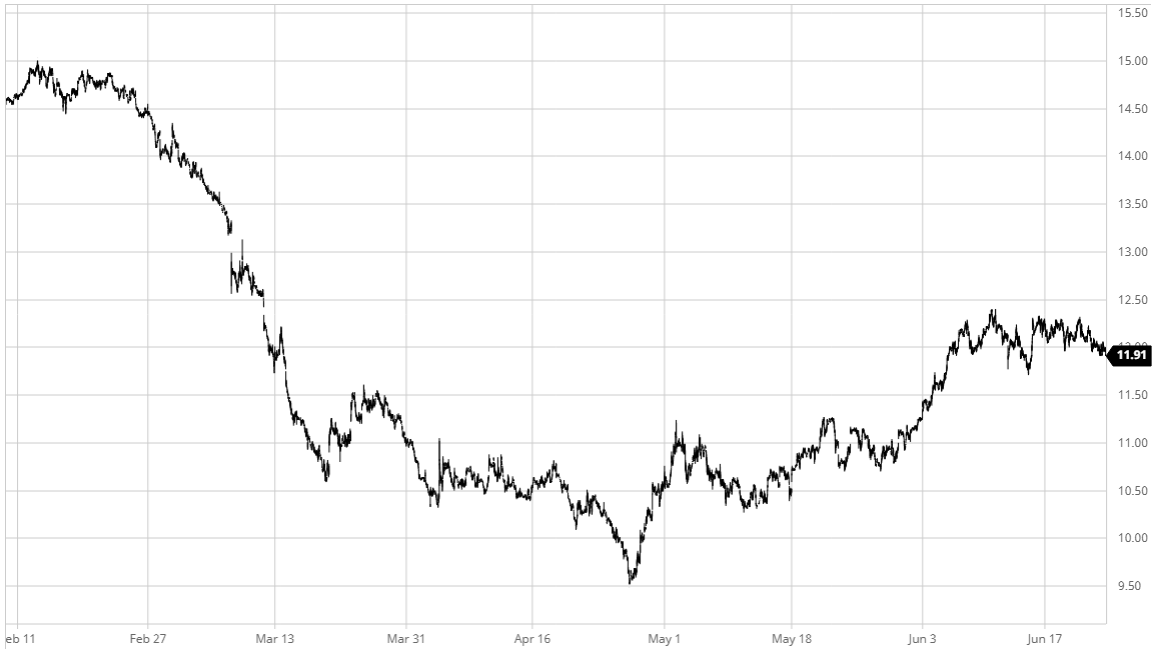

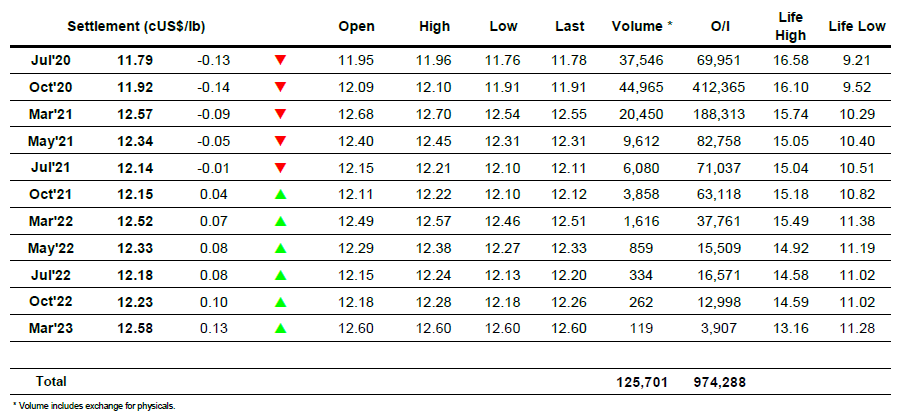

It was a slow start to the day as Oct’20 initially held near to unchanged before slipping a few points, spending the rest of the morning in a narrow range either side of 12c. This was in contrast to the wider macro which was being led higher by crude and equities, and maybe shows how the shift on the structure of the whites seen recently is transferring across to No.11 and adding to concerns that the recent highs around 12.30 may represent a near term top. There was a dip to a new session low of 11.91 as US based traders came online however in keeping with the recent range bound nature of the market we then resumed the morning pattern to again centre activity back around 12c. Spreads were also proving rather quiet with Jul/Oct’20 trading near to -0.14 pts throughout the session, while the moderate volume for the front month will increase the feeling that we may see another large tender at next week’s Jul’20 expiry. There was no real change to flat price through the rest of the day, BRL back towards 5.15 was making no difference given how quiet the producers have been and we meandered to the close before settling at 11.92 following a burst of MOC selling.

SB Oct- Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

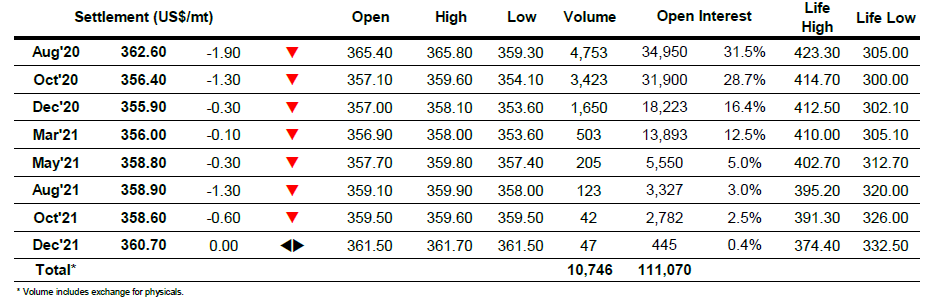

ICE Europe White Sugar Futures Contract