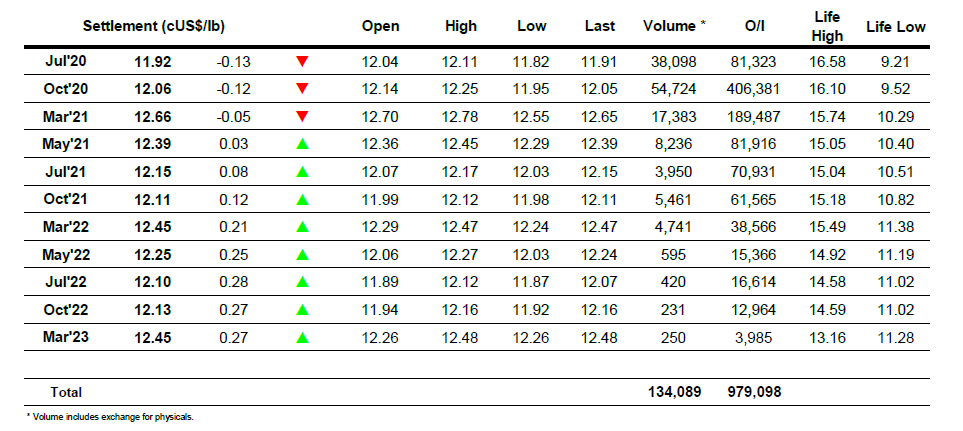

There was little to inspire the market ahead of the new week with the only fresh news being the confirmation that as expected the specs/funds had increased their long position to show as 47,118 lots as at cob Tuesday. Initial buying was quickly filled and we were soon trading lower, possibly in reaction to losses already showing across the agriculture sector although with London whites suggesting a change to the structure last week this may also be raising some concerns amongst the longs. Still we did not collapse with buying ahead of 12c providing support which held through to mid-session. The start of the US morning then saw a burst of fresh spec buying that pushed values back towards session highs, however the move fell just short of the early 12.25 high mark as producer selling again sat poised above the market and we instead fell back downwards, eventually trading below 12c. In keeping with recent days there was buying for the final hour which ensured another settlement above 12c though it did not disguise what was a rather featureless range bound session.

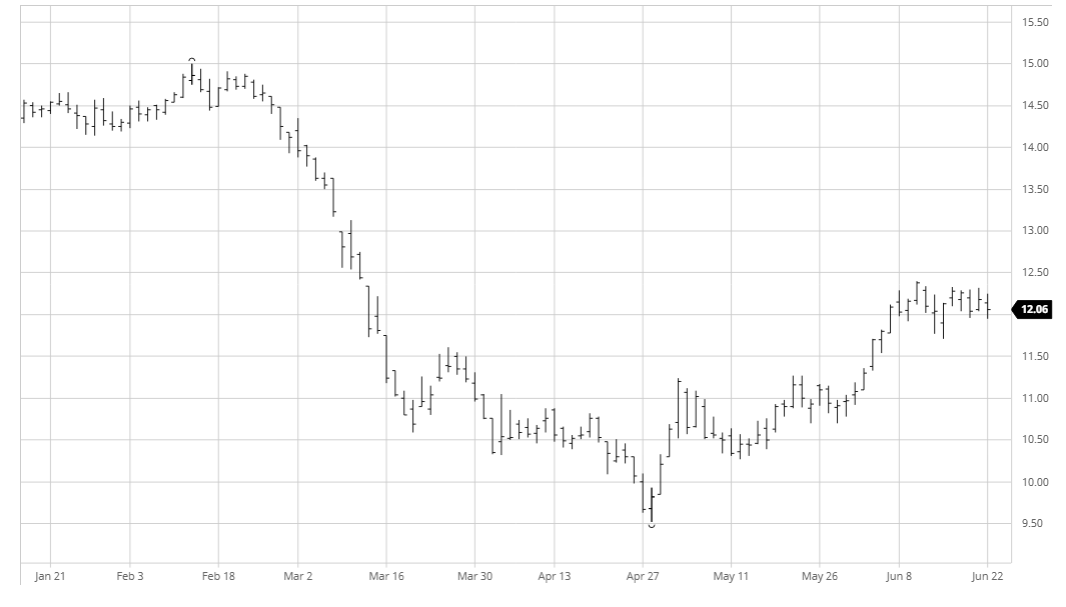

SB Oct’20 – Sugar no.11 Futures

ICE Futures U.S. Sugar No.11 Contract

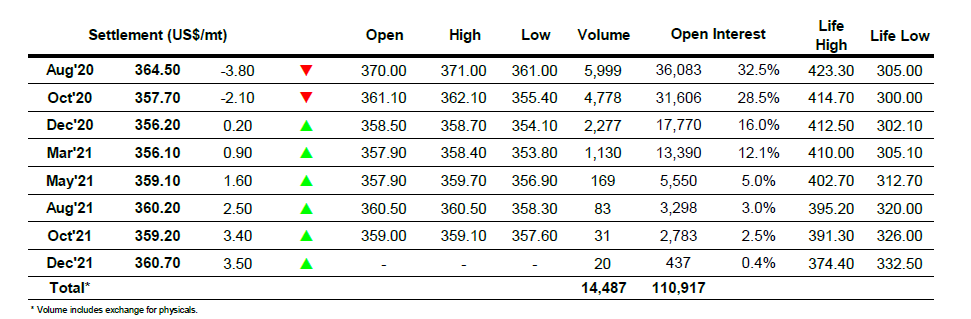

ICE Europe White Sugar Futures Contract