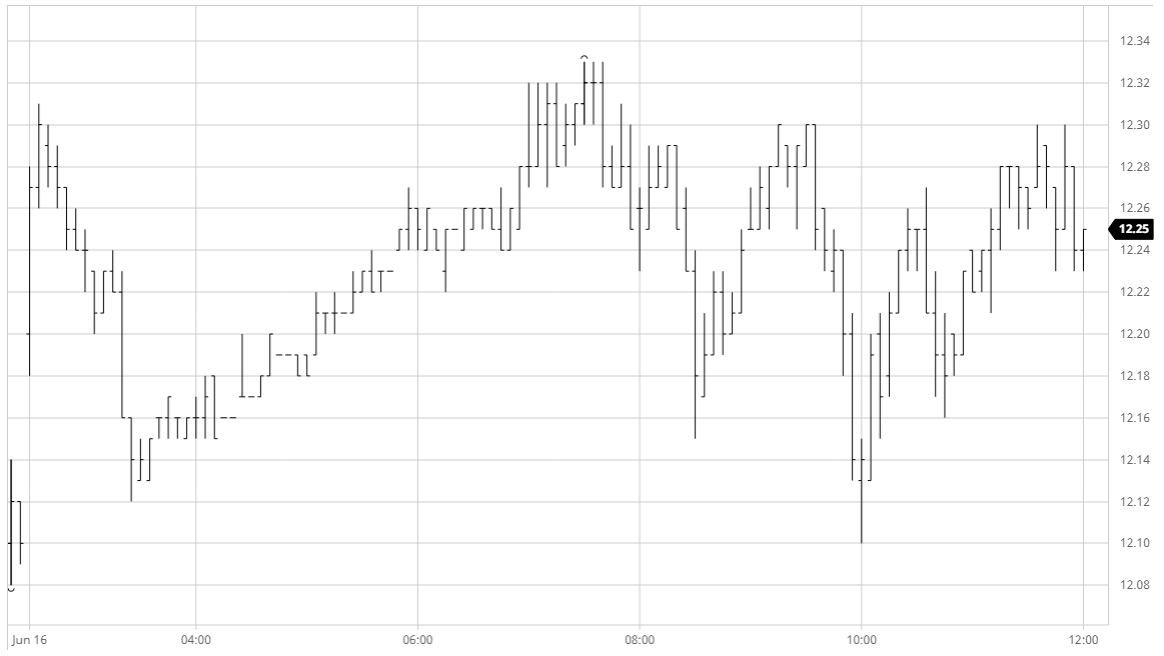

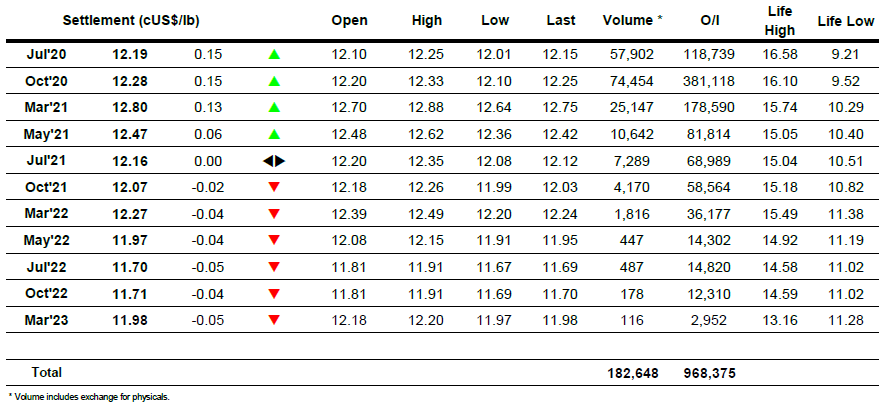

The macro continues to provide the ammunition for the speculative community and released from the shackles of last night’s Jul’20 option expiry with a firmer picture contributing to a gap opening as Oct’20 traded on to 12.31. There was no follow up buying however and the gap was clearly evident in the focus with the market soon correcting down to fill it before beginning to edge higher once again in a more controlled and steady fashion. The steadiness was maintained through into the early afternoon and led prices through to new session highs at 12.33, though progress became trickier above 12.30 with better selling from producers showing up as we approach last week’s high mark of 12.40. An afternoon of volatility followed as prices zipped around within the same broad range (a marginal new low of 12.01 was established) with tests of both ends proving to be rather short-lived. This marked a detachment from recent macro led activity where sugars position within the basket has varied on said moves, and overall only serves to further cloud the recent lack of direction. Spec longs were naturally wanting to maintain a positive gloss to conclude the day and had Oct trading to 12.30 on the call with a positive settlement just beneath this level at 12.28.

SB Oct- Sugar no. 11 Futures

ICE Futures U.S. Sugar No.11 Contract

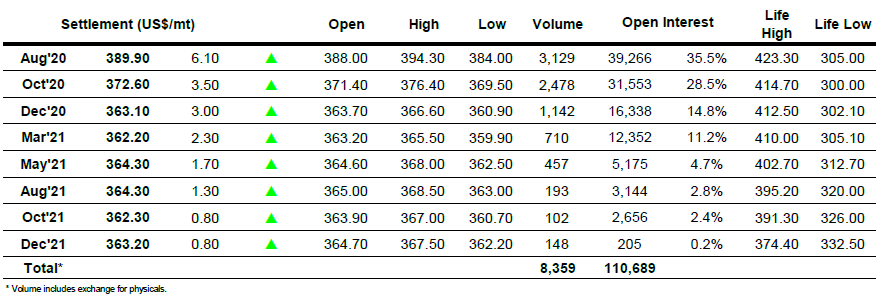

ICE Europe White Sugar Futures Contract