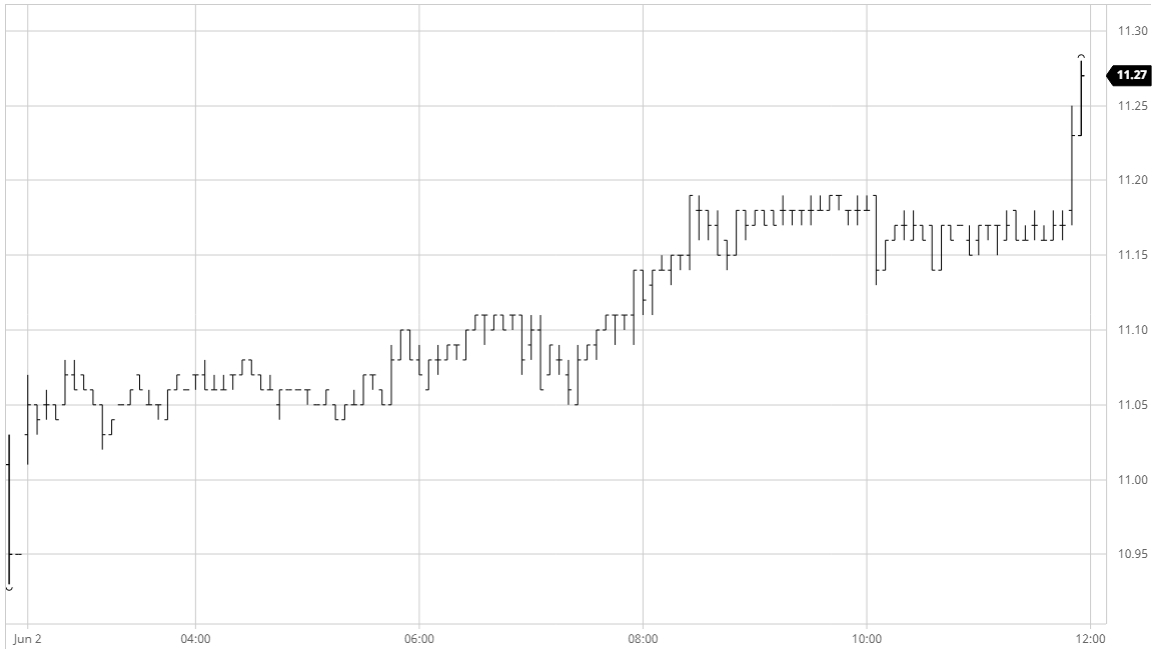

The market opened positively above 11c however there was little to get excited about as were proceed to spend the first few hours nudging sideways on incredibly light volumes. This did at least provide a platform to try and work back up towards last week’s highs and with the macro in positive territory the specs were suitably encouraged to make a push during the afternoon which sent Jul’20 through some assorted producer selling to reach 11.19 before stalling. Though we were lacking the volume of buying to continue upwards we did not fall back by far, instead spending the next three hours holding a narrow 6 point range just below the highs. The afternoon meanwhile saw the macro remain firm, led by solid performances across the energy sector, something that would have encouraged specs to hold on to their long holdings, while the USDBRL was pushing to new recent highs at 5.2116. This currency strength was based upon two spot auctions taking place as they continue to fight against the threat of further depreciation, though was not making any real difference to the producer scale selling which continued above the market. The picture changed during the final 10 minutes as aggressive spec buying broke through the 11.19 mark to reach 11.28 on strong volume, with settlement established in between at 11.22. The recent high mark of 11.32 (21st May) is now only just above and will no doubt provide the initial focus tomorrow as specs look to build on the momentum.

No.11 Futures

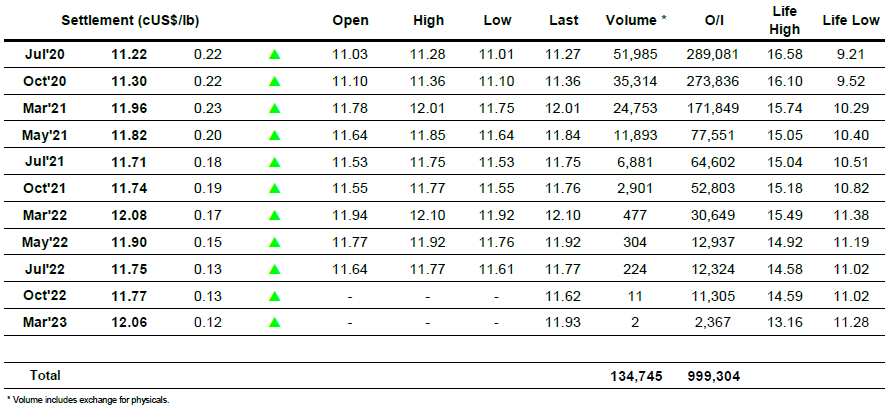

ICE Futures U.S. Sugar No.11 Contract

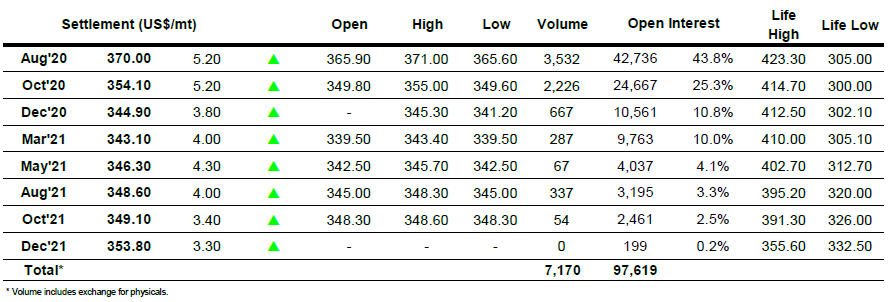

ICE Europe White Sugar Futures Contract