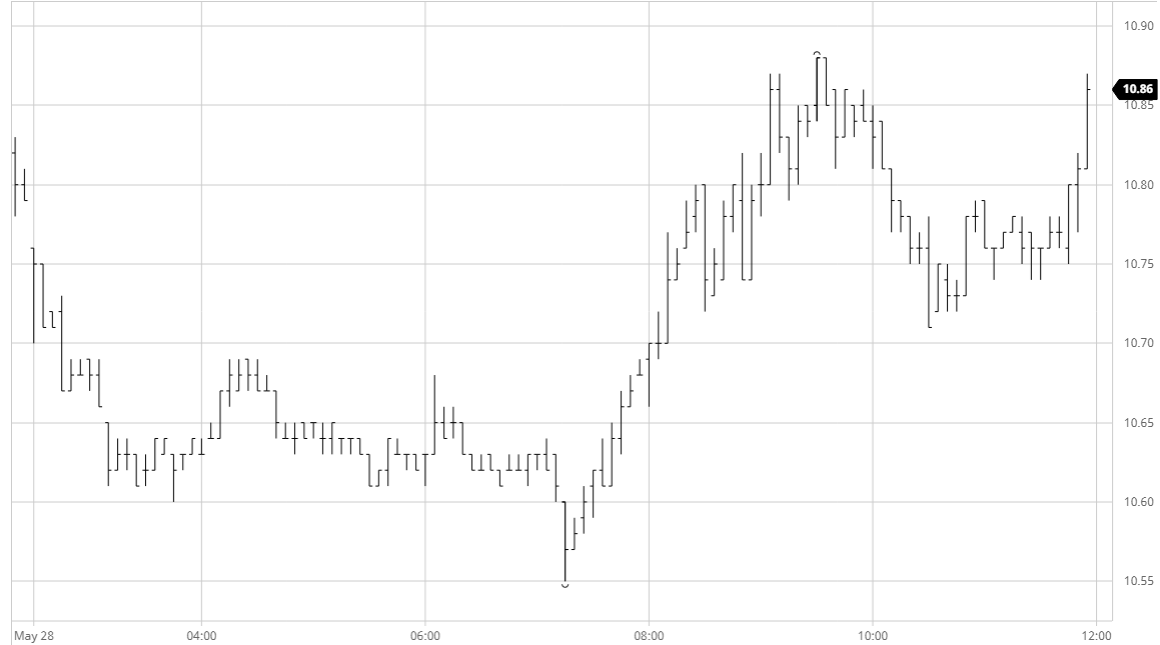

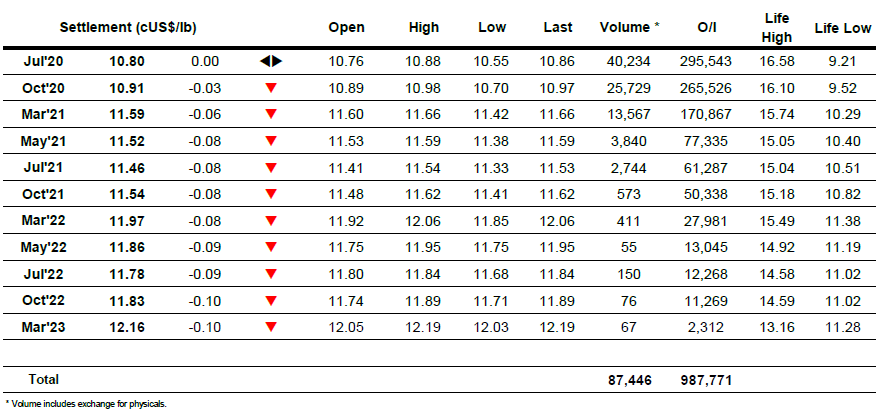

Yesterday’s relatively poor showing set the tone for early activity with nearby prices losing further ground during early trading before consolidating the 10.60’s. Volume remained light with the trade standing away from the market as we continue to play the same broad range, while spec activity has also slumped. We continued at the lower end of the range until the early afternoon when reports that Opec may extend the production cuts through the rest of 2020 sent WTI and the wider energy sector back upwards, with spec buying emerging to track the macro once again. This simply pulled values back towards unchanged levels however and lacking the strength to mount a more serious push back up we remained in this area to conclude a slow day with Jul’20 settling unchanged at 10.80.

N.o 11 Futures

ICE Futures U.S. Sugar No.11 Contract

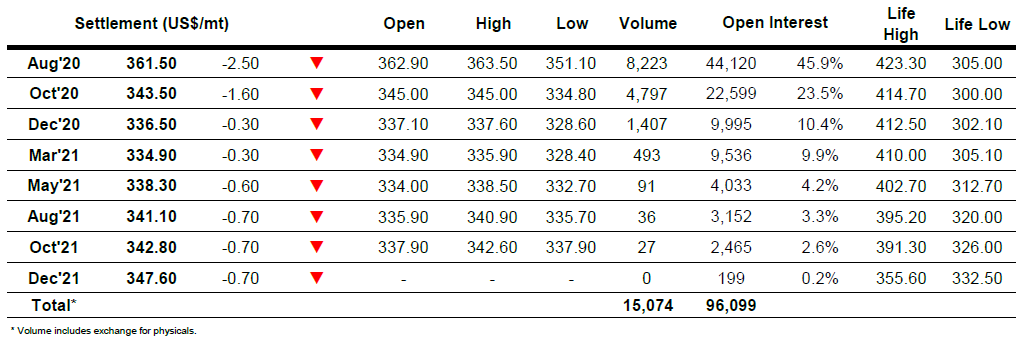

ICE Europe White Sugar Futures Contract