The market opened positively following the extended holiday weekend with Jul’20 following the macro and gapping higher as it pushed to 11.20 during early trading. With funds now believed to be pretty much square after Fridays COT showed a net short of just -10,506 lots as at cob 19th May we simply edged along sideways throughout the morning with no other direction being provided in the quiet conditions. The slow narrow range continued on into the afternoon and unusually it was fundmentals rather than the macro which saw us finally generate some movement as the publication of the latest UNICA figures showing 2.5m tonnes of sugar with an ATR of 130.82kg/t encouraged selling which forced a sharp correction back to 10.93, in the process filling the overnight gap on the daily chart. Prices then remained at the lower end of the range until the final hour and it seemed as though we may conclude near to unchanged values however the specs had other ideas. Whether their late buying was motivated by the whites which were putting in another stellar performance (QN20 WP trading above $133) or a desire from the specs to continue the recent move and turn long remains to be seen, however it was sufficient to ensure a close above 11c with Jul20 ending the day at 11.05.

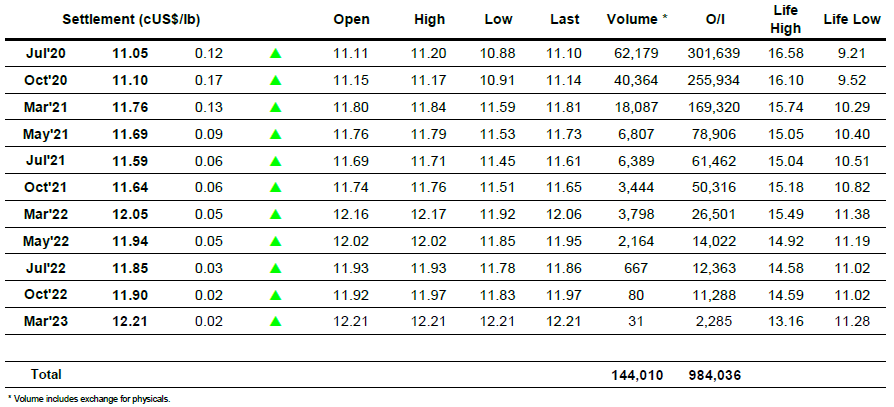

No.11 Futures

ICE Futures U.S. Sugar No.11 Contract

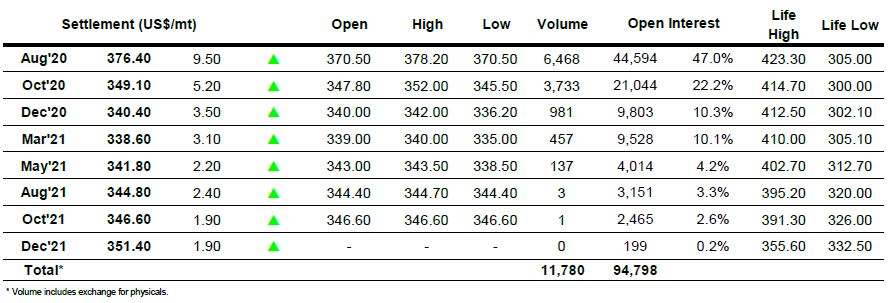

ICE Europe White Sugar Futures Contract