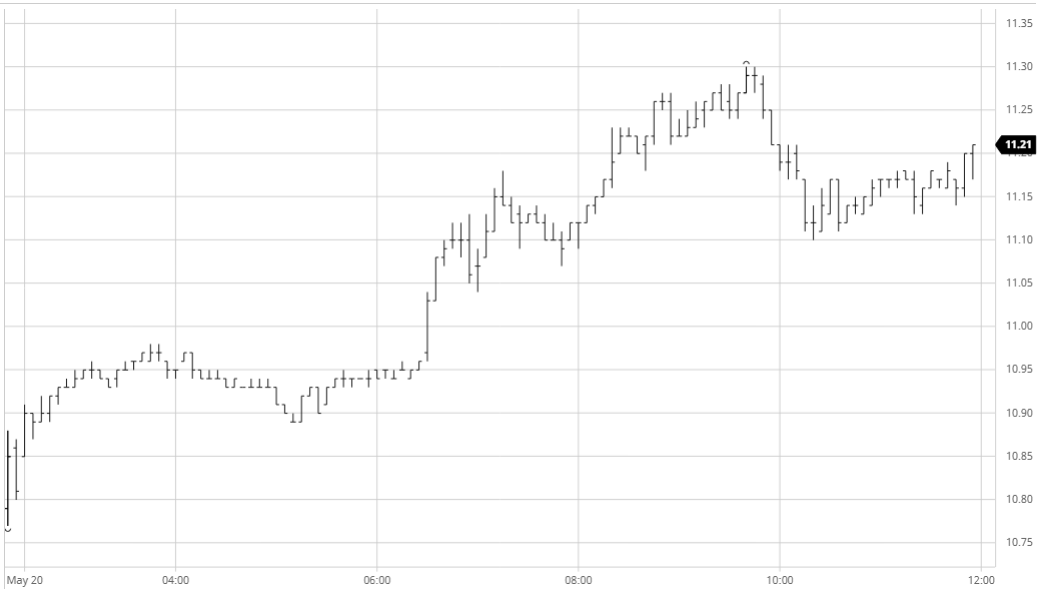

A calmer morning saw Jul’20 consolidating the recent gains and position itself in the 10.90’s ready for a new look at the recent 11.01 high. It took until the early afternoon for the momentum to build however a push from specs sent the market up into fresh ground, triggering some fund buy stops in the process as we reached 11.18 before pausing. Nearby spreads were also gaining in strength once again and we saw Jul/Oct return to a small premium where it remained for the rest of the session. With macro strength again being led by increases in crude values we pushed further through producer pricing to reach 11.30 until a correction into the range took place against some spec/algo long liquidation as the macro stumbled briefly following the release of the oil inventories. Still the market gathered itself once more and holding comfortably above 11c the final two hours proved to be calmer and ensured a positive close which maintains the recent technical strength.

N.o 11 Futures

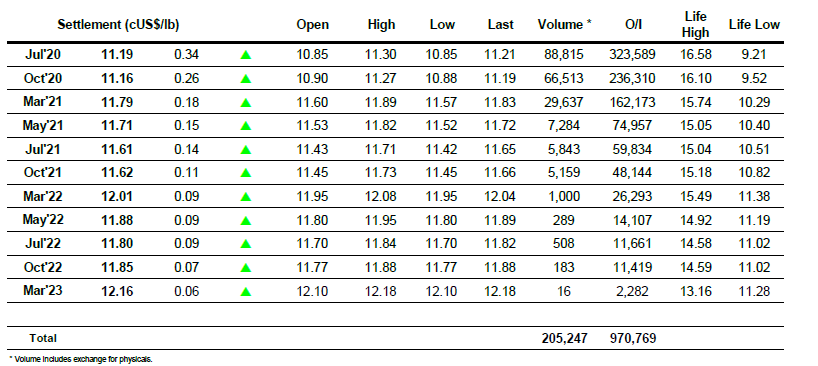

ICE Futures U.S. Sugar No.11 Contract

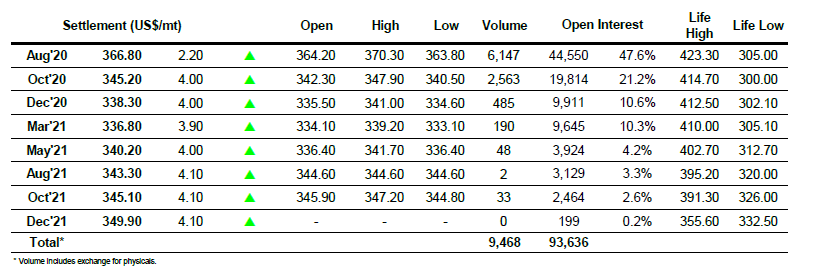

ICE Europe White Sugar Futures Contract