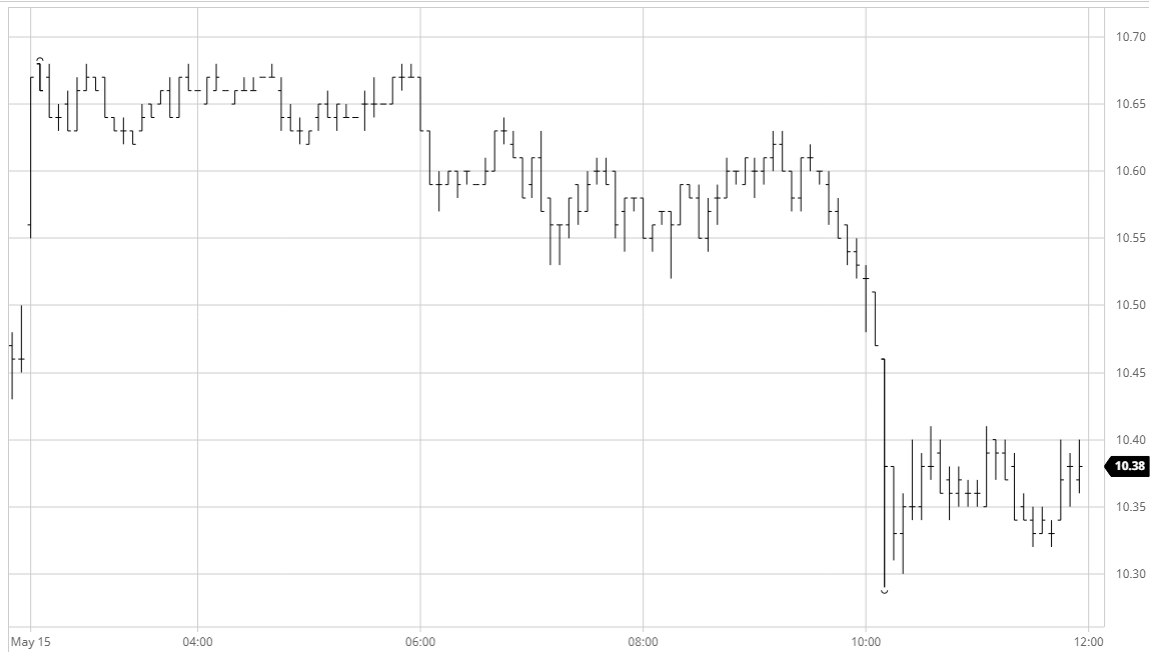

Recent strength sparked immediate spec/fund buying which took Jul’20 up to 10.68 during the opening minutes. This failed to generate any continuation though and a rather non-descript morning followed with nearby values continuing to nudge against this high without being able to push beyond. With crude values leading the energy sector upwards again the steady values were likely a continuation of the recent spec correlation, though as the day went on so we broke away from this to edge back down into the range. Falling back beneath 10.50 prompted some spec long liquidation mid-afternoon which sent us back to 10.29, and the fall also prompted some spec selling with Jul’20 spreads giving back some of the gains made in recent days. USDBRL was still having little influence as it worked either side of 5.80 and we remained at the lower end of the range heading towards the close. Some late position squaring saw Jul’20 settle off the lows at 10.38.

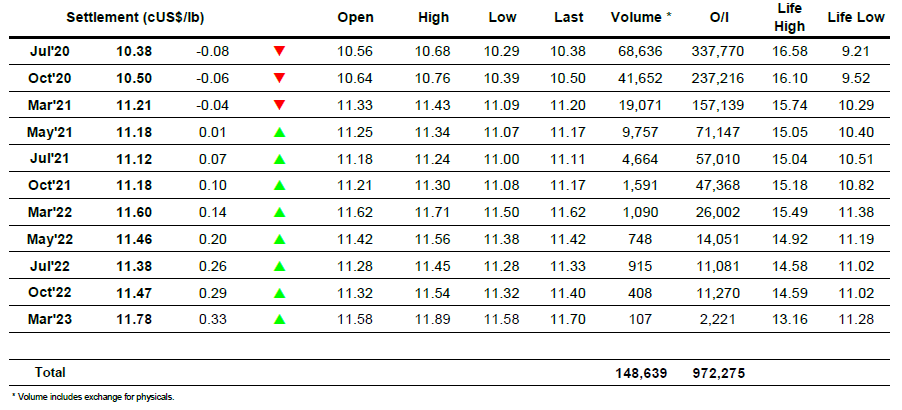

n.11 Futures

ICE Futures U.S. Sugar No.11 Contract

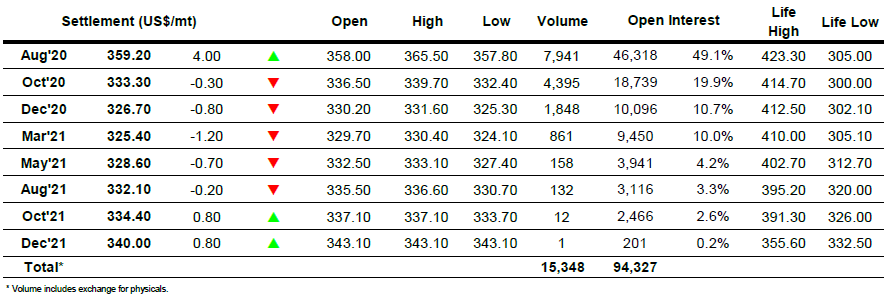

ICE Europe White Sugar Futures Contract