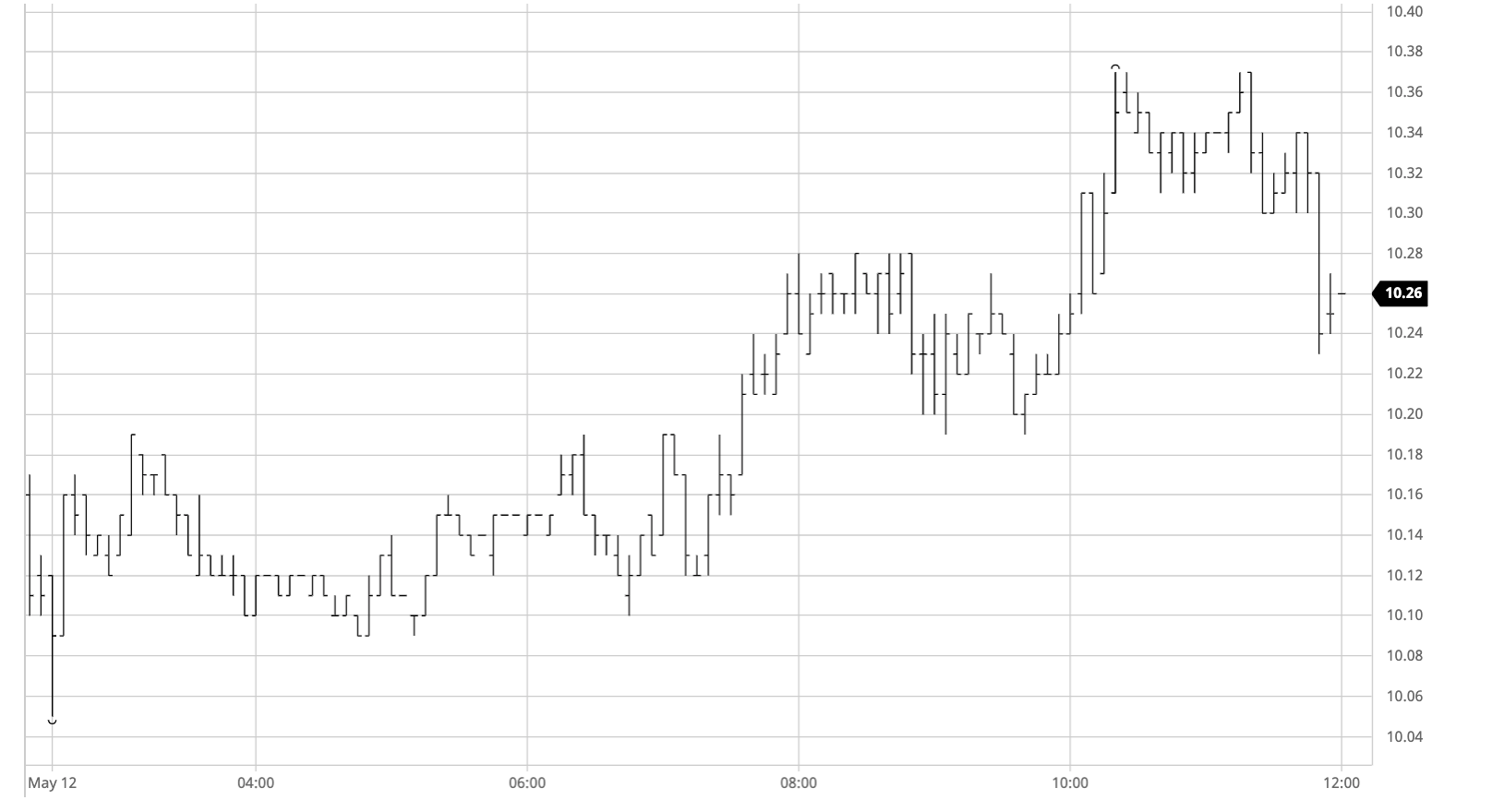

In keeping with recent market action we experienced an uninspiring morning as nearby values edged along near to overnight values on low volumes. The situation only began to change with the opening of the USDBRL which recently has provided the basis of direction for the smaller specs and algo’s, and firmer early rates in the region of 5.75 encouraged some buying that took Jul’20 up a little to 10.28. Stories on the newswires regarding the decreasing global consumption numbers due to coronavirus were being disregarded and though the UNICA figures showed higher than anticipated sugar production at 2.016m tonnes with a 45.76% sugar allocation to provide another bearish piece of news we in fact continued to nudge higher with a second push up taking July to 10.37. With most of the buying on an intra-day basis it was no great shock to see prices drop back into the range late on as some long liquidation occurred, possibly also motivated by the BRL which had eased back to 5.79. Settlement at 10.25 leaves us comfortably within the recent range as the malaise continues.