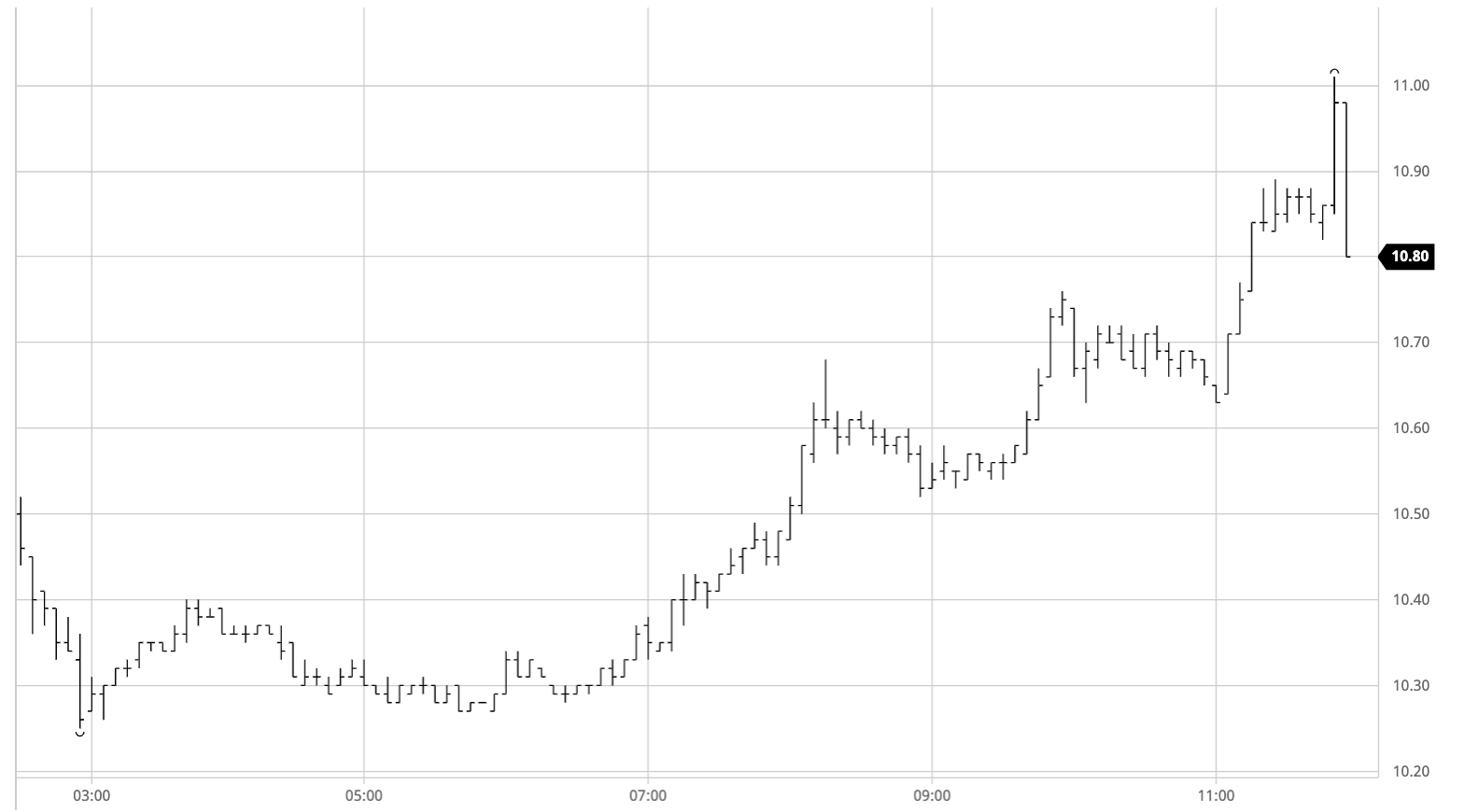

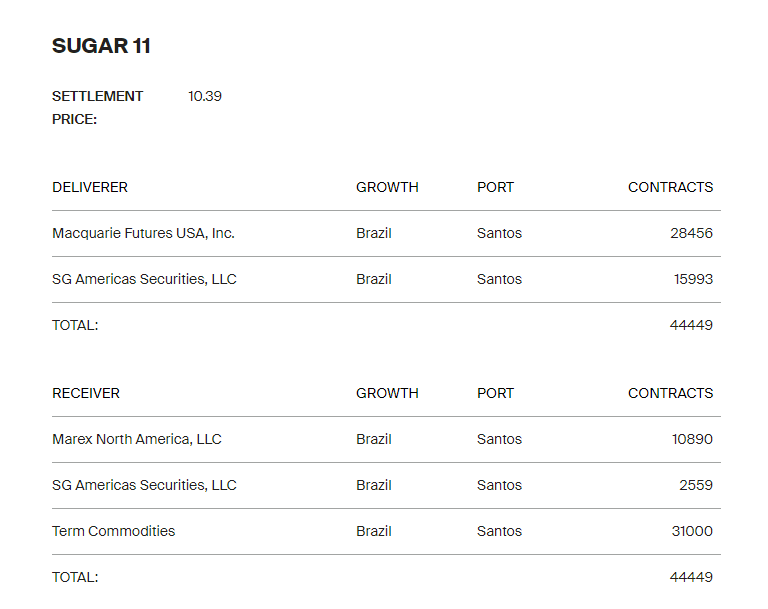

With many nations closed for public holidays today we saw a slower start and nearby values veered either side of last night’s settlement levels during morning trading. The record delivery tonnage against the May’20 expiry (details below) has been interpreted as positive my many and Santos will now form the focus of attention as we wait to see whether there is a raft of early vessel nominations. This acted as a trigger for prices to push up for a fourth consecutive session, with three separate waves of buying (maybe spec short covering?) taking July’20 all the way to 10.80 by late afternoon – whatever the COT number shows the spec short at when published tonight there will be calculations being made as to what quantity has been subsequently covered. Increasingly the move became technical and was in complete separation from a neutral daily macro picture, July ultimately recording an incredible session high at 11.01 on the call. Having achieved an 11c print the final 5 minutes saw a correction back to 10.80 on some pre-weekend position squaring, though settlement at 10.97 was impressive when we consider that the spot month almost saw an 8 handle as recently as Monday.A total of 44,449 lots (2,258,120t) was tendered against the May’20. Please find the exchange notice below.

No.11 Futures