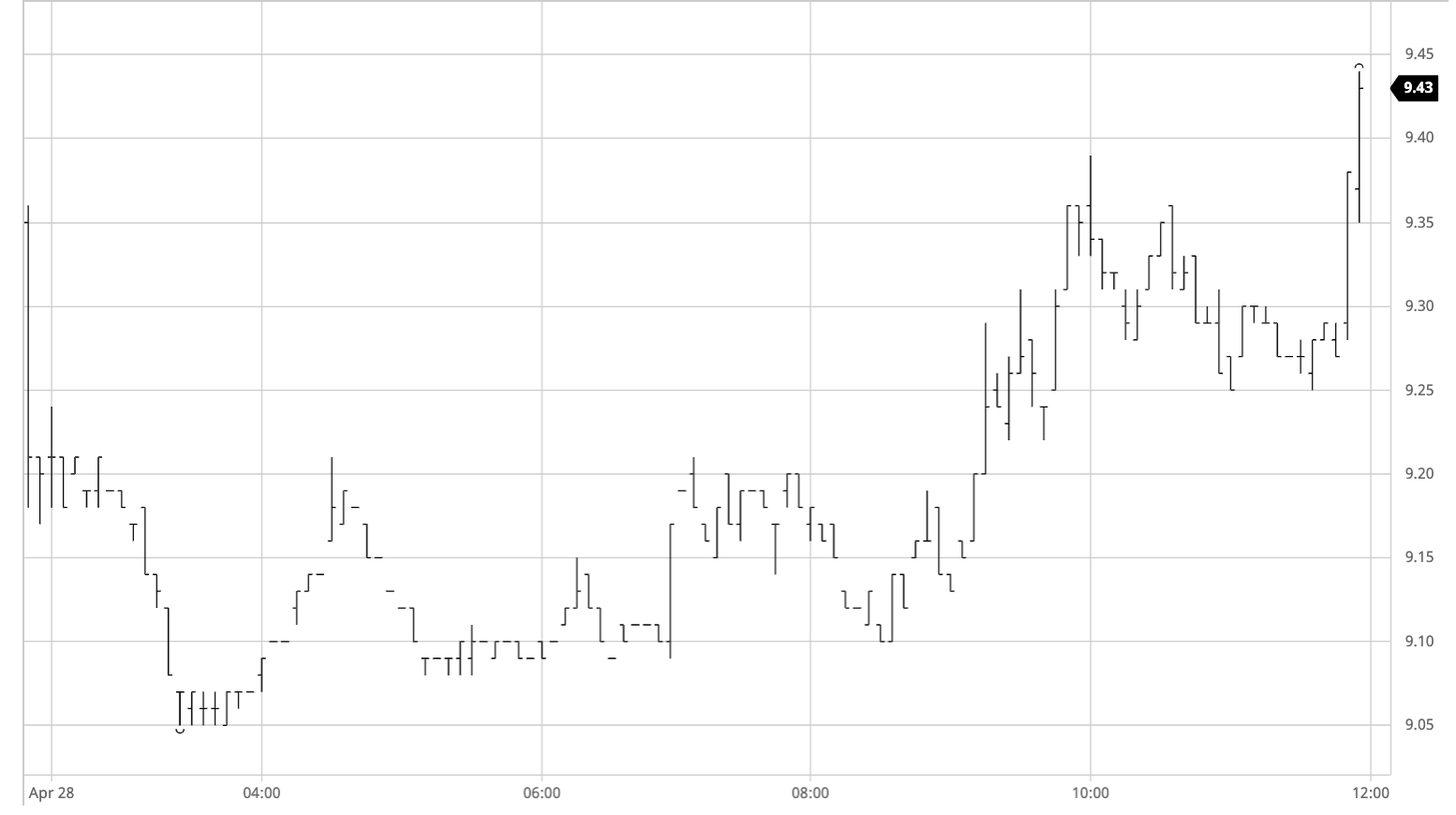

Early trading saw a continuation of the recent pressure as specs pushed nearby values down to record further life of contract lows. For a while it seemed that May’20 was set to continue the move below 9c however consumer buying provided support to limit the lower end of the range to 9.05 (May’20) and 9.21 (Jul’20). What followed was some rather dull consolidation with the market maintaining a narrow 10 point range for many hours, putting macro concerns to one side for a change following the recent decline. The sideways action was broken mid-afternoon when prices pushed back into positive ground on some spec short covering, moving in two waves to reach 9.57. With the macro steady and USDBRL having a rare firmer day there was no encouragement for specs to sell and following further consolidation they covered some more of their recent shorts during the closing stages to record fresh session highs. Whether this is anything more than a dead cat bounce remains to be seen, however it does at least provide some respite for long holders while providing some relief to oversold technical indicators.

No.11 Futures