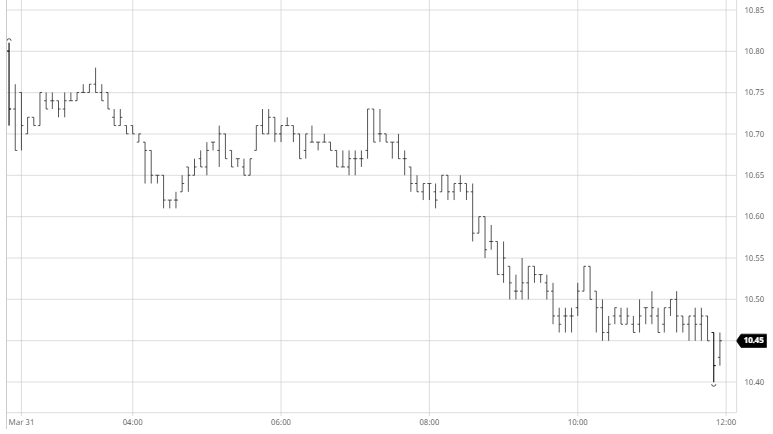

There was little change to nearby values during early trading however as the day wore on so we saw prices start to slide lower once again. Today this seemed to be influenced by a combination of yesterday’s ethanol news from Brazil and more general technical sentiment while placed sugar at the bottom of the CRB pile on what was generally a rather more neutral day. USDBRL was also weaker and was touching 5.20 during the afternoon to lend another element of negative sentiment to the macro, and with ethanol parity now beneath 9c/lb it is difficult to see where how a meaningful recovery can be stimulated in the near term. The one area that does continue to see support is the May’20 whites contract which pushed further ahead to reach $23.30 premium against Aug’20 while the May/May WP worked out further to $124.00. The afternoon led No.11 to a low of 10.45, placing it right around contract lows during the final couple of hours. The negative sentiment then encouraged additional selling for the call, the weight of which sent us to a new lifetime low mark 10.40 with settlement only just above at 10.42 to lend a further negative factor to the current environment as we end the first quarter of the year.