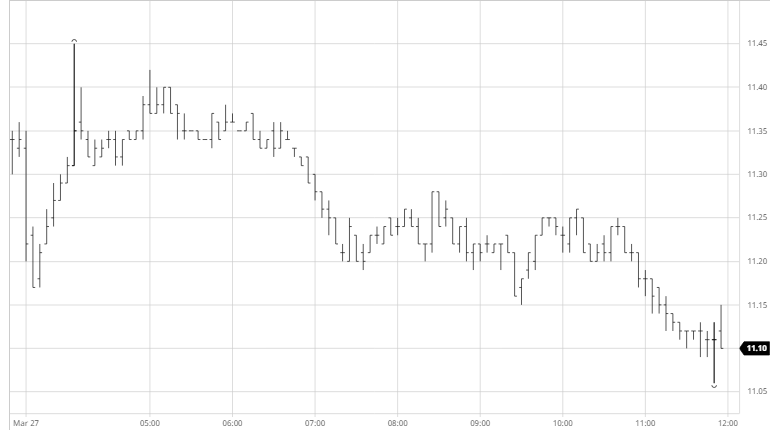

With the macro giving back some of the week’s gains it was not too surprising that the No.11 followed, although not before it had put in a push to 11.45 during morning trading. A weaker USDBRL opening at 5.06 suggested that the tide was turning here also, with the currency seeming to be losing ground at a quicker rate than commodities. The one exception to this weaker pattern was the whites where we built upon yesterday’s immensely strong showing to push further ahead, particularly for the white premium where May/May’20 touched $114 and Aug/Jul’20 recorded a more modest $96. Whites too was eventually pulled back from the highs though still continued to be stronger than the majority of the commodity sector with the CRB now down by more than 2%, while the USDBRL mad a slight recovery from the intra-day 5.1272 low to be trading back around 5.09. The wider weakness encouraged some aggressive pre-weekend selling onto the market which had us trading session lows late on, with settlement established just above at 11.10. In such a quickly evolving global situation let us pray for some more encouraging news over the weekend before we reconvene on Monday.