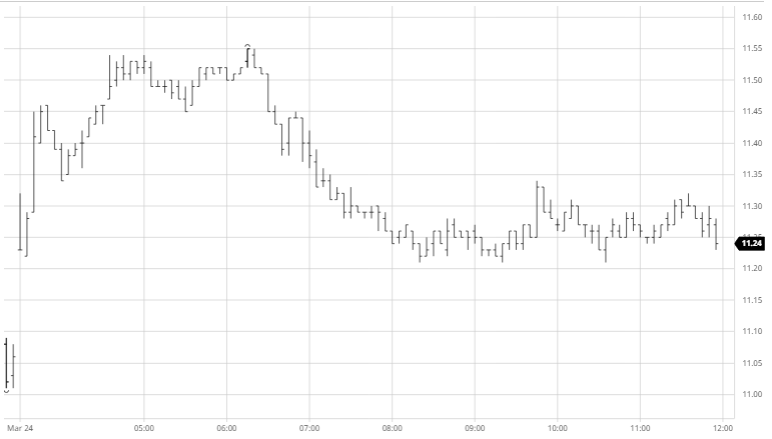

Macro improvements in Asia overnight combined with a firmer CRB to bring the market in more than 20 points higher this morning. This provided a springboard to kick on further with both May’20 and Jul’20 recording morning gains of 50 points on a combination of moderate consume buying and algo activity. As the buying eased so the higher levels could not be sustained with prices easing back towards opening levels, though with producers now largely absent from the market and funds de-risked we did not fall any further and instead experienced an afternoon of slow consolidation. News of port closures in India over the next 20 days as people lockdown while the impact of the Coronavirus there is assessed will no doubt dissuade sellers further, while there are also rumours that tighter controls may be following in Sao Paulo State though with suggestion that sugar and ethanol may receive some kind of “key service” status to try and protect such an important industry to their economy. With this in mind we may well see continuing support as encouragement is provided to end users that we have seen the lows for the time being at least. May’20 remained in the 11.20’s through the closing stages to settle at 11.27 and post a second consecutive positive performance.