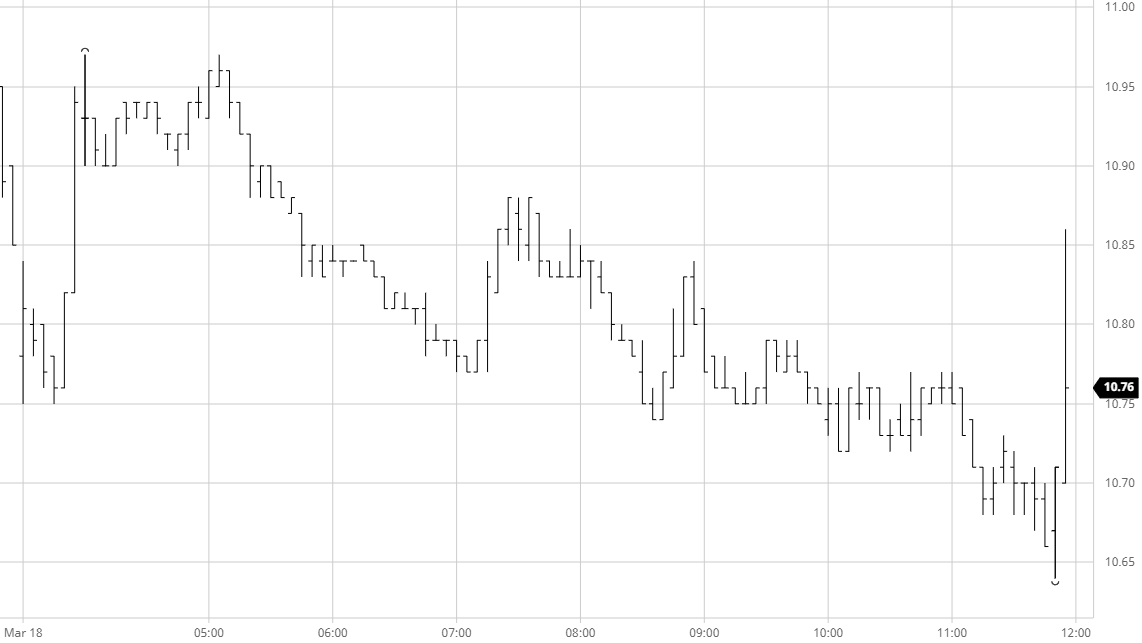

Macro continues to rule the waves and we commenced around 10 points lower this morning in reaction to the ongoing weakness. The losses were short-lived and prices soon experienced a sharp recovery into positive ground, though the gains remained modest with buyers reluctant to pay up to the higher levels. This led values to ease back down towards the opening lows, and what followed was a cycle of steady downward action which led us to reach 10.64 by the closing call. Throughout the move there seemed to be a steady stream of buying flowing through with consumers showing in greater numbers to price beneath 11c for the 2020 positions, but we did not collapse lower as has been the case when BRL weakness has occurred recently, instead almost disregarding the intra-day move for USDBRL to 5.1760. An unexpected late surge took May’20 up to 10.86 on the post close (very aggressive short covering maybe?) though settlement was established a considerable way below at 10.67.