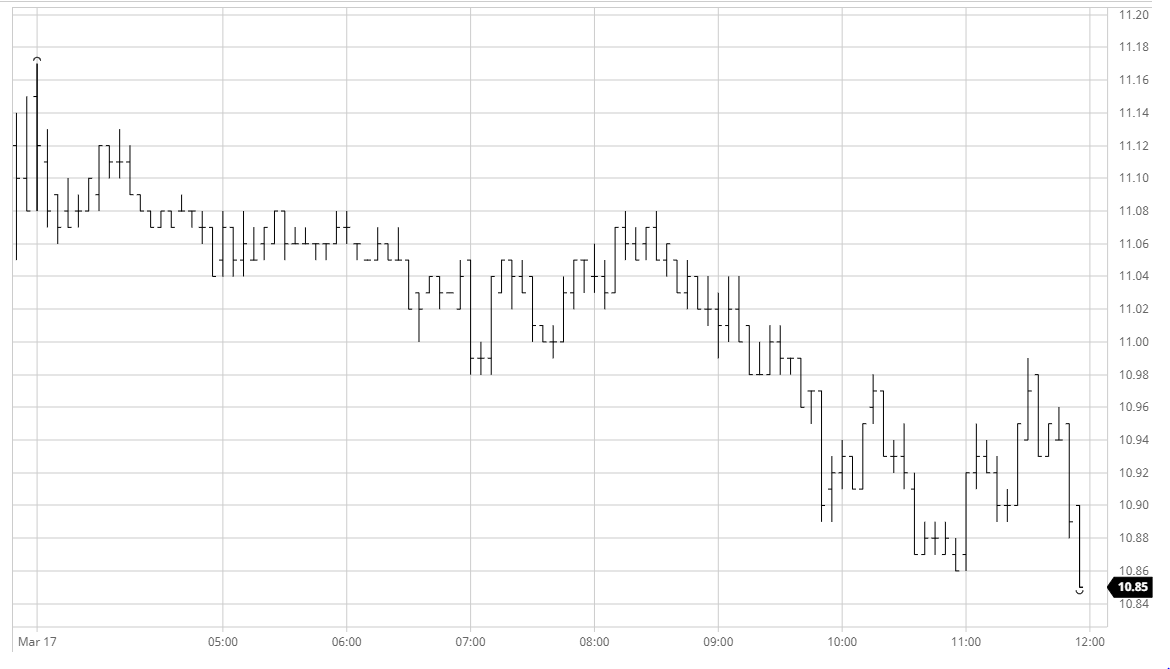

The market saw a calmer day today, however it still maintained a downward bias as global uncertainty around the COV-19 virus continues. Early activity was rather mixed and we saw only marginal losses however the USDBRL opening triggered the first sub 11c prints of the day and set the tone for the afternoon ahead. Values did not melt down however there were a few sell stops triggered beneath 10.95 and we ultimately recorded a new recent low 10.85 very late in the day. Spreads saw some slight weakness but in the main were quite resilient, while WP values saw support during the afternoon sending May/May back towards $100. Closing values were towards the lows and all the signals remain negative at present despite the ongoing (and disregarded) oversold status.

No.11 May Contract – Intraday