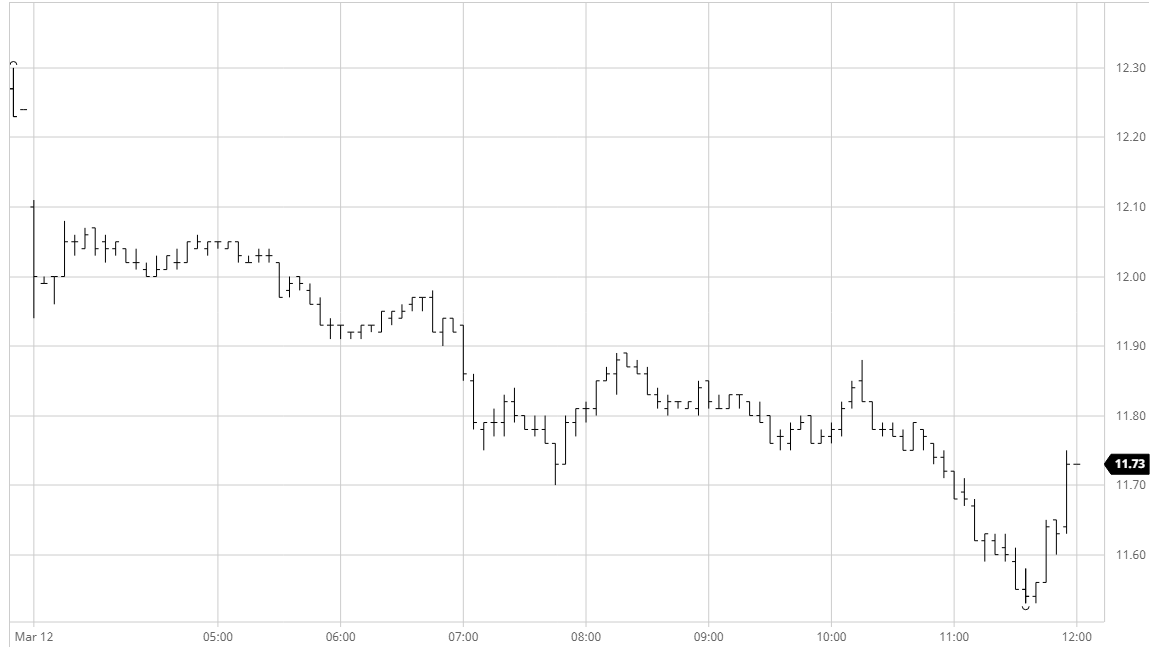

The pattern is now feeling oh so familiar as we saw another session of price erosion, following the macro downwards with the US position on restricting visitors from Europe the latest bear trigger. The opening high mark of 12.11 for May’20 proved to be the session high, and though we consolidated above 12c for a while the decline could not be kept at bay for long. There were bursts of continuing fund liquidation on the way down, while algo’s and smaller specs naturally continue to press from the short side as the take advantage of momentum. White premium values meanwhile are strengthening at a rapid pace with concerns over the availability within the contract requirements seeing the May’20 WP touch $100 having been trading below $80 just two days ago. A startling USDBRL opening at 5.02 was surprisingly calmly received, but though the BRL fought back into the 4.80’s during the afternoon we saw further weakness to record a session low 11.53 during the final hour. Late short covering brought values back higher for the close with final trades around 10 points above settlement values as the buying continued until the bell.