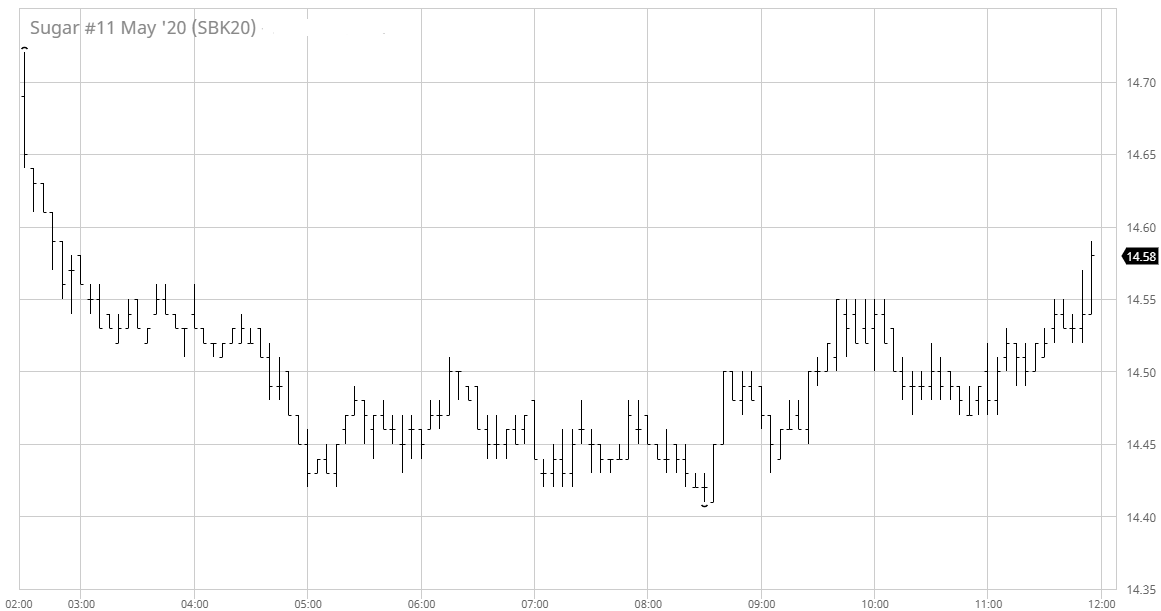

Macro worries once more dictated the market direction today as we lost ground from the start. Unlike yesterday it was the whole board making losses as we struggled to find any significant buying with May’20 only finding a degree of stability in front of 14.50. March’20 was faring worse still as selling of the March/May spread heaped more pressure on the soon to expire prompt, by mid-afternoon the differential was struggling to stabilise around the 0.30 mark having printed down as far as 0.27. There was a little more support around during the afternoon which bought May away from its 14.41 low, however the macro environment remained mixed with both commodities and equities flitting around and, in this environment, we appeared content to remain in the vicinity of 14.50. In the meantime, we saw the opening of the USDBRL for the first time this week with the rate collapsing to yet another new low of 4.4475, potentially adding to a cap on sugar should we climb back toward recent highs. So, with the fundamentals seemingly ignored at present despite having been so important in the decoupling from the macro over recent weeks, it seems as though for the near term at least we must look more intently at the wider economic concerns of the Coronavirus and its impact. There was some more sizable buying during the final 30 minutes for May’20 which looked to ensure settlement above 14.50, and to this end the longs were successful as we closed at 14.54.