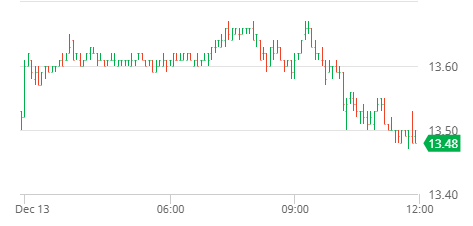

There was immediate buying for the market today with March’20 quickly moving to 13.62 as news of the US-China trade deal buoyed commodity markets as a whole. Consolidation of these gains followed with traders happy to maintain longs in the face of the ongoing scale selling from producers. Volume was good as specs continued to push the long side, though they struggled to make significant additional gains with afternoon efforts stalling at 13.67 on a couple of occasions. The second failure seemed to trigger some pre-weekend profit taking/long liquidation with denials of the trade news from Trump removing some of the earlier sector buoyancy. Given the recent technical strength the close was something of a disappointment with the best efforts of the specs to push back into credit on the call ending in failure as settlement was established at 13.50. Still not a terrible performance but it removes a touch of the recent gloss.