163 words / 1 minute reading

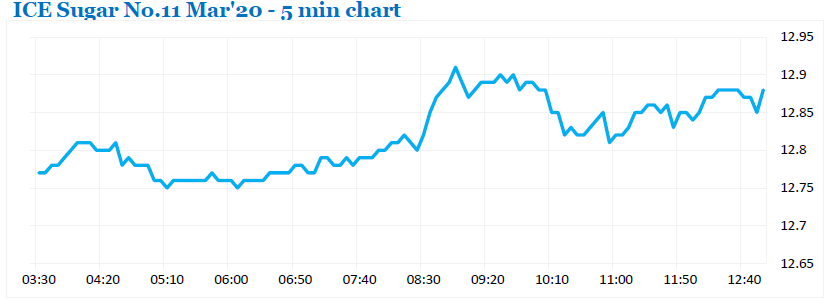

The market reacted reasonably well following on from yesterday’s correction back down to 12.75. The news that last night’s COT report was showing a further reduction in fund short holdings to -95,880 lots could have had a negative impact given the further wave of short covering that took place last Friday. However, it seems that producers are not following the market down and so we were instead able to consolidate beneath their next selling levels.

March’20 steadied to reach a session high of 12.92 while there was renewed stability for both the March’20 and May’20 spreads as the nearby prompts attracted the bulk of today’s more limited volumes. With selling continuing from producers at the higher levels, an afternoon of stability followed with March’20 holding in the 12.80’s and concluding a rather mundane session at 12.86.

Whether this can form the basis of a second tilt at pushing beyond 13c remains to be seen, however it certainly provides the bulls with some encouragement.

If you have any questions please feel free to contact the derivatives team at jwhybrow@czarnikow.com.