191 words / 1 minute reading time

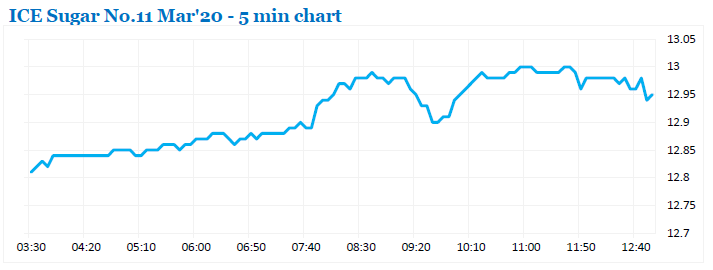

Trading resumed positively following the Thanksgiving holiday with March’20 climbing steadily through the 12.80’s over the course of the morning. Specs then stepped up to the plate around the “US opening” and gave an aggressive push through the $12.91-12.93c/lb resistance level, in the process triggering a host of buy stops placed above this area. The impact of the stops was restricted by the sheer weight of overhead producer selling, large quantities at every point seeing March’20 pause at $12.99c/lb. For around an hour the market pushed against the wall of selling in from of $13c/lb but then corrected back into the range as some of the specs lightened the load and sold back some of the fresh longs. From $12.87c/lb there was a renewed push higher and on this occasion we saw that elusive $13c/lb handle with a marginal new high of $13.01c/lb. Nearby spreads were also firmer on the move however that was to prove sufficient in terms of outright gains with prices holding just shy of the highs through the last couple of hours before giving back a few points on the call against pre-weekend position squaring.

If you have any questions please feel free to contact the derivatives team at jwhybrow@czarnikow.com.