Insight Focus

This week there was more clarity over how frosts in Russia impacted wheat. Strong corn production and favourable weather weighed further on prices.

It was a positive week for Euronext corn, and negative in Chicago. With some clarity now on the impact of the Russian frost, some of the recent volatility in the market is reduced.

Uncertainties remain regarding corn planting as both the US and France are facing significant delays. But dry weather in Europe should result in good progress in France and we think the few rains forecast in the US should also allow for good progress in the US. We expect some downside risk if we see good corn planting progress.

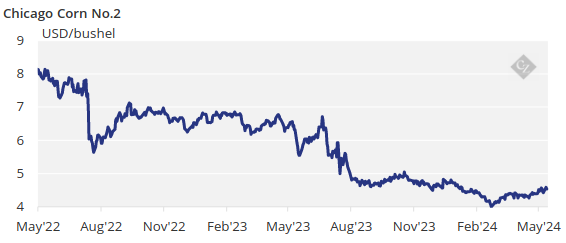

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average in a range of USD 4.15/bushel to USD 4.4/bushel with an upside bias. The average price since September 1 is running at USD 4.55/bushel.

Corn Corrects Amid Strong Production

Last Monday started strong with wheat rallying on continued worries over Russian production and pulling corn higher. But the market corrected over the rest of the week with clarity given by the Russian government, weak export data out of the US, and drought areas in the US improving.

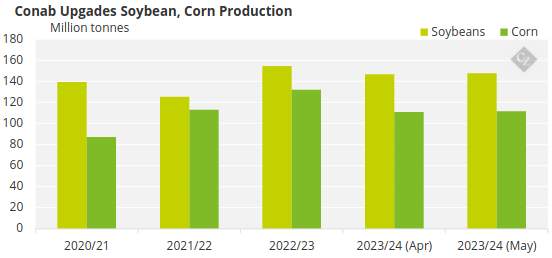

The Brazilian National Storage Company Conab surprised the market last week increasing its production forecast for corn and soybeans to 111.6 million tonnes and 147.6 million tonnes respectively, versus 111 million tonnes and 146.5 million tonnes previously. They also suggested the soybean crop could have reached up to 148.4 million tonnes if it wasn’t for the losses of the floods in Rio Grande do Sul.

Source: Conab

US Corn is 49% planted, up from 36% last week and versus 60% last year and the 54% five-year average. Corn areas experiencing drought fell 2 points week-on-week to 12% last week.

Russian corn planting is 61.8% complete, up 19 points week-on-week and compared with 54.7% last year. Ukrainian corn planting continued to make big weekly progress and is now 91% completed – significantly ahead of the 63% recorded last year.

French corn is 72% planted, up 18 points week-over-week but down on the 85% recorded last year and lower than the five-year average of 91%. The French Agriculture Ministry Agreste forecasted corn area up by 9.6% year on year.

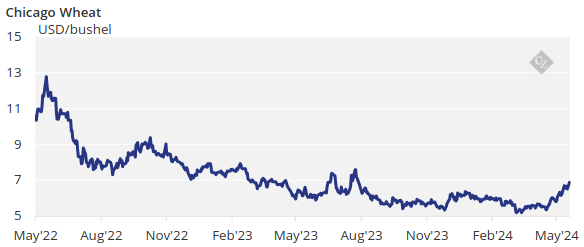

Russia Clarifies Wheat Situation

Last Monday’s wheat rally fuelled by worries of a lower Russian crop due to frost damage turned around quickly on Tuesday following some clarity given by the authorities.

The Russian Ministry of Agriculture said crops destroyed by frost would be replanted in some areas. The Ministry estimates that 640,000 hectares has been damaged, of which 500,000 hectares will be replanted. It now estimates wheat production in a range of 84 million tonnes to 88 million tonnes – significantly lower than April forecasts in the range of 90-93 million tonnes.

US wheat condition was 50% good or excellent — unchanged week on week and higher than the 29% recorded last year. Areas under drought conditions fell 3 points week-on-week to 25%. The French wheat condition was 64% good or excellent, flat week-on-week and compared with 93% last year.

Southern Brazil is expected to continue receiving rains this week while the rest of the centre south is expected to remain dry again. Cold temperatures and rains are expected in Argentina. Europe is expected to finally have some dry weather in the northwest. Rains are expected in the US growing regions.