Main points

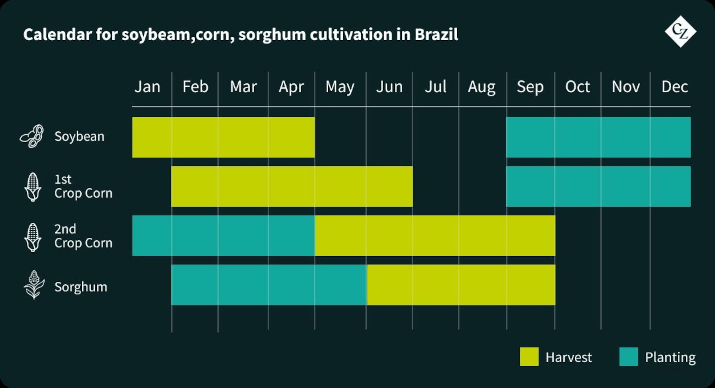

The delay in the 23/24 soybean harvest compromised the corn harvest calendar. This led producers to explore alternative crops due to low corn prices. Sorghum has emerged as the main competitor.

Delay in the Ideal Planting Window As we mentioned in our previous report, soybean planting was marked by droughts in the central regions of the country, and extreme rains in the South – the two major soybean production hubs in Brazil. The adverse weather caused many producers to postpone the start of planting or replant crops, delaying the soybean harvest.

The second corn harvest (“safrinha”), responsible for 80% of national corn production in Brazil, has its planting window shortly after the soybean harvest.

Thus, the delay in soybeans caused the ideal window for corn cultivation to be missed.

Planting outside the ideal window can result in lower crop productivity and greater risk of loss, since rainy and dry seasons will be mismatched to the plant’s needs.

Therefore, producers who chose to continue with the corn harvest, even outside the cultivation calendar, may face lower-than-expected financial results.

Low Prices = Lower Margins

In addition to the loss of the ideal cultivation window, corn price is not very encouraging for producers. With a drop of 33% year on year, corn is now at its lowest prices since 2020.

Source: Bloomberg

Considering current prices, a good corn harvest does not guarantee a good margin of return for producers.

In Mato Grosso, where the largest safrinha corn cultivation is located, the margin has been falling drastically in the last 2 harvests. In the 2022 harvest, producers yielded 61 bags/ha, which fell to 19 bags/ ha in the last harvest. For the next one, the downward trend continues due to prices and expectations of low productivity.

The story of soybeans is repeated for corn: even with the production cost reduced compared to the last harvest, the price does not guarantee a better return for producers. Therefore, we expect a reduction in the corn planted area by 2 million hectares for this harvest.

Other prominent states, such as Paraná, Mato Grosso do Sul and Goiás, also show a drop in operating margins.

Major Competitors

For this second crop, many producers might opt for alternative crops in their areas, leaving aside the traditional corn second crop following soybean crops.

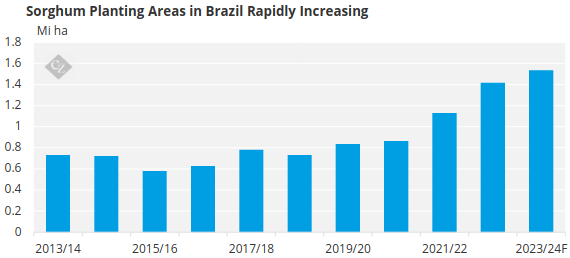

According to CONAB (Brazilian National Supply Company), corn’s biggest competition for this crop will be sorghum.

Sorghum production has grown rapidly in recent years, and despite being small compared to soybeans and corn, it is becoming a popular off-season option. Sorghum still has similar uses to corn, being used mainly in animal feed, but can also be used in human food and in the production of flours/starches for the food industry.

The crop, in addition to being more resistant to periods of drought, also has lower production costs compared to corn, and can be a good solution for the low returns that corn has been presenting.

We expect the sorghum area to increase by 8.2%. Its largest planting area is located in the states of Goiás, Minas Gerais and Bahia (with 45% of total production in the Centre-West region).

Source: CONAB

In addition to sorghum, other crops such as rice (mainly in the south of the country), beans and cotton can also occupy the corn planting areas in the off-season.

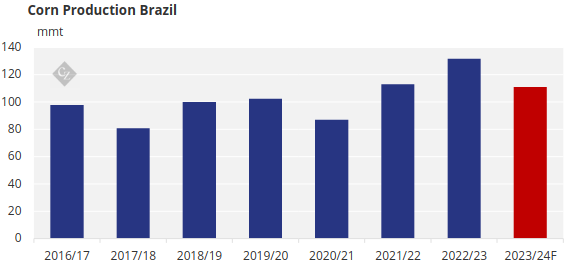

What to Expect from the Brazilian Corn Harvest

It is not news that this year’s Brazilian corn harvest will be disappointing compared to the last harvest. After the record 131 million tonnes reached last year, we forecast a drop of 20 million tonnes, to 111 million tonnes produced – returning to the lowest levels since the 2021/22 harvest.

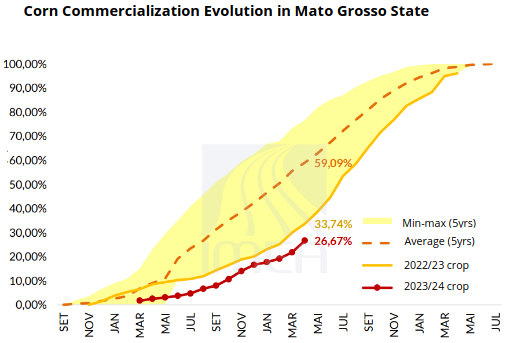

Furthermore, with the planting of the second crop already completed, commercialization levels are also alarming. To date, in the state of Mato Grosso, corn sales are well below the minimum observed in the last 5 years. Until the first week of April, MT corn was sold at 26.6%, more than 32 percentage points below the average of 59%.

Source: IMEA

The export window should be affected not only by the delay in commercialization, but also due to the delay in soybean exports. As we mentioned previously, producers held back soybeans due to discouraging prices, causing the export window to also be affected. But the situation for corn is now similar.

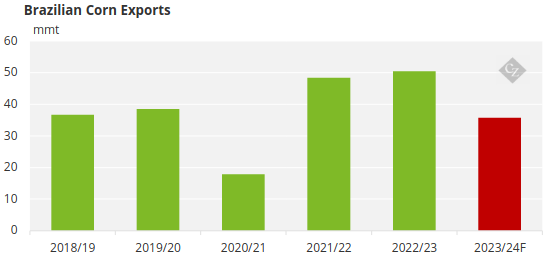

While in May 2023, 8 million tonnes of corn had already left Brazilian ports, in 2024 the volume fell to 4.2 million – a drop of 47% year on year. With the lower of the harvest this year, we expect exports to fall 15 million tonnes, totalling 35 million tonnes of corn.

The great question is when this corn will be available for the international market. Although we have not yet entered the grain export window – which mostly occurs between the months of June and August – we can already see delays in volumes, and, with soybean exports also outside the ideal window, Brazilian ports are likely to become congested when these grains decide to leave the country.

Recent Flooding in South Brazil

Another issue that concerns the market are the recent floods in the state of Rio Grande do Sul. The 23/24 summer corn crop was still in the process of being harvested when strong storms affected the region, leaving cities and fields below water and compromising machinery, inputs, warehouses, etc. It is estimated that around 27% of corn crops were still being harvested.

But the summer corn harvest represents only 20% of the total produced in the country. Furthermore, Rio Grande do Sul represents 15% of the summer harvest production and only 3% of the total national production, having no significant participation in the second crop, as the predominant product in the region is soybeans – with an area 8x larger than that of corn.

Soybeans and the livestock industry are expected to be the most impacted at the moment, with estimates that around 6 million tonnes of soybean were still resting on the fields. Regarding livestock, the flooding made it impossible for the animals to pasture, in addition to the great logistical challenges of transporting animals and feed with damaged road access and loss of animals during the floods.

We believe that, although the impact on corn is not so alarming at the moment, we could see consequences of the catastrophe in the next harvest with an increase in production costs and a reduction in the producer’s margin caused by damage to crops and losses of equipment. Despite this, the extent of the damage caused by the rains cannot yet be estimated.