Insight Focus

- A major bridge in Baltimore was destroyed when a container carrier collided with it last week.

- While impacts are likely to be limited, there will be knock on effects for the supply chain.

- A temporary channel is set to be established while repairs take place.

The shipping industry seems to have entered a new period of uncertainty after the collapse of the Francis Scott Bridge in Baltimore, US on March 26.

The Singapore-flagged container vessel Dali, chartered by the Danish shipping giant Maersk, lost propulsion and collided with the road bridge, resulting in two confirmed fatalities, while four others are presumed dead.

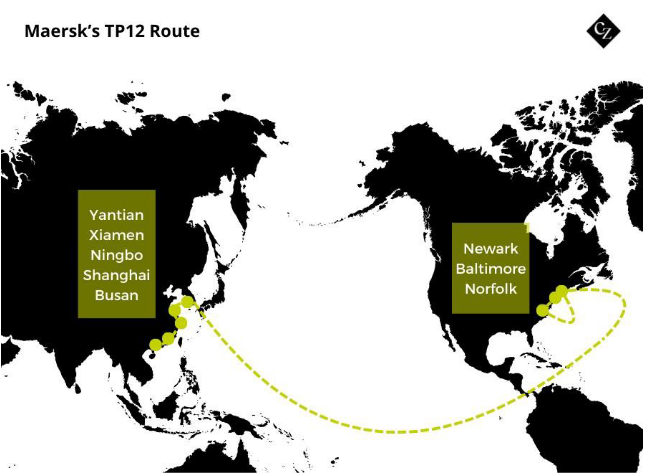

The vessel has a container capacity of 10,000 TEUs and was sailing from the port of Baltimore to the port of Colombo in Sri Lanka under the 2M alliance’s Transpacific service, referred to as TP12 by Maersk and Empire by MSC.

It appears that the ship owner is Grace Ocean Pte Ltd, a Singapore-based company owned by the Abe family of Japan, which also owns the Japanese tonnage provider Nissen Kaiun.

Operations Impacted

With the Port of Baltimore remaining out of operation, shipping lines are seeking alternative options to move cargo destined for Maryland’s major port. The majority of the largest container carriers have already implemented contingency plans, utilising other US ports such as Newark, Norfolk and Philadelphia for their cargo.

Judah Levine, head of research for the global freight booking platform Freightos, believes that the accident will not have a significant effect on global trade because the port of Baltimore is not a major port for container ships. “The port is more significant for goods such as farm equipment and automobiles,” he pointed out.

Source: Maryland.gov

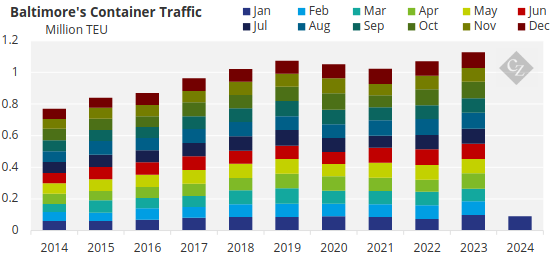

On the other hand, Emily Stausbøll, Market Analyst at Xeneta, an ocean freight shipping rate platform, is not so optimistic about the potential impact of the bridge collapse. “While Baltimore is not one of the largest US East Coast ports, it still imports and exports more than 1 million containers each year, so there is the potential to cause significant disruption to supply chains,” she said.

Stausbøll also noted that the supply chain disruption in Baltimore could lead larger US East Coast ports to handle additional container imports, a possibility seemingly confirmed by ocean carriers’ contingency plans.

Government Funding Needed

President of the United States Joe Biden said he expects the federal government to cover the entire rebuilding cost, with his administration approving USD 60 million in emergency federal aid to pay for debris removal and other initial costs.

The total cost of rebuilding the bridge could reach USD 2 billion, according to early estimation of the legislative monitoring website, Roll Call. However, United States Secretary of Transportation Pete Buttigieg said that only USD 950 million is available in the country’s emergency fund, and the bridge will compete with other projects for the money. Therefore, raising further funds will require action from both houses of Congress, with the House controlled by Republicans and the Senate controlled by Democrats, to agree on the allocation of additional funds.

In the meantime, Maryland Governor Wes Moore emphasized the time that will be needed for the whole recovery. “This work is not going to take hours. This work is not going to take days. This work is not going to take weeks. We have a very long road ahead of us,” he stated.

Temporary Channel Established

As a first step to facilitate cargo movement through the region, the US Corps of Engineers, who are working to remove the wreckage of Baltimore’s Francis Scott Key bridge, will open a temporary channel on the northeastern side of the main access channel. Latest reports from the Maryland authorities have said the Captain of the Port (COTP) is preparing to establish a temporary channel for commercially essential vessels.

“This will mark an important first step along the road to reopening the port of Baltimore,” stated Captain David O’Connell, Federal On-Scene Coordinator, Key Bridge Response 2024, who added, “By opening this alternate route, we will support the flow of marine traffic into Baltimore.”

Although the temporary channel will only have a 3.4 metre draught, an 80-metre horizontal clearance, and a 30-metre height clearance, the Captain of the Port said “this action is part of a phased approach to opening the main channel. The temporary channel will be marked with government-lighted aids to navigation.”