Insight Focus

- As the 2023 financial year closed, shipping liners reported falling profits.

- But it must be remembered that the falls come from a very high baseline.

- The industry faces constant uncertainty and must take extra steps to mitigate risk.

Gemini Profits Plunge

The last year saw all the major container lines return to pre-pandemic levels of profitability, translating to huge year-over-year declines in revenues, ranging between 45% and 65%.

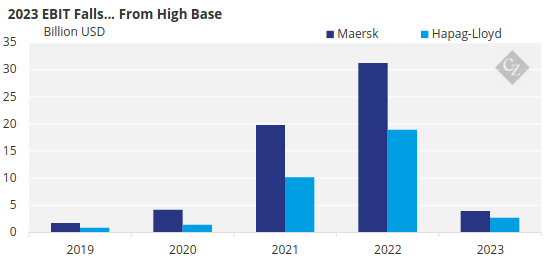

Danish ocean giant Maersk saw a huge decline of USD 30 billion in its revenues, reaching USD 51 billion for 2023, while the company’s EBIT (Earnings Before Interest and Taxes) plummeted from USD 31 billion to USD 4 billion.

Maersk CEO Vincent Clerc said that “2023 was a transitional year following the extraordinary market boom caused by the pandemic.” He added, “We secured solid financial results despite significantly changed circumstances, and we are well positioned to manage the expected headwinds in 2024.”

Source: Hapag-Lloyd, Maersk

Maersk’s future partner in the Gemini Cooperation, Hapag-Lloyd, reported yearly revenues of USD 19.4 billion and a profit of USD 3.2 billion, translating to massive year-on-year drops from USD 36.4 billion and USD 18 billion, respectively.

The German carrier’s EBIT fell from USD 18.5 billion in 2022 to USD 2.7 billion in 2023. Despite the significant year-over-year declines, Rolf Habben Jansen, CEO of Hapag-Lloyd, highlighted that his company achieved the third-best group profit in history.

Other Liners Record Dips

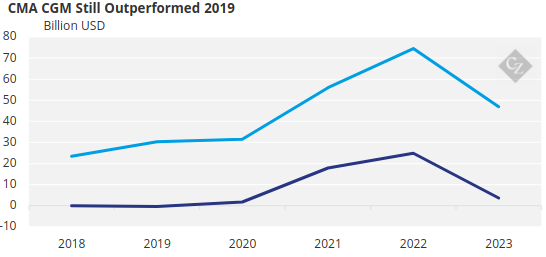

Another major European shipping group, CMA CGM, recorded revenues of USD 47 billion in the previous year, representing a 36.9% decline compared with 2022 figures, and net income of USD 3.6 billion, down from USD 25 billion in the previous year.

“As our sector normalized, the group’s performance remained solid in 2023. Shipping market conditions deteriorated progressively during the year. Our results are down as we expected,” noted Rodolphe Saadé, Chairman and CEO of the French shipping company.

Source: CMA CGM

In a similar trend, OOCL announced revenues of USD 8.3 billion and a profit of USD 1.4 billion in 2023, down from USD 19.8 billion in revenues and USD 10 billion profit in 2022. The Chinese shipping giant COSCO, which is the parent company of Hong Kong-based OOCL, has not published its financial results for 2023 yet.

There is much interest in the financial figures of the Israeli container line ZIM, which saw its 2022 USD 4.6 billion profit turn into a financial loss of USD 2.7 billion the following year. Additionally, ZIM saw its revenue decrease from USD 12.6 billion to USD 5.2 billion in 2023.

“The annualized revenue growth rate in 2023 is in line with 2018-2019, which suggests that the sharp revenue decline is an artifact of the abnormal revenue growth of 2021-2022, rather than a fundamental revenue loss in 2023,” commented the Danish shipping and maritime data analysis company Sea-Intelligence.

Not All as It Seems

But one useful way to calculate profitability is through EBIT/TEU, which measures profitability per unit transported. According to Sea-Intelligence, Maersk’s EBIT/TEU of USD 94/TEU is significantly lower than in 2021-2022, but it is still higher than most of the pre-pandemic years. And Hapag-Lloyd’s USD 235/TEU profit is the highest outside of 2021-2022.

ONE recorded an EBIT/TEU of USD 116 for the year. That of HMM was similar at USD 119/TEU. Although this is lower than in 2020, is still an improvement on the 2011-2019 period, when the South Korean company was not profitable at all.

ZIM was the only liner to register a significant loss in EBIT/TEU at negative USD 765/TEU. This was not driven by operating conditions however, but was based on a $2.1 billion impairment loss in the fair market value of ZIM’s vessels, containers and handling equipment.

What’s Next?

It is clear from financial results that the past year has not been quite as unprofitable as one may expect. While profits were down, they were down from a very high baseline. The past year can be seen as a normalisation of sorts.

However, a great deal of uncertainty remains, and it is crucial for companies to remain vigilant and prepared for unexpected challenges that could disrupt operations.

As the past few years have taught the industry, it is susceptible to various unexpected events, ranging from geopolitical tensions to natural disasters and global pandemics. These disruptions can cause significant delays, congestion at ports, fluctuations in freight rates and shortages of containers, impacting the entire supply chain.

In this dynamic environment, proactive risk management and agility are essential for shipping companies. Developing contingency plans, diversifying routes, enhancing communication channels with partners and leveraging technology for real-time tracking and monitoring are several strategies that can help mitigate the impact of unexpected events.

Moreover, fostering resilience through collaboration within the industry and with relevant stakeholders can strengthen the collective response to disruptions. This is a primary reason why box carriers are forming alliances and initiating partnerships for joint services.