Insight Focus

- Houthi attacks in the Red Sea increasingly make the Suez Canal off limits.

- Many container operators have chosen to withdraw from the region, causing rates to surge.

- The conflict threatens food security and could depress the global economy.

Freight Rates Rise

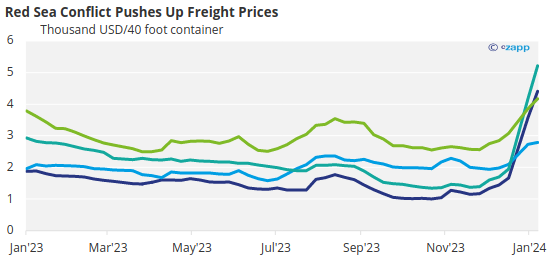

After an entire year of stagnation, freight rates suddenly and significantly jumped this month. Drewry’s World Container Index which has risen by 110% since December 7, reaching USD 3,072/FEU on 11 January.

Source: Drewry

Likewise, the Shanghai Export Containerized Freight Index (SCFI) rose to USD 2.206/TEU on January 12 – 118% higher than the rate on December 1. The Ningbo Containerized Freight Index (NCFI) also increased by almost 150% during the same period climbing to USD 1,745/FEU.

The sudden rise in freight prices is due to attacks launched on ships transiting the Red Sea by the Houthis, a Yemen-based and Iran-backed rebel and military group in response to the ongoing conflict in Gaza.

Vessels Rerouting Causes Delays

A major issue for global freight companies is that the Red Sea links to the Suez Canal – a key shipping route for global trade. While the Houthis initially stated they would target any ship travelling to Israel, the actual destination of the vessels attacked remains unclear.

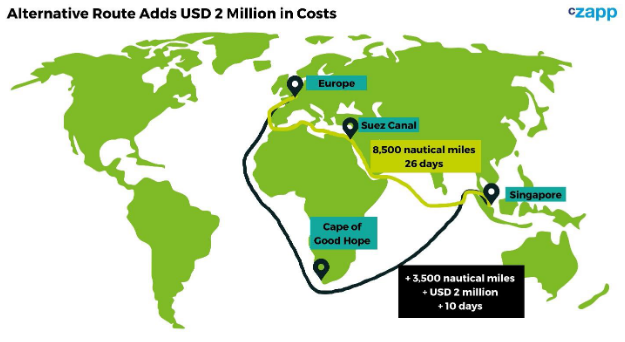

This means that companies have had two options: either divert vessels or avoid the Red Sea entirely. According to Linerlytica, a shipping market data provider, the number of container ships that have been diverted from the Suez to the Cape of Good Hope route has reached 354 for the period December 15 to January 7. This figure represents 80% of all the container vessels travelling between the Atlantic and Mediterranean basins and the Indian Ocean.

But these vessels need to tack on an additional 3,500 nautical miles – or 8.5 days – to avoid the conflict zone around the Red Sea and Suez Canal. The forced change in vessel routes has led ocean carriers to apply additional surcharges.

As a result, most of the major container shipping companies have already announced the suspension of Red Sea passage until further notice, and this number is expected to grow in the next weeks.

The ongoing crisis in the Red Sea and Suez Canal area represents one of the most challenging periods in recent years for the container shipping industry with ocean carriers’ services and networks remaining extremely volatile and prone to rapid changes.

Conflict Threatens Economy, Food Security

The Suez Canal is a vital element of the Egyptian economy, accounting for 2% of the national GDP. The escalating conflict is likely to have a major financial impact on the country.

Admiral Osama Mounier Mohamed Rabie, chairman and managing director of the Suez Canal Authority (SCA), said on January 11 that dollar revenues from the canal are down 40% from the beginning of the year compared to 2023, while vessel traffic has declined by 30% in the same period.

Financial analysts say the economic impact of the crisis on the Red Sea and the Suez Canal is relatively limited for now but could become painful if Houthi attacks keep throttling traffic through the main shipping artery connecting Europe and Asia.

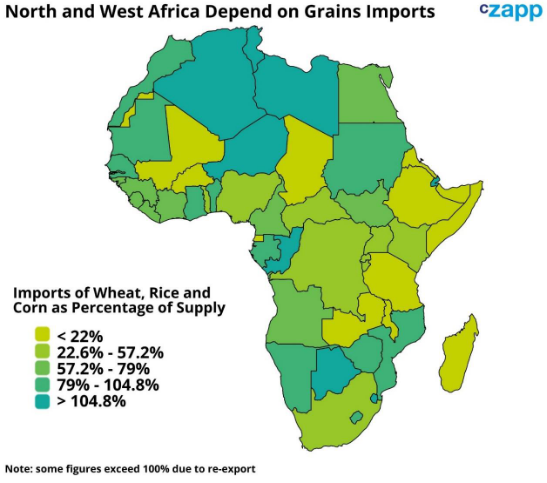

Another issue to consider is food security. The Suez Canal provides a key route for staple foods such as rice for many lower-income countries. These countries, particularly in North Africa and in the Eastern Mediterranean, import much of the grains they consume.

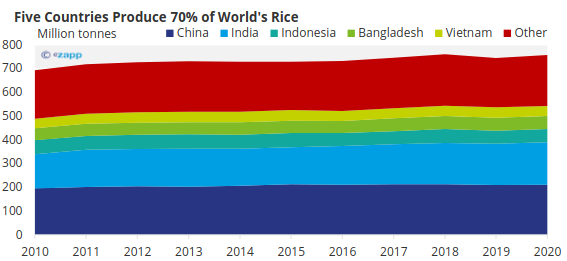

Lower-income countries will be the worst off as the world contends with higher prices and lower availability. Just five countries – China, India, Indonesia, Bangladesh and Vietnam – produce 70% of the world’s rice. If they are cut off from markets in the west, the price of the staple is likely to rise.

Source: FAOSTAT

The price of rice has already been barrelling higher in the final months of 2023.

Source: World Bank

We know that the last time the price of staple foods rose so fast so quickly, the resulting unrest spread across the Middle East in what became known as the Arab Spring.

Additionally, former Egyptian deputy foreign minister Hussein Haridi told Arab media that the US and UK attacks could have a negative impact on Egypt’s already-struggling economy and cut shipping through the Suez Canal even more. He further noted that the US-UK attacks might exacerbate the crisis and could cause a widening of the conflict affecting the security and the economies of countries in the Middle East and Europe.

US and UK Launch Strikes Against Yemen

With the US and UK having launched military strikes in Yemen on January 12, the situation looks like it will only escalate. A few hours after the attack, the Houthis warned that all US and British assets have now become targets.

“These targeted strikes are a clear message that the United States and our partners will not tolerate attacks on our personnel or allow hostile actors to imperil freedom of navigation,” stated US President, Joe Biden.

The Houthis’ Supreme Political Council responded that “all American-British interests have become legitimate targets for the Yemeni armed forces in response to their direct and declared aggression against the Republic of Yemen.”

Some unverified rumours suggest that ocean carriers entered into discussions with Yemen’s Houthi supreme revolutionary committee to reach an agreement ensuring the safe passage of their vessels through the Red Sea and the Suez Canal.

However, as of now, no official announcements or statements have been made by any involved party. For the moment, it looks like most carriers will choose to avoid the Red Sea in an effort to mitigate risk.

Global Shipping Industry Enters Uncharted Waters

The current environment marks the second occasion within a span of less than three years that the traffic through the Suez Canal has been interrupted. In March 2021, Ever Given, an Ultra Large Container Vessel operated by Taiwanese container line Evergreen, ran aground and blocked the canal traffic for about a week.

The event caused significant delays and disruptions in the global supply chain and blocked an estimated USD 9.6 billion in global trade each day.

But this time, the blockage in the Red Sea is likely to be much more prolonged. Depending on how long the conflict lasts, it is likely to jeopardise the global economy, food security and could expand to a new regional conflict across the Middle East.

Currently, there is great uncertainty surrounding the ongoing Red Sea crisis and predicting the resolution remains challenging. In the context of the shipping industry, the prospect of shipping companies returning to the Red Sea appears improbable for now as concerns for the safety of their crews and vessels remain high.