Insight Focus

- December’s 25% sugar price fall was mild by historical standards.

- Prices are trying to stabilise near 20c, a historically high level.

- The market remains extremely fragile to adverse events.

To watch the video, click here!

Hi everyone, it’s Stephen from CZ. Welcome to another video on the state of the sugar market. I never quite found the time to make a video in December, so here it is instead in early January, which might actually be a better time for it? A New Year and a fresh look at the market.

Since my last video raw sugar futures have collapsed by around 25%. Hopefully, if you’ve watched my recent videos on the market this wasn’t too much of a shock. In my October video, I spoke about how demand destruction was happening without anyone noticing. At the time I said that wasn’t just because sugar prices were high but also because they had sustained at high levels for so long.

Refined sugar prices had been above $600 for most of 2023, having only ever hit that level twice before. People had run down sugar stocks and then had to make a choice about whether to buy at a high price or do without.

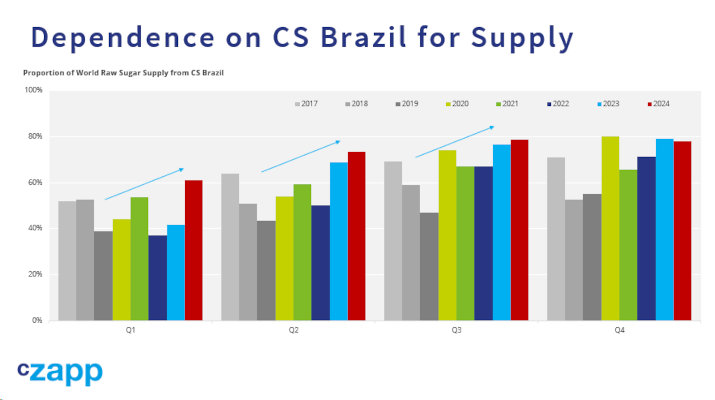

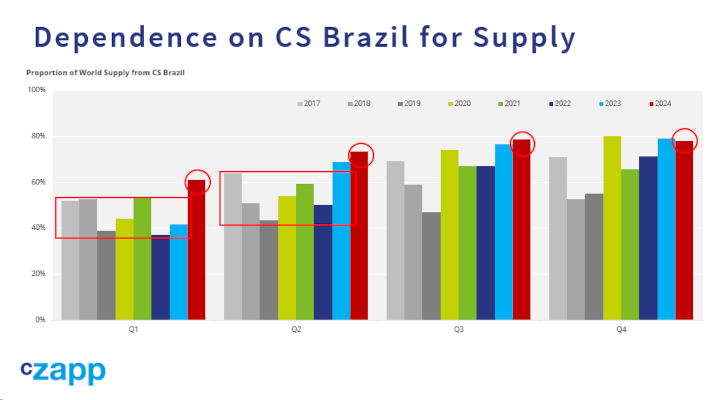

I also mentioned that the market’s dependence on CS Brazil for sugar supply and the fact that this sugar was constrained by port loading capacity might lead to demand destruction, simply because people couldn’t get hold of the sugar when they wanted it even if they could afford to buy it.

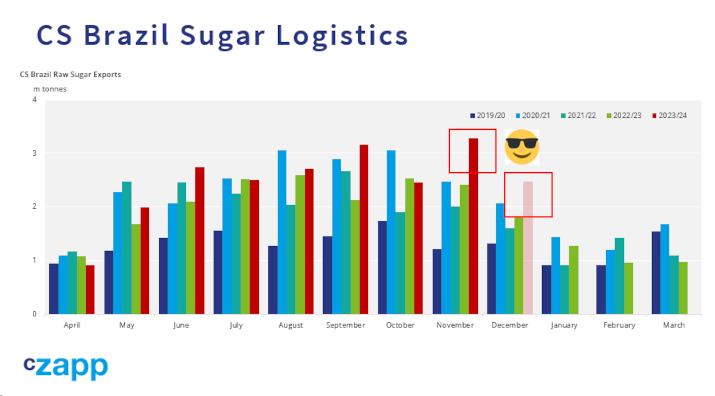

You can see from this chart here that the market’s dependence on Brazil for sugar supply has been growing.

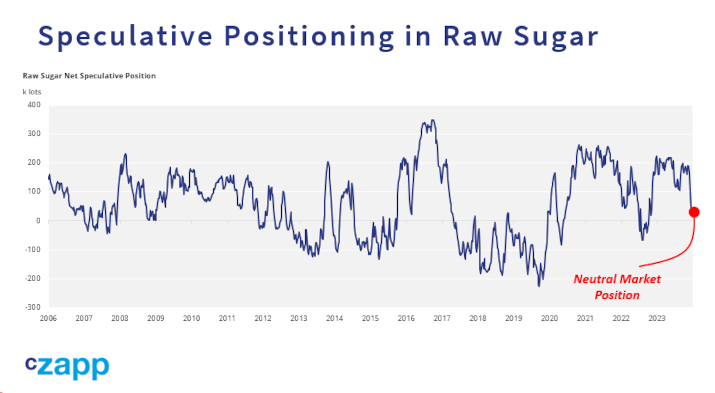

In November I spoke about other risks to the sugar market, how the US Dollar and interest rates were still strong, which is usually negative for commodities. I also spoke about how many other commodity markets had already peaked and were weakening. About how the speculator’s long position in sugar was getting stale. About how commodity indexes were cutting their longs in sugar, and the trade were less bullish than they had been earlier in the year. I said that I still thought 2024 would bring fresh highs for the sugar market, but that we might get to 30c via the low 20s first. And this is what has happened.

Word on the street is that the speculators have largely been ok. Their long was built in the early 20c area, the backwardated market has paid them each time they’ve rolled ahead of a futures expiry and they’ve largely sold in the mid-20s.

But the commodity trade houses seem to have been hit really hard. Some of the largest commodity houses in sugar seem to have given up all of their 2023 sugar profits in just a few weeks on the way down. I guess it’s quite easy to be nimble with a sugar futures position, which can be cut with very little notice at the first signs of trouble. But it’s much harder to reposition a large physical book that reaches far into the future and has various futures hedges associated with the physicals.

So what happens next? I’ve consistently said in recent weeks that I think the market could hit fresh highs this year.

It’s too utterly dependent on Brazil for supply. Look at this chart again, which shows the proportion of the world’s raw sugar supply that comes from Centre-South Brazil each quarter. Normally in the first quarter of each year Brazil accounts for 40-50% of the world’s sugar supply. This year it’ll be 60%. In Q2 it’ll account for a record 75% of global supply, before reaching nearly 80% in the second half of the year. Any problems in Brazil will be reflected in the price.

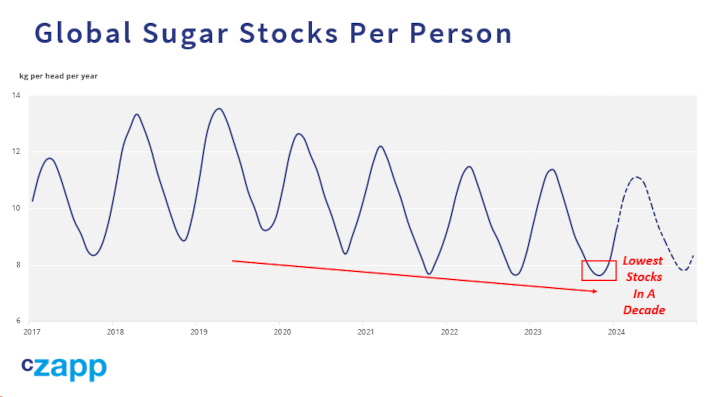

Global sugar stocks remain super-low. Many buyers have nothing to fall back on. This is a market that’s stretched super-thin and is vulnerable.

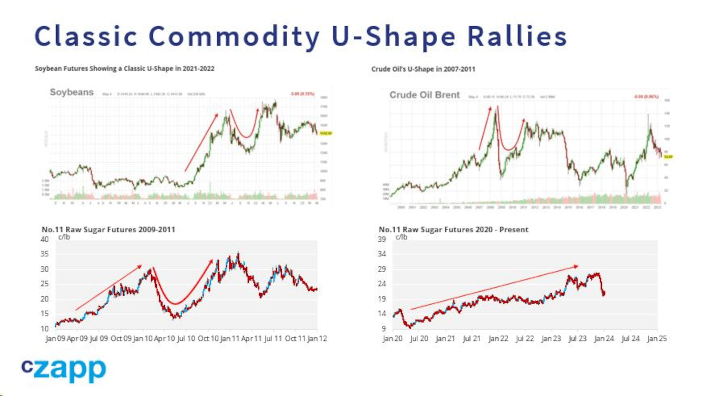

Commodities often rally in broad U-shapes too.

I mentioned this last May when I looked at sugar’s last major rally in 2009-11 in a Czapp article.

Speculators often lose confidence and the newswires abandon the old stories for the new ones even before the underlying structural problems that drove prices higher have been resolved. The news follows price action, not the other way around. The news looks the most bullish at the top. Market models such as trade flow analysis are reactive to events and price.

Bull markets are about order flow and sentiment: markets are a succession of squeezes and in bull markets these squeezes are more severe than normal. But when the last distressed short is forced to cover, the rally is over. Newswires and fancy excel models won’t tell you when this has happened. This can create opportunities for disciplined hedgers.

With all this fragility in mind, it doesn’t make any sense to me that the entire 2024 raw sugar futures curve falls into carry. The March-October spread traded close to flat and so perhaps that’s the first sign that the market could stabilize near 20c.

But the truth is that when markets collapse no-one knows where they turn. There’s the old trading phrase, “never try to catch a falling knife”. Don’t try to be too smart. Be like Drake; have a plan and use it.

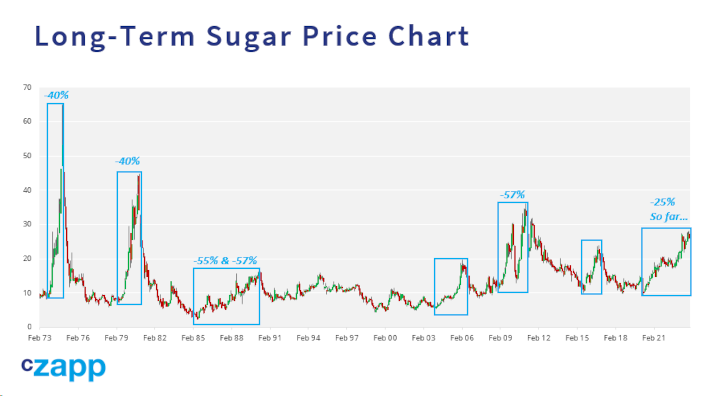

Here are some reasons why the market could continue to fall. Firstly, most previous sugar bull markets see drops of 40-60%. Here are the sugar markets 7 bull markets in the last 50 years. 2 haven’t seen a major pull-back. The others have. This means the current 25% pull-back is actually quite mild by historical standards, though I accept it may not feel like this.

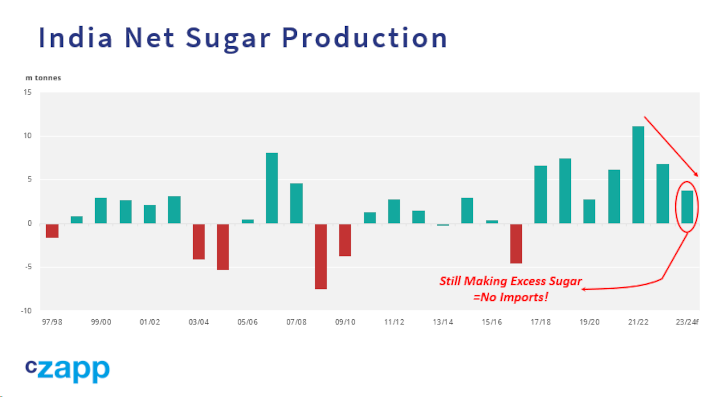

Secondly, cane yields in Southwest India are rumored to be better than many have expected, which means some of the alarming lowball crop projections for India have been withdrawn. This and the government’s changes to their ethanol policy means that the world’s largest sugar consumer probably won’t need to import sugar in 2024.

Thirdly, Brazil’s logistics continue to perform well; sugar is flowing to the world market. September shipments were the best in at least 4 years, October shipments were normal, November shipments were the best of the season so far. We’re awaiting a final recap from December, but early signs are that the flow of sugar in the month to the world was strong too.

Fourthly, we don’t yet know the full extent of sugar demand destruction around the world. It might be larger than we think.

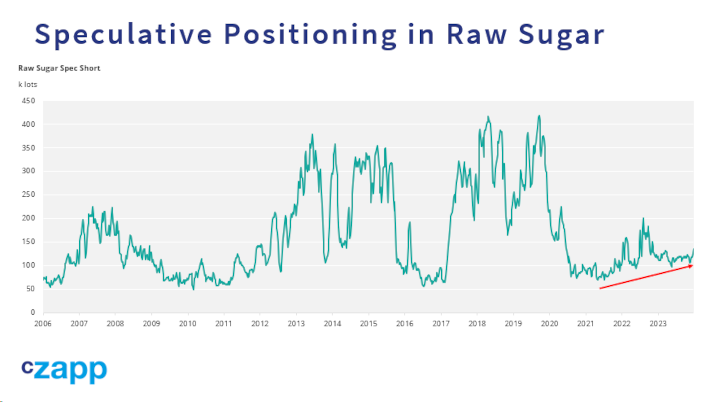

Finally, there’s no reason the speculators couldn’t short the market. They’ve cut their longs and are net neutral the market.

But the speculative short position has been rising, and could continue to rise.

So what does this mean for sugar hedgers in 2024?

I still think we see new highs at some point this year, so I’d suggest hedging accordingly. This is a golden opportunity for consumers to hedge 2024 and 2025 at close to 20c. Recall that historically sugar is cheap below 20c and expensive above 20c.

Producers can probably afford to wait for prices to improve before adding to their hedges.

Bull markets are usually volatile, which should mean everyone is able to reach their goals with a disciplined plan.

Good luck in the year ahead.