Insight Focus

- New Zealand milk collections rebounded in September.

- Volatile October weather is expected to lead to strong milk collections in the month.

- Whole Milk Powder market remains tight.

New Zealand Milk Collections:

- The latest milk collection figures for the month of September have been reported by all dairy processors. As we had expected, the favorable warm wet end to September saw milk collections rebound and erase the losses reported in August. New Zealand collections are now up 0.5% Fonterra Financial Year to Date (even though Fonterra themselves are only flat through the same period).

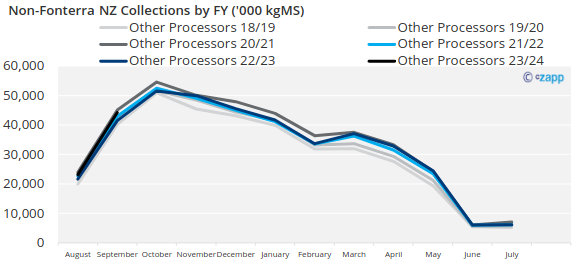

- As per August, all milk collection growth in September came from the non-Fonterra processors. The group are up 6.8% FYTD and 6.6% YoY. With Fonterra reporting weakness in the North Island, we continue to believe much of the non-Fonterra gains are coming from milk supply won from Fonterra. At this early stage in the season, it seems that the 2023/24 non-Fonterra collections are quite closely following those of the 2020/21 season.

- New Zealand weather in October has been volatile, with the average temperature for the month only 0.4 degrees Celsius higher than a typical October but with a wide range of temperatures observed. More westerly airflows brought warmth, typical of an El Niño pattern, but this was offset by colder southerlies. A similar story can be told for rainfall, with some key dairying regions very wet (Northland and interior Canterbury) while others were very dry (Waikato, Taranaki and Southland). As the season goes on an El Niño pattern typically does lead to drought in many dairying regions.

- The current soil moisture anomaly shows wetter than usual conditions across most of New Zealand, pastures will be thriving and we expect another strong milk collection print for October to come.

- We are looking for a DCANZ print of around 256 million kgMS for New Zealand Milk Production in October. Expectation would be approximately 202 million kgMS from Fonterra with losses in the North partly offset by gains in the South. The Non-Fonterra group could conceivably total 54 million kgMS with their market share increasing further but at a slowing rate.

Whole Milk Powder snippets and indicators:

- With New Zealand having just passed its annual “peak milk day” lets focus in on the country’s flagship dairy product: Whole Milk Powder (WMP).

- The WMP market remains tight, however we have seen some suppliers with parcels to sell in December after most suppliers were reportedly “sold out” until 2024 ETDs a month ago.

- If Fonterra are losing milk to competitors then this does have an impact on the aggregate product mix in New Zealand. Fonterra’s assets basically exist to all be running and processing all of the milk over “peak”. Many of the smaller processors in NZ do not have the ability to choose between making different products and those that do will be favoring the SMP/fat stream. This means that the aggregate production of WMP by NZ as a country might be even lower than expected by the broader market.

- The WMP futures market has exhibited an extremely strong carry recently, with one month calendar spreads able to be traded on screen at a premium (i.e. the near month offer is below the next month’s bid for the front seven months, this is highly unusual and probably reflective of the El Niño more so than the national product mix. Cash-and-carry operations should be profitable for most physical participants able to store and fund stock. Derivative calendar spread trading opportunities should be investigated.

- On the 21st of August the traded WMP price of $2,420 USD/MT was the furthest from the calculated long-run mean since the start of April 2022, the gap reaching almost $1,300 USD/MT. This gap has closed to $490 USD/MT now. The LRM is set to reduce to approx. $3,450 in early December but with the WMP half-life stretching out to 90 days the upward pull of mean-reversion on WMP is diminishing.

- Calculated historic volatility in WMP remains high around 32% and can be expected to reduce toward its own LRM of around 19%. Implied vol in the market is closer to 21% at time of writing.

- Technically WMP appears to have faltered at the 61.8% Fibo. Short term a test of the 50% level around $2,920 USD/MT is likely. This level was established in the WMP market way back in 2014 and has been a key support/resistance marker over the past nine years. We often observe swift price action around this level both to the up- or down- side.