Insight Focus

- New Zealand Non-Fonterra milk collections exceed expectations.

- Whole Milk Powder market is tight; GDT sees increased demand.

- CME spot butter reaches record highs due to strong US consumption.

New Zealand Milk Collections:

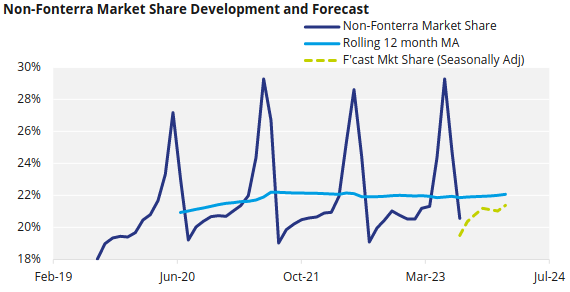

- The latest milk collection figures for the month of August have been reported by all dairy processors. The Non-Fonterra bloc have exceeded seasonally adjusted expectations for market share by 1.1%, a strong start to the season! Their August YoY collections were up 6.8%.

- Fonterra’s North Island collections were down almost 5% for the month of August. Fonterra have claimed that “wet weather has meant lower pasture utilization”, however a closer look at the data reveals that this might actually be milk lost to competitors. We have noted in recent articles that the Waikato will be a key region to watch this season for competition and this seems to be playing out already.

- After New Zealand’s coldest August in the past seven years we have gone on to have our warmest September on record. Rainfall has been over 120% of normal for most regions, with a particularly wet end to September. The effect of this warm wet period is that dairying regions should be in great condition. As they say, “you can hear the grass growing.” New Zealand aggregate milk collections were only down 0.9% in August, a figure that will easily be recovered over peak if current conditions prevail.

Market snippets:

- The WMP market is very tight, most suppliers are reportedly “sold out” until 2024 ETDs. This creates a very interesting dynamic for GDT as it is now the only place with substantial WMP volume available for shipment this year.

- SGX-NZX futures are currently pointing to a $3,000 USD/MT result for Fonterra WMP Regular C2 on the next GDT, a further $50 USD/MT up from the most recent Pulse result.

- As we saw last GDT event, further gains could be justified by continued Chinese buying, as product bought now will arrive into China duty free. At the same time, local Chinese milk powders which were dried earlier in the year have supposedly all expired too.

- Algerian buyers are expected to be tendering again in November with SMP demand from January and WMP demand from February/March ETDs. Timing will be crucial for the Algerian buyers here: on the one hand there is the possibility of extra milk coming back into the NZ supply mix at peak, while on the other hand GDT could show significant short-term strength. Either way, a large clip of milk powders bought by Algeria would only serve to tighten this market further. Uruguayan participation will likely be key for any coming demands and premiums from all origins could be significant.

- A rare occurrence in the last Soummam tender was that NZ origin won significant SMP volume (around 1,650mt).

- Two very interesting points were made at the SGX-NZX Global Dairy Seminar.

- Mike McCully (McCully Group) talked about the USA’s approach to environmental factors in dairy being much more commercially oriented than Europe and Oceania – the impact of this is that US milk supply will continue to grow while the other key origins stagnate, and US market share will then grow in an outsized manner as global demand continues to increase.

- Khoon Goh (ANZ) talked about Chinese household savings being 107% of GDP (vs. an average of 80% pre-COVID). Once the Chinese consumer regains their confidence then this significant savings pot could begin to be spent again. A realistic case can be made for demand for simple luxuries, such as ice cream, to benefit from this when it happens. Granted the Chinese housing market is a key driver of this confidence level and the situation there is still uncertain/weak, so a confidence induced release of savings could still be further away than people expect.

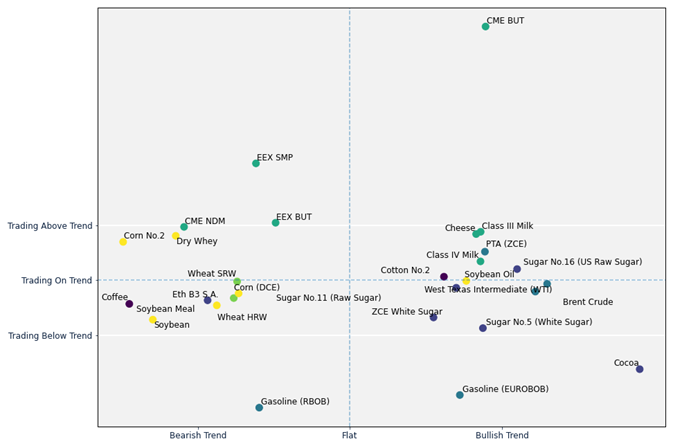

Dairy futures continue to trade “above trend” – CME Butter “has exploded”:

- CZ’s Quantitative Analysis team have an algorithm which identifies the most significant commodity market trends over a two-week up to a 6-month timeframe, as well as the deviation away from the current trend.

- CME spot butter has traded at record highs. This is due to very strong local US butter use (consumption or product being stored locally for consumption). This period is the typical buying time for Thanksgiving.