Insight Focus

- Global refiners slow raw sugar purchases.

- Raw sugar prices remain near decade-highs.

- Refined sugar demand is normal.

Click here to watch the full video on demand!

Hello everyone and welcome to my update on the sugar market for July 2023.

I’m not at all sorry that this update is a bit late because in the week or so that I’m overdue a lot more has become clear about the state of the sugar market.

I now I feel I have something interesting to say.

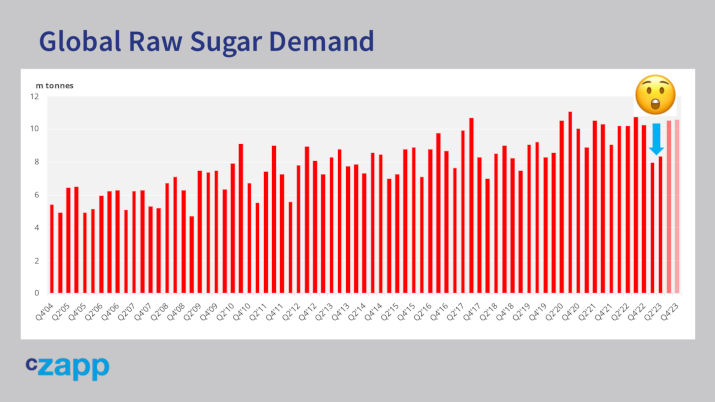

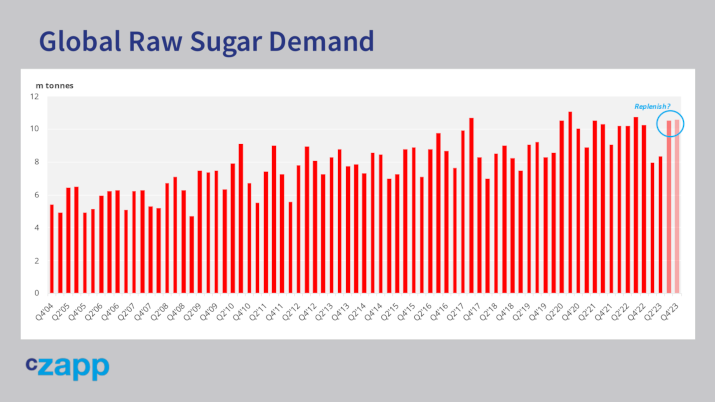

For example, did you know that raw sugar demand in the first half of 2023 was 20% lower than in the first half of 2022? This is huge. It’s really rare to get demand deferral on this scale in the sugar market. Yet no-one’s talking about it.

The newswires and papers love a scary news story – imagine if global gasoline demand had dropped by 20% – you could have drowned in the number of words written on the subject. But a 20% drop in sugar demand? No-one’s noticed or no-one cares.

Source: Refinitiv Eikon

This is your regular reminder that the press won’t help your risk management decisions. Watching the news will only make you perform worse. I mean, the media was full of stories on the way up, but prices fell 18% too at the end of June with barely a comment.

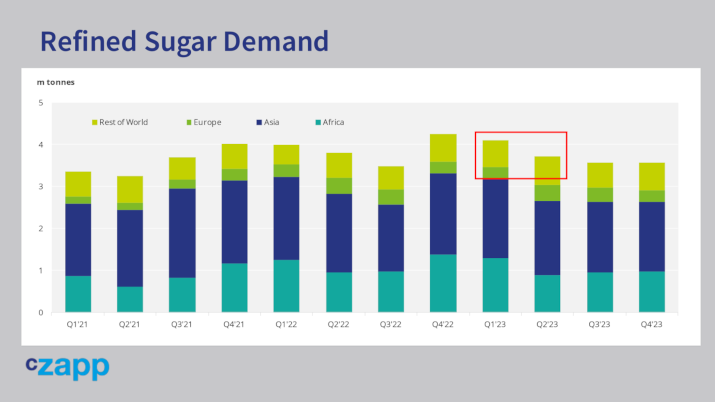

What’s even more interesting to me is that we’ve not seen any demand deferral at all in refined sugar, which is the stuff that people actually eat.

So what’s going on? My read on this is that people are still eating the same amount of sugar today as they do always, even with the higher prices we’re seeing around the world. Sugar is cheap and enjoyable. In September 2022, I even made a video where I used Tony Soprano to explain that sugar was recession-proof.

This remains true, and we’ve also largely avoided a global recession in 2023 so far. But higher prices are having an impact further up the sugar supply chain.

Raw sugar processors – refiners who turn raw sugar from an industrial product into food – are running down their stocks rather than buy fresh raw sugar at high prices. They’ll look to replace these stocks if and when prices reduce.

Source: Refinitiv Eikon

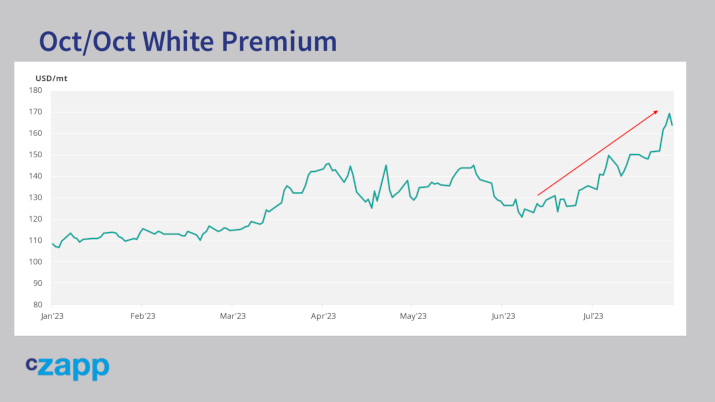

You can see this is happening by looking at futures prices.

Source: Refinitiv Eikon

The refined sugar market has been leading the raw sugar market higher.

The white premium – the difference between the two markets – has been rising as a result. The white premium is also a measure of re-export refiners profitability. This means that there’s a bid under the raw sugar market both re-export refiners and those refiners who sell their raw sugar domestically and who’ve been running down their stocks will want to buy raw sugar if it becomes cheaper.

Source: Refinitiv Eikon

I suspect there’s plenty of interest between 20-22c again. It also means that for refined sugar we’ve not had high enough prices to trigger noticeable consumer consumption loss – not yet, not on a global scale.

By looking just at demand, we can conclude that the price floor to the market is stronger than the ceiling. But that’s only looking at one aspect of the market, and the strength of each doesn’t necessarily tell you which way the market will go. The supply side of the market is much better known.

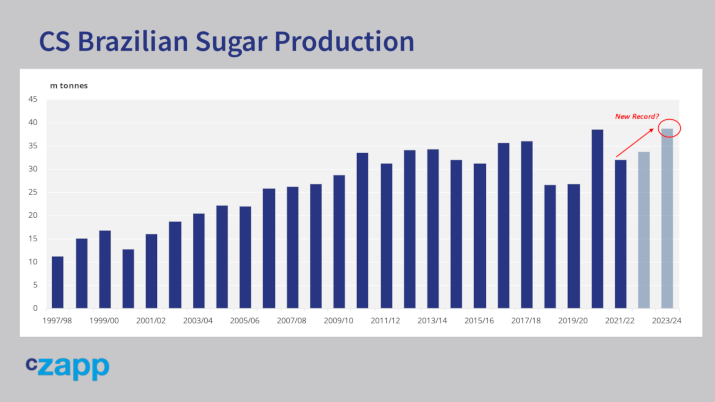

Everyone knows that this year’s centre south Brazil crop is MASSIVE.

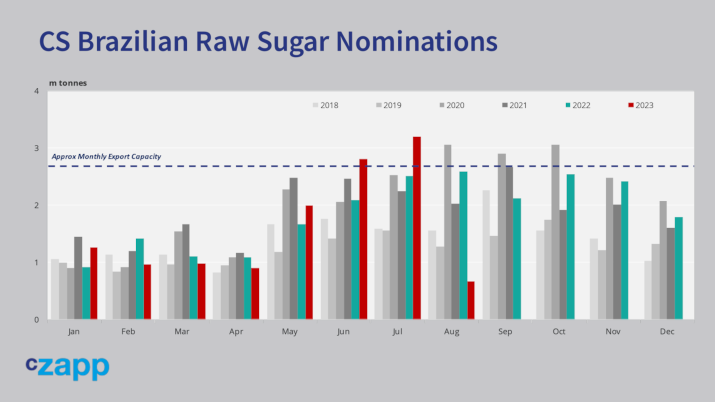

Everyone knows the problem is getting this sugar from upcountry down to the port, where there’s a bottleneck. Generally ports can load 2.6m tonnes a month. Sometimes in a good month they get closer to 3m tonnes. But this is roughly half the rate the sugar is made.

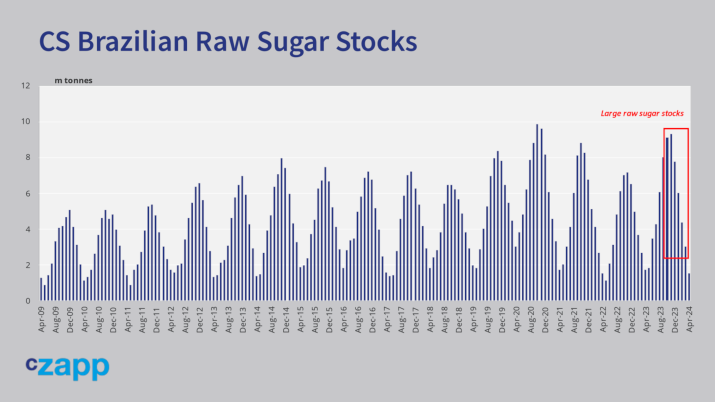

This means Brazil is going to carry a lot of sugar into its December to April offcrop. Tthe sugar may not be fully available today, but it’s available early next year for anyone who can defer demand that long.

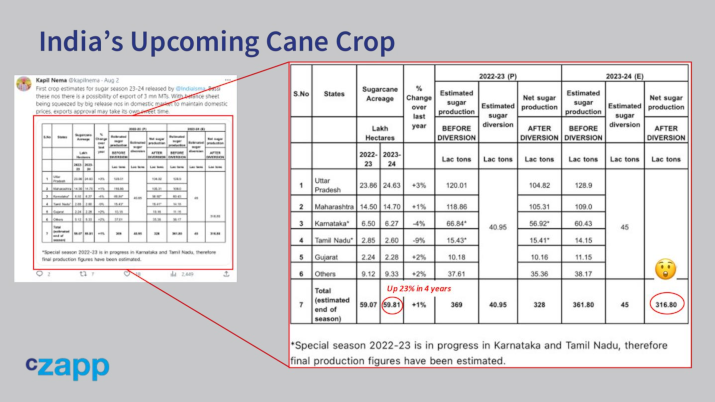

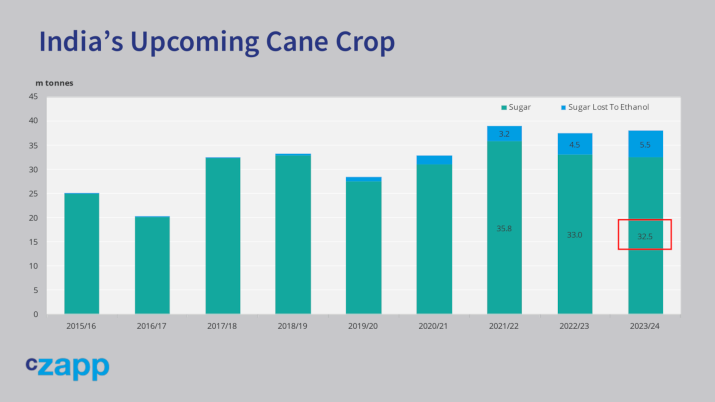

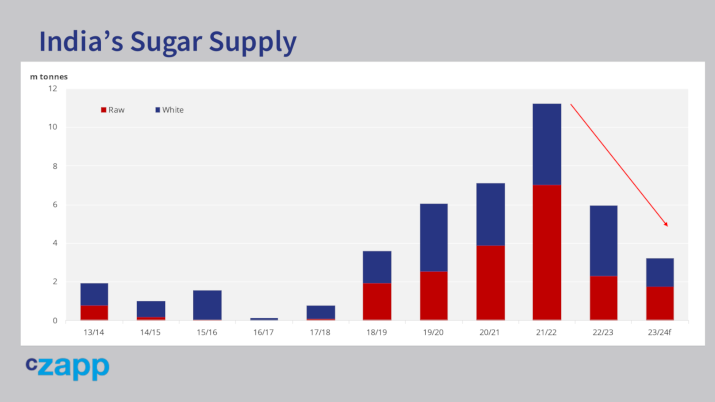

Meanwhile in India, as always, no-one knows anything much. Local sources continue to talk the crop lower. The Indian Sugar Milla Association put out a 31.7m crop forecast last week, which was one of the lowest we’ve seen.

Yet cane acreage has hit a record high of 6m ha and the weather looks pretty normal from the data we receive.

So we’re keeping our 32.5m tonne forecast, which means we think the India will allow 3 or 4 million tonnes of sugar exports at some point in the first half of 2024.

This is several million tonnes less than we’ve seen in previous seasons, but you could argue this is also counterbalanced by Brazil’s extra availability in this time.

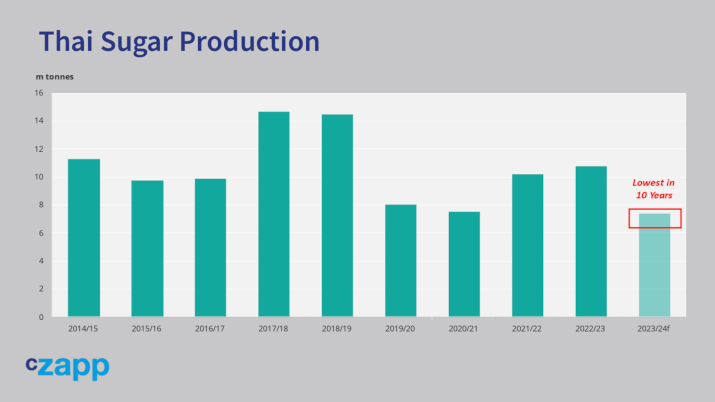

Thailand’s poor crop is well-known and priced in. So from a supply point of view there’s the potential for extra stress in the market, but for now things are ok. Everyone is watching and waiting.

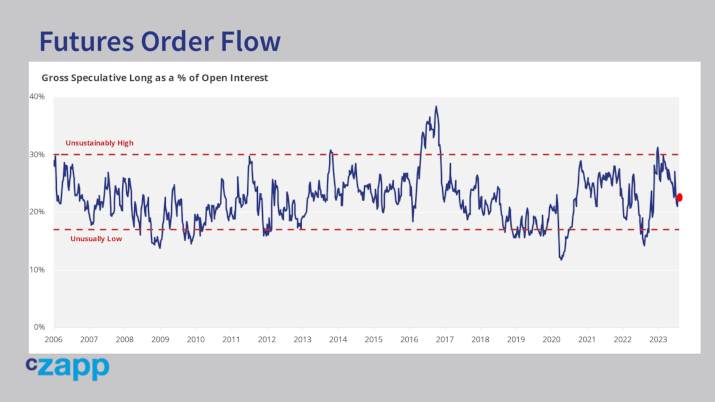

You get a sense of this from the futures market order flow.

Speculators have spent most of the year slowly trimming their long, and they now have quite a neutral position in the market.

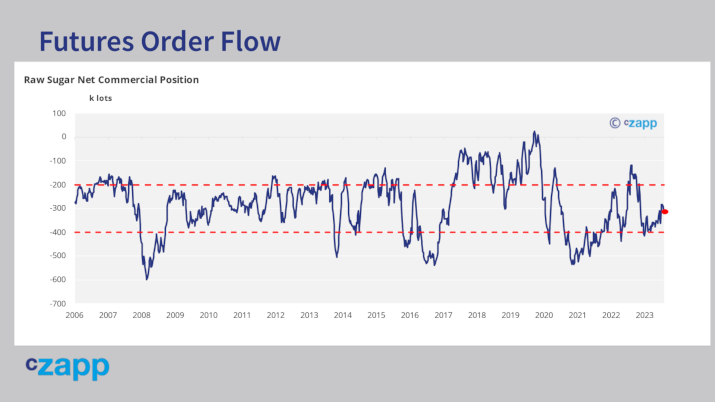

It’s the same for consumers, whose net position in the market is pretty mid-range.

Source: Refinitiv Eikon

The last fireworks came in June, when sugar’s upward parabola broke and the market promptly collapsed to 22c. Escalator up, elevator down. But, anyone who quickly changed course and shorted got burned when the Chinese refiners bought at 22c and rammed the market higher once more. Potential shorts will worry about being burned twice.

Meanwhile, any speculative longs who had their fingers hovering over the sell button might have had a reprieve but will still be nervous that the market has stopped rising; we’ve had a succession of lower highs. Stale longs tend to get trimmed.

Source: Refinitiv Eikon

So we’re stuck between the 50 and 200 daily moving averages, going nowhere. If you’re looking to hedge sugar, this is not helpful. So what is helpful?

In the short term the market could move sideways to lower; we could easily see the market back at 20c. There’s no immediate sugar supply stress.

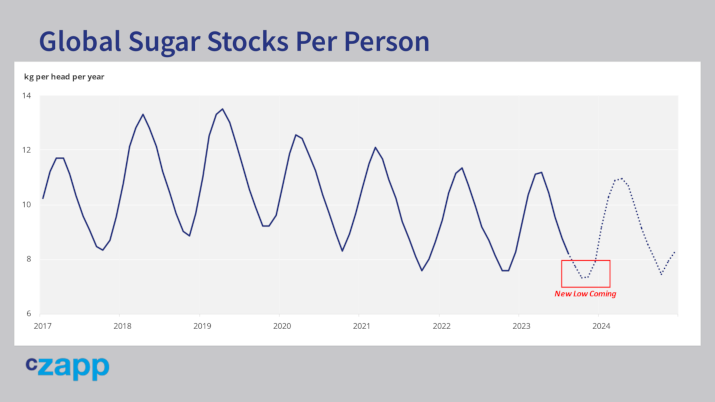

In the longer term, sugar stocks around the world have been drawn down.

They’re at the lowest level since we started recording this data. There’s nothing much to fall back on if something goes wrong.

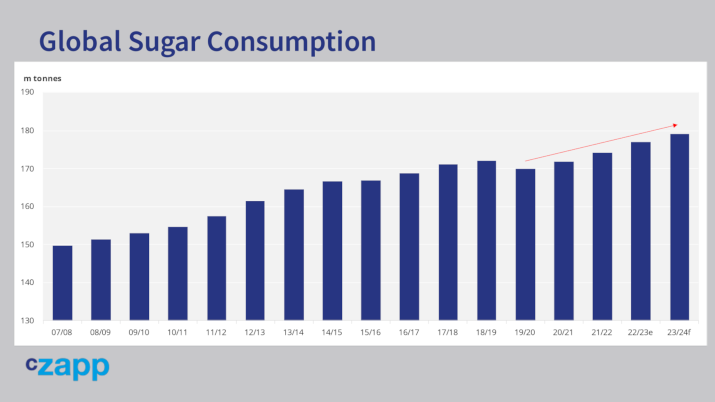

We’ve not yet found the price at which people eat less sugar.

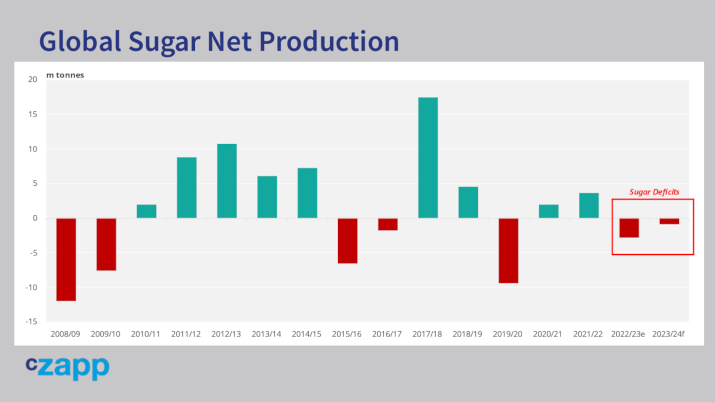

We’re seeing the 2nd largest sugar production around the world on record and it’s still not enough to keep pace with consumption growth.

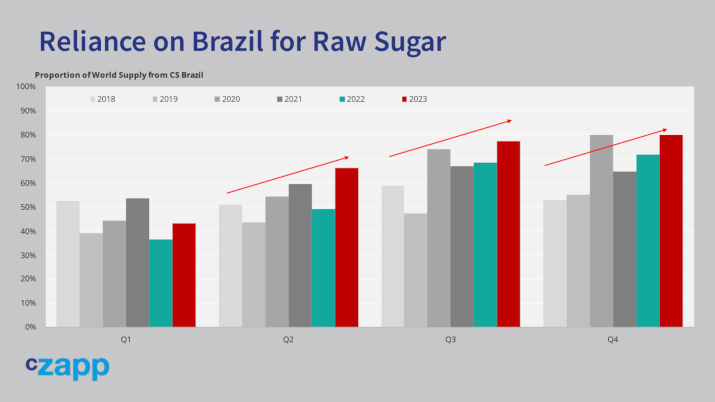

The market is becoming dangerously dependent on Brazil for its supply, as this is the only region where we are seeing major sugar production growth.

Source: Refinitiv Eikon

Plus macroeconomic conditions are becoming more favourable for commodities: the Dollar is weaker and interest rates are peaking.

None of this suggests a low price environment to me.

I think therefore that at some point in the next 12 months we will see new highs in the sugar market. I just don’t know when. All it takes is for something somewhere to go wrong.

Source: Refinitiv Eikon

Remember, markets above 20c are rare, the higher they go the more volatile markets can be.

Hopefully, this means the coming months give everyone a good opportunity to hedge sugar. Make sure your risk management program allows you to move quickly to capture market opportunities.

As always, good luck and thank you for watching.