Insight Focus

- Record-high May New Zealand milk collections.

- Warmest May on record with above-average temperatures and rainfall.

- Halal restrictions on Algerian imports not impacting NZ exports, monitoring ongoing developments.

New Zealand Milk Collections:

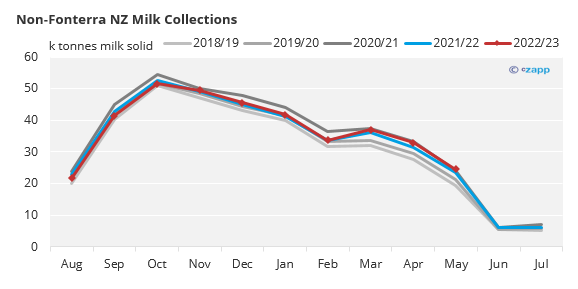

- The latest milk collection figures for May have been reported by all dairy processors, marking another notable milestone. Following an exceptionally strong April, May milk collections were also the highest ever recorded for this month. As a result, the cumulative collections for the Financial Year to Date (August to July) have turned positive for the first time this year. Through May, national milk collections have increased by 0.29%, positioning it as the fourth highest collection volume during this period.

- Fonterra collections are playing catch up, with milk flowing strongly in both islands. Meanwhile, the “Non-Fonterra” sector maintains its strength as the season winds down, thanks to their winter milk farmers who remain in production. As a result, this group has achieved their second highest milk collections ever recorded at this stage of the season. This is lead primarily by Open Country Dairy, Synlait and Westland Milk. When accounting for seasonal fluctuations, the collections from the non-Fonterra group have rebounded close to the typical 22% market share threshold.

- According to The National Institute of Water and Atmospheric Research it was the warmest May on record in New Zealand. Temperatures were >1.20°C above average for most of the country. Rainfall was above normal >120% for almost every major dairying region.

- Looking ahead to June: temperatures across NZ were still above average but rainfall was below 79% of normal for most key dairying regions. Expect collections to have dipped back to more normal levels as most herds will have been dried off and grass growth has slowed.

NZ Production Decision Drivers:

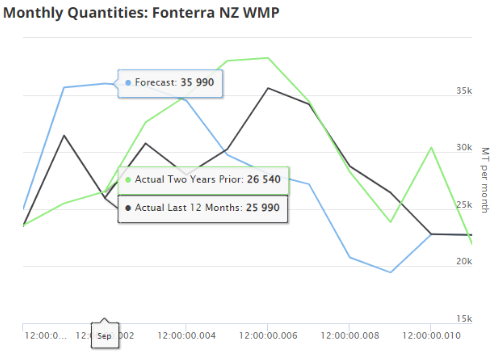

- There has been quite a significant reduction of sugar demand from dairy processors in NZ, especially for plants located in Waikato. We are told that this is “due to FFMP demand crashes”. We understand that this demand reduction is being led by three key factors: (1) as the price of Whole Milk Powder (WMP) has fallen recently, the delta between WMP and FFMP has closed to the point where buyers can substitute back to WMP. (2) FFMP competition has increased, as stocks of SMP in Europe grow, FFMP will become an increasingly valuable proposition to clear European Skimmed Milk Powder (SMP) solids. (3) conflict in Sudan, which has become an increasingly important demand location for FFMP, has damaged the ability of buyers located there to buy and to process/distribute their product locally.

- Recent Global Dairy Trade (GDT) results indicate that in NZ SMP/Butter remains substantially ahead as the leading stream return. This has closed fractionally but the delta is still enormous. SMP/AMF also remains in front of the WMP stream, though unusually the Butter price remains at a premium to Anhydrous Milk Fat (AMF) (which is illogical on a fat equivalent basis). Given that milk flows remain strong and most non-Fonterra processors do not have the ability to make butter, expect AMF supply to remain disproportionately strong and this unusual dynamic to persist.

- The above may partly explain the large skew of Fonterra’s GDT “Cream Group” offer volumes to AMF over butter. Finding buyers for AMF must be hard off-platform and by loading up GDT volumes the giant could be seeking to sustain the depressed pricing for AMF vs. butter – setting a tougher environment for their competitors, who need to match Fonterra returns at a Cream level.

- While there are signs of slowing milk supply in the US and EU it’s not enough to overcome weak demand in those markets. Stock levels continue to be reported as high anecdotally, especially for SMP and Butter.

- GDT remains weak and demand on the platform has been low. GDT volumes have been front-loaded for the coming auctions on WMP, SMP and AMF (the only exception being Butter). This factor may continue to weigh on pricing over the coming events.

Source: NZX-SGX

China and Algeria:

- Chinese supply/demand and Algerian demand are the key points to watch on the buy side. So far this year Chinese demand has been surprisingly weak and their local milk continues to flow strongly (to the point where local milk is being dried which will serve to extend the weak expected import picture). The Algerian demand picture has been surprisingly strong and has essentially kept the wheels on a wobbly global market.

- Further Algerian import licenses are being issued now which will continue to keep the market from sinking markedly.

- The message from the New Zealand Ministry of Primary Industries (“MPI”) Market Access team is that the Halal restrictions being imposed on Algerian imports only applies to exports from Europe and doesn’t currently impact exports from New Zealand.

- Algeria is an “Annex 1” priority country under the MPI Halal notice. This means that the MPI Market Access team directly assist with listing and registration requirements for exports to Algeria from NZ.

- MPI’s Market Access team is following up with their embassy base in UAE to see if any further developments or changes will impact NZ dairy exports to Algeria.