Insight Focus

- No.11 Mar’23 expired at 22.08c/lb, close to a 6 year high.

- The current No.11 May’23 contract has since been trading above the 18-20c/lb range.

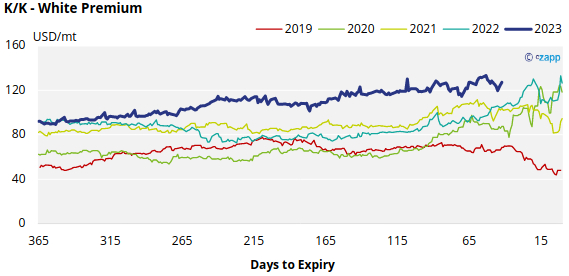

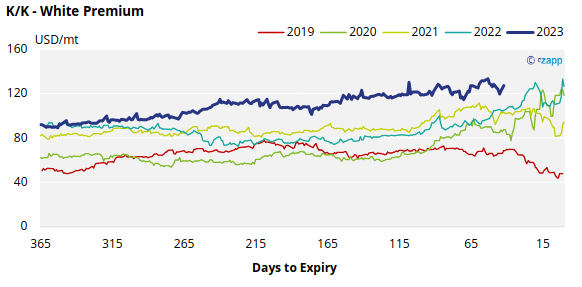

- K/K sugar white premiums stand at 127USD/mt.

New York No.11 (Raw Sugar)

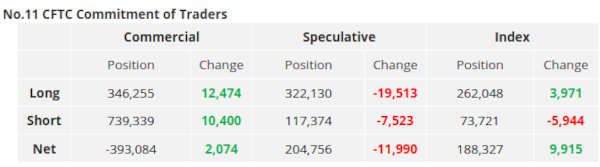

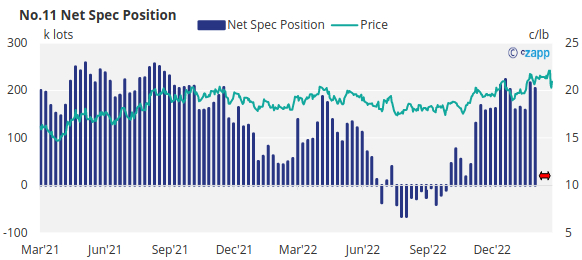

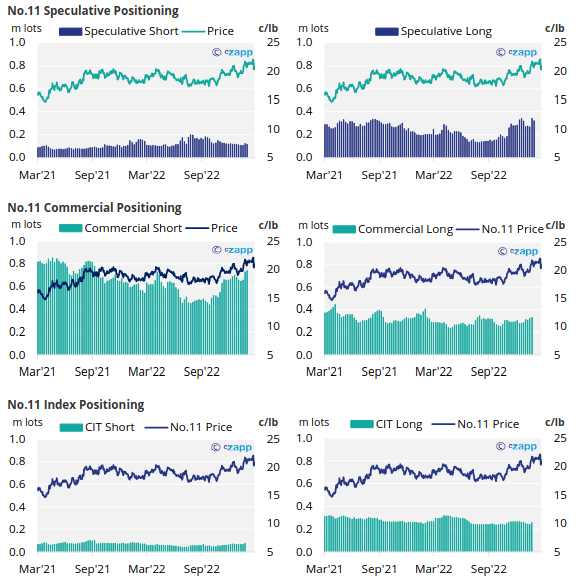

Due to the ongoing cyber-related incident impacting CFTC, data on the Commitment of Traders is updated to the 7th February 2023.

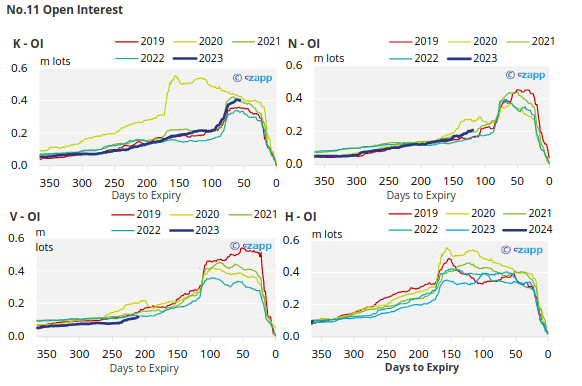

Mar’23 No.11 raw sugar futures expired last week at 22.08c/lb, before dropping back below 21c/lb as we move into May’23 contract.

As the CFTC progresses to resolve their incident impacting the CoT data, their latest released data includes position changes up to the 7th of February 2023.

We think it’s likely that speculators still hold a large, long position in raw sugar. For reference, by the 7th of February (latest CoT CFTC), the net spec position stood at 204k lots.

On the commercial side, raw sugar producers should still be able to capitalise on higher prices whilst consumers will likely still be hand-to-mouth buying in the lead-up to the May expiry.

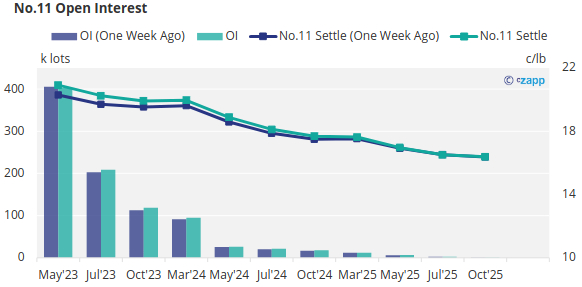

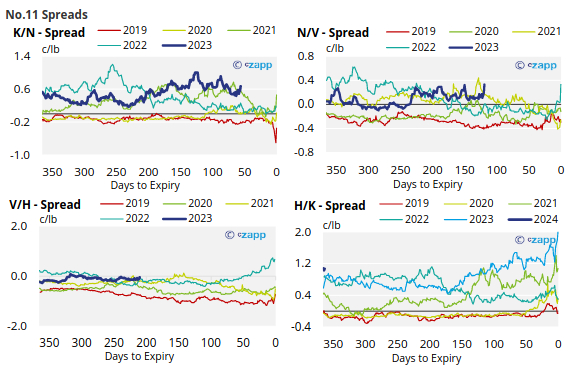

The No.11 forward curve remains inverted until Oct’23, moving slightly into contango into Mar’24.

London No.5 (Refined)

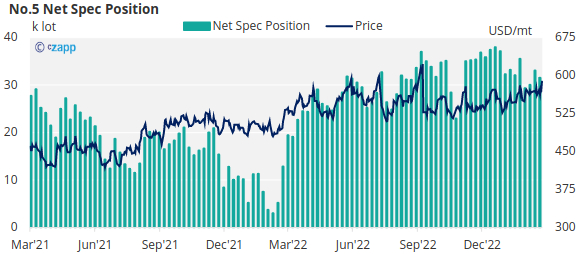

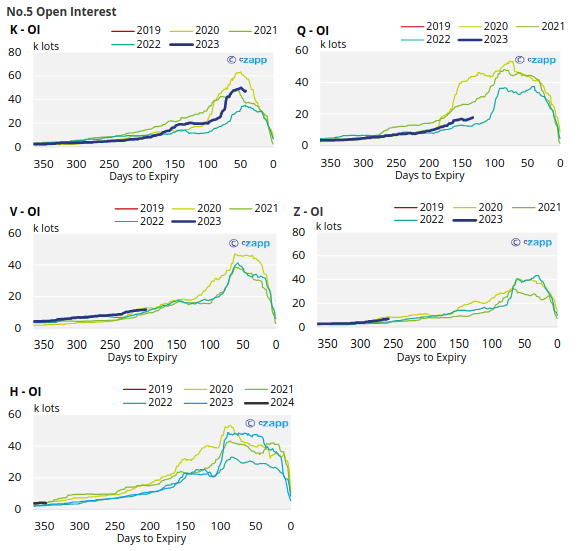

No.5 CoT data has been unaffected by the hack impacting CFTC. As such, data regarding No5. Net Spec Position is up to date.

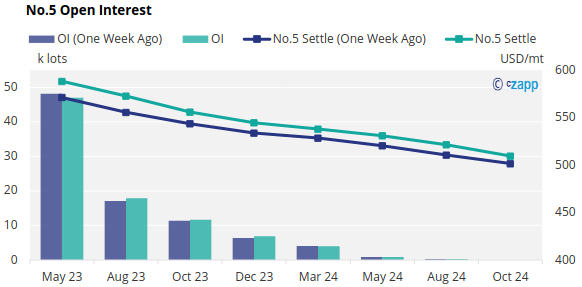

No.5 refined sugar futures traded sideways over the last week, until Friday when the market rallied to close at 588USD/mt.

By the 3rd of March (latest CoT ICE), the net spec position dropped to 31k lots.

Whilst contracts down the board have lifted over the last week, the No.5 forward curve remains backwardated into 2024.

White Premium (Arbitrage)

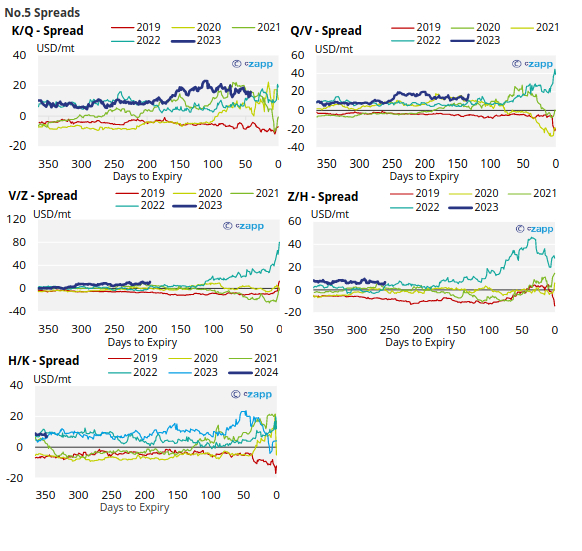

The K/K sugar white premium increased to 127USD/mt by the end of last week.

With world energy prices falling, we think re-exports refiners need around 115-125USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

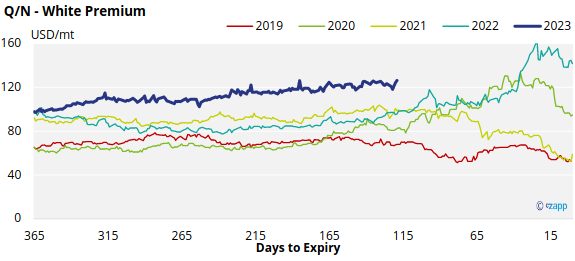

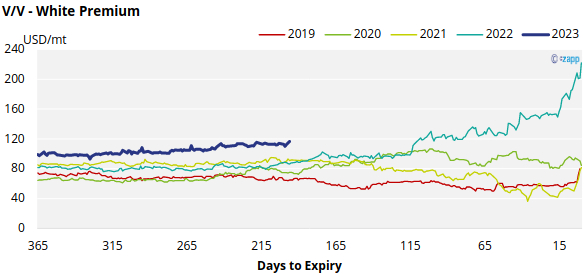

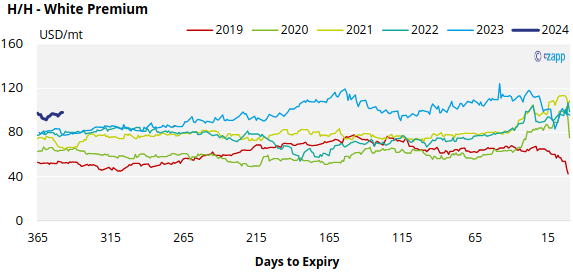

White Premium Appendix