Insight Focus

- Both raw and refined sugar futures broadly traded sideways over the last week.

- Both forward curves remain inverted.

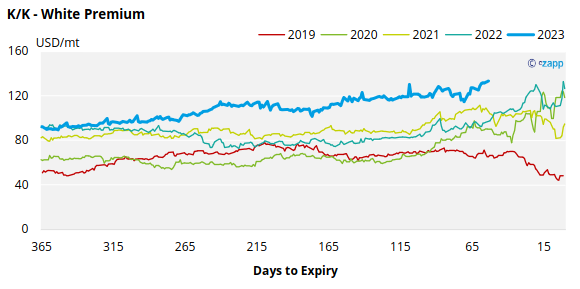

- K/K sugar white premium strengthened above USD 130/mt.

New York No.11 (Raw Sugar)

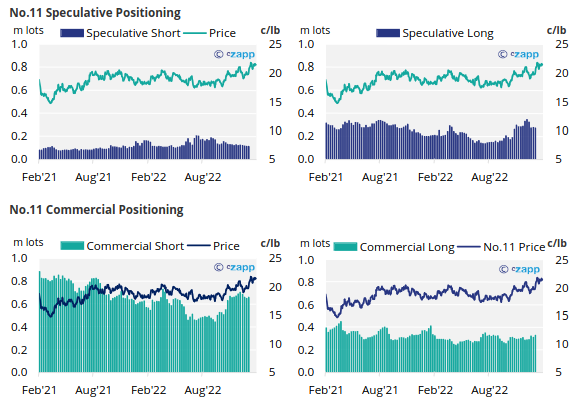

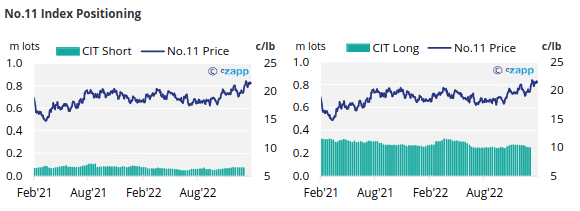

Due to the ongoing cyber-related incident impacting CFTC, we still have no visibility on the Commitment of Traders. Once data is available, we will comment.

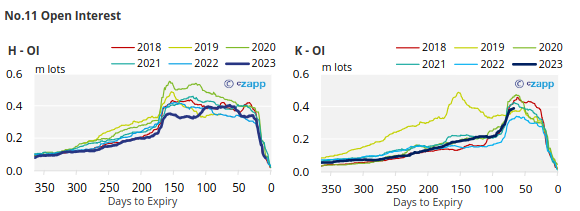

No.11 raw sugar futures have traded sideways over the last week, closing at 21.41c/lb by Friday.

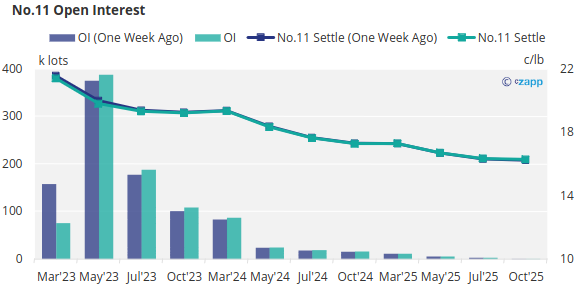

With the Mar’23 contract close to expiry; attention is moving toward May’23 which better represents whether prices will finally break out of the long held 18-20c/lb range. For the moment the May’23 is trading toward the top of this range.

Stronger prices likely have pressured raw sugar consumers to return to hand-to-mouth buying. On the contrary, raw sugar producers may have taken advantage of market strength.

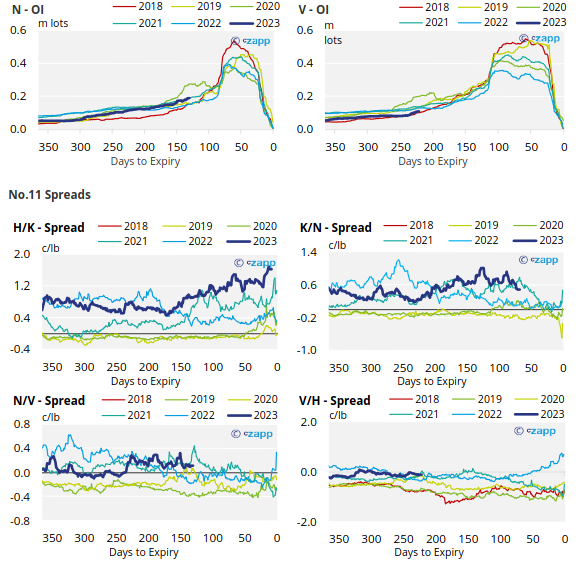

The No.11 forward curve remains inverted until Oct’23, moving into contango into Mar’24; the H/K’23 spread remains close to recent highs; now trading around 160 points.

London No.5 (Refined)

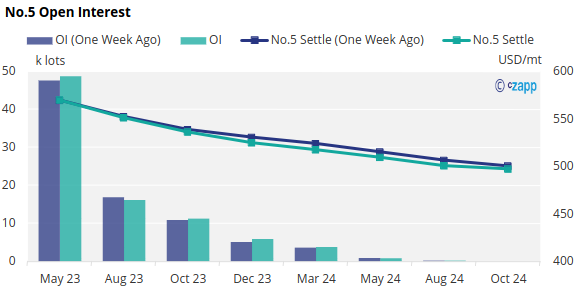

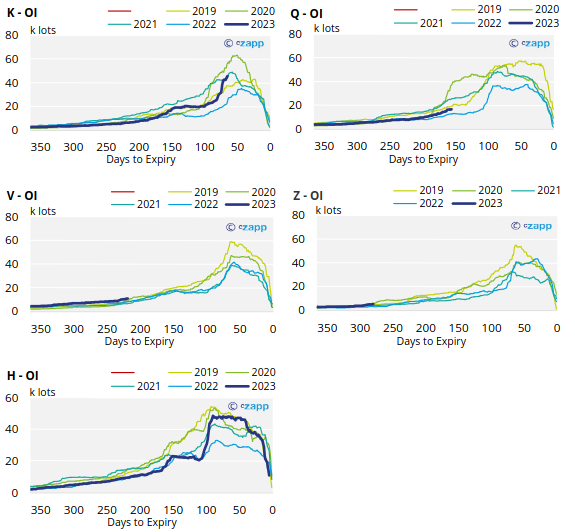

Following the recent March’23 expiry, No.5 refined sugar futures have traded slightly higher over the last week, closing at 568USD/mt by Friday.

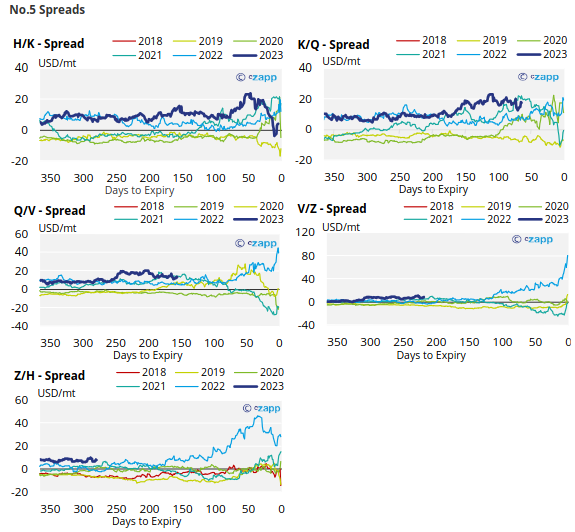

The No.5 forward curve nearby contract remains backwardated into 2024, contracts further down the board have fallen slightly over the last week.

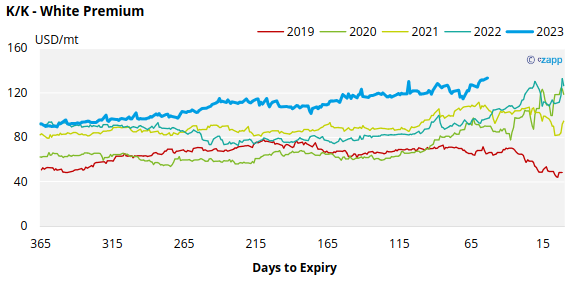

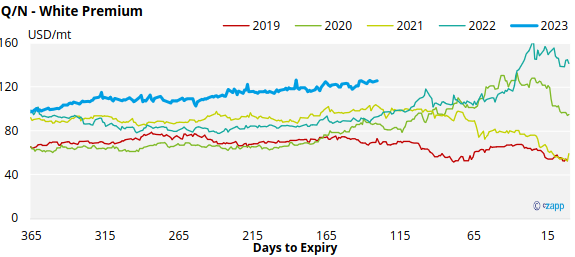

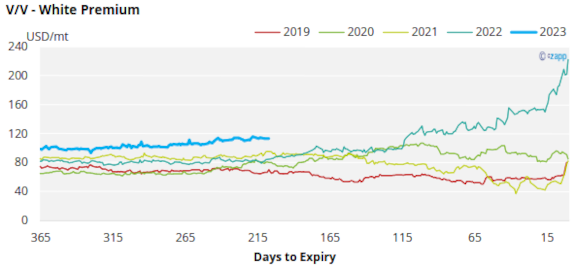

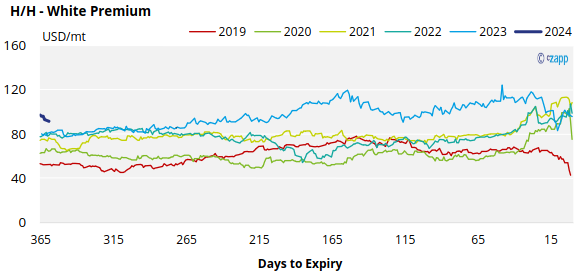

White Premium (Arbitrage)

The K/K sugar white premium reached 133USD/mt by the end of last week.

With world energy prices falling, we think re-exports refiners need around 115-125USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

No.5 Open Interest

White Premium Appendix