Insight Focus

- Both raw and refined sugar futures strengthened over the last week.

- Raw sugar consumers add new hedges despite market strength.

- H/H sugar white premiums have softened below 100USD/mt.

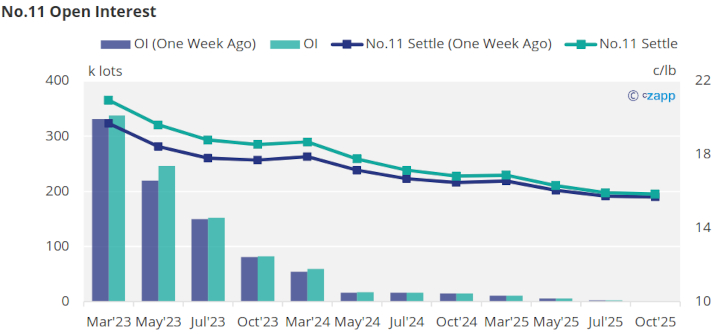

New York No.11 (Raw Sugar)

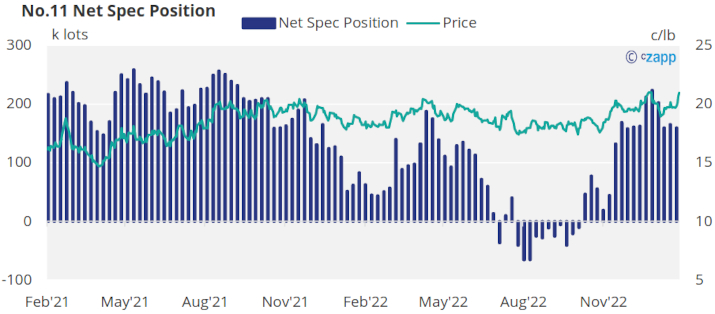

No.11 futures rallied over last week, briefly breaking the 21c/lb mark, the highest so far in 2023.

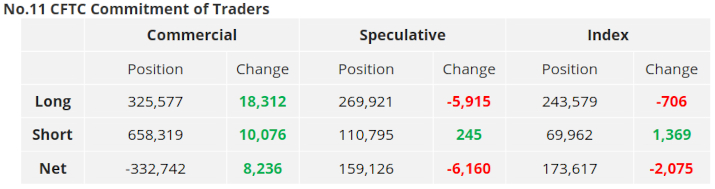

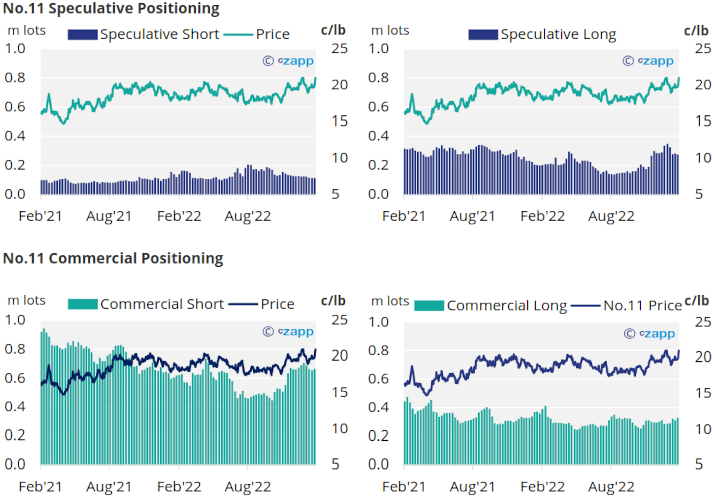

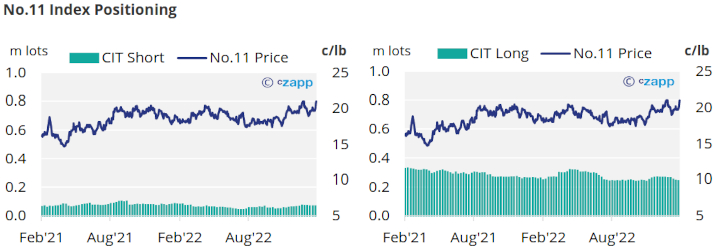

By the 24th of January (latest CoT CFTC), prior to the rally, speculators closed 6k lots of long positions while adding 245 lots of short positions.

As a result the net spec position retreated slightly to 159k lots, once data covering this most recent rally is available it is a likelihood that this retreat will be reversed.

Raw sugar consumers added 18k lots of new hedges, since the No.11 hasn’t traded near 18c/lb since early November 2022 (the level we would previously observe stronger consumer buying), this could be indicative of raw sugar consumers returning to hand-to-mouth buying.

Stronger market prices currently benefit raw sugar producers more, who added 10k lots of new hedges.

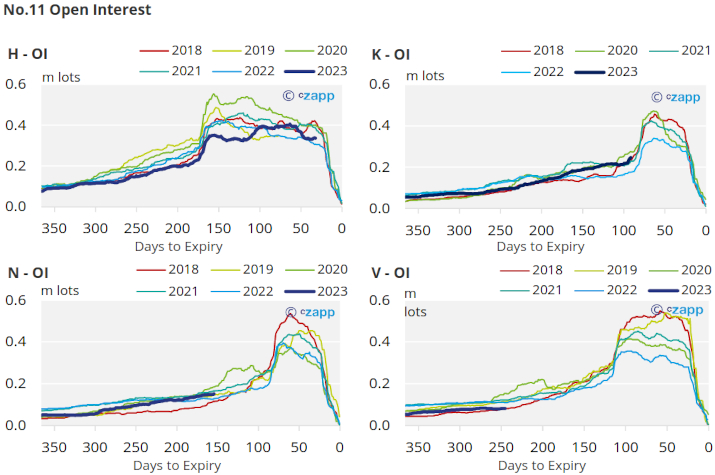

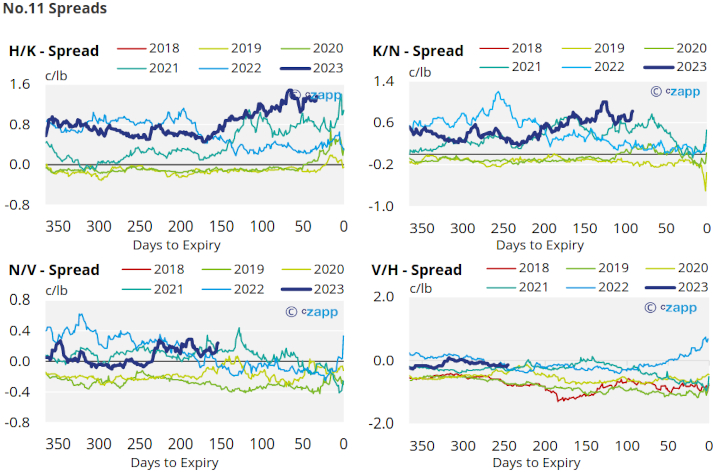

The No.11 forward curve remains inverted, however it steepened significantly in the nearby contracts.

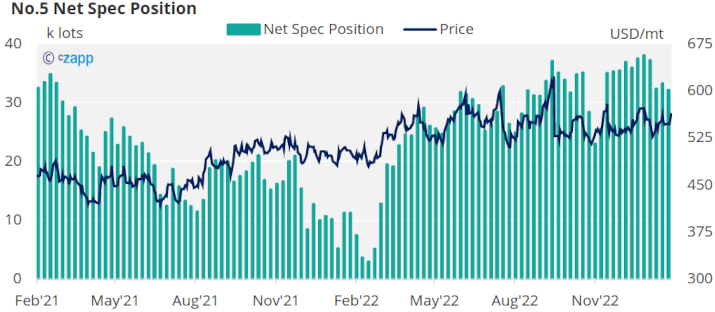

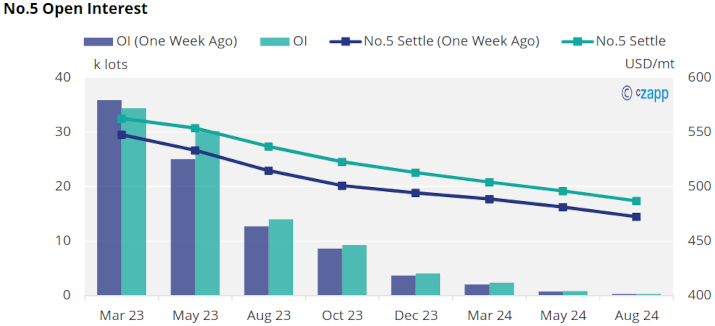

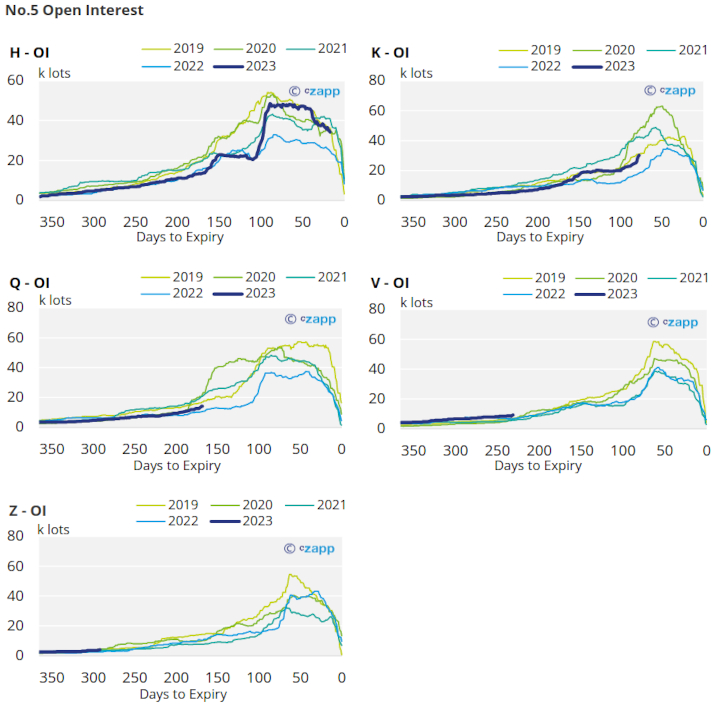

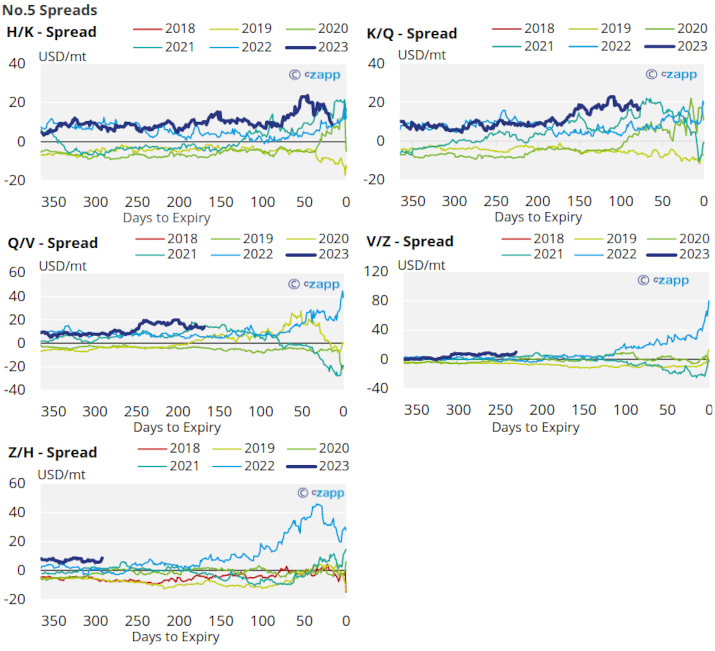

London No.5 (Refined)

No.5 refined sugar futures also strengthened toward the end of last week, closing at 562USD/mt by Friday.

By the 24th of January (latest CoT CFTC), the net spec position retreated to 32k lots, with the March’23 expiry upcoming, not all positions will be rolled over to the May’23 contract.

The No.5 forward curve has lifted since last week, remaining backwardated into 2024.

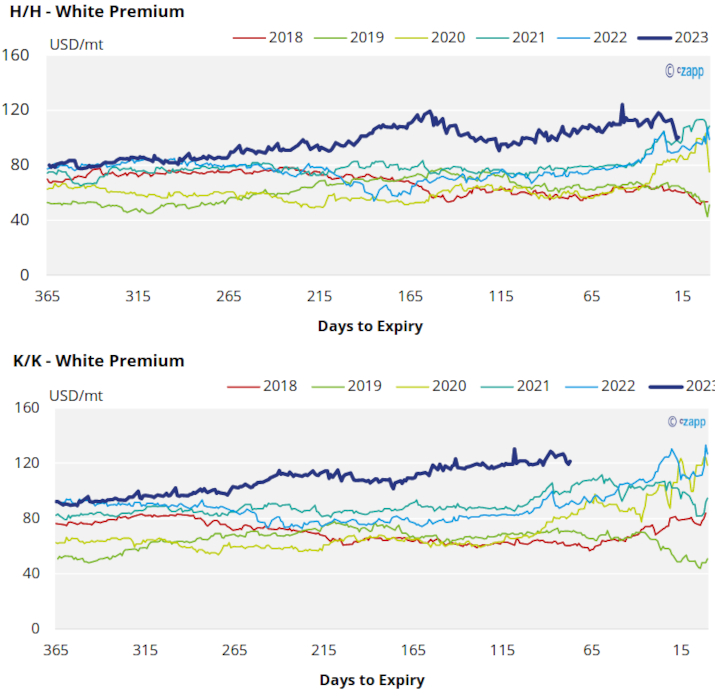

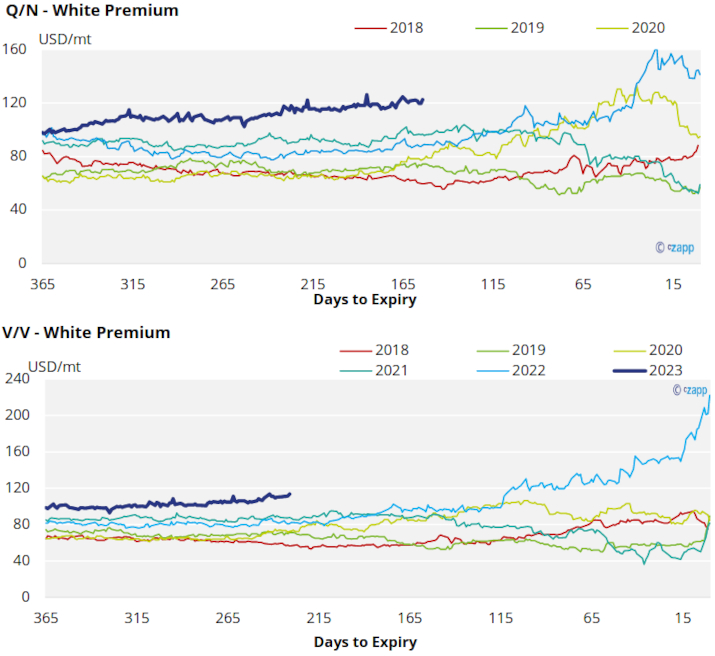

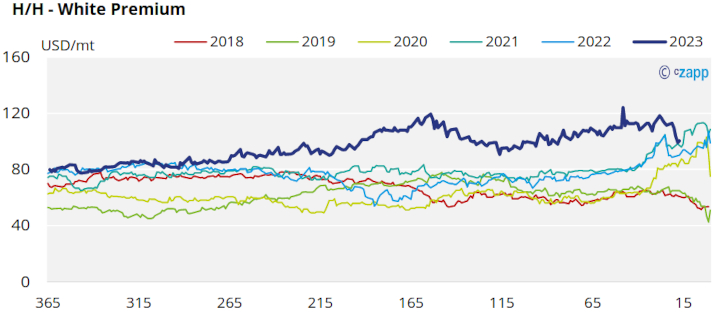

White Premium (Arbitrage)

The H/H sugar white premium dropped significantly, now standing below 100USD/mt.

We think re-exports refiners need around 115-125USD/mt above the No.11 to profitably produce refined sugar which hasn’t been the norm throughout the H/H period, therefore physical values are necessary to bridge this gap.

Comparatively stronger K/K and Q/N white premiums both around 120USD/mt suggest the refined sugar market is likely to be slightly undersupplied for most of 2023.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix