Opinions Focus

- Thailand might be about to phase out E85 fuel.

- Thai motorists are using less ethanol than they were before COVID.

- The Thai ethanol industry needs to find new markets.

Is Thailand About to Drop E85?

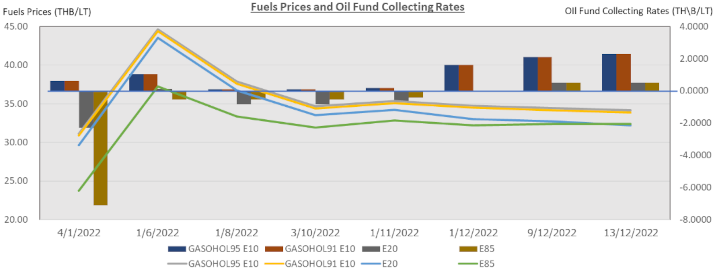

It seems Thai fuel policy has changed. The Energy Policy and Planning Office has defined a new fuel price structure which would make E85 less competitive than E10 and E20 gasohol. This is likely to mean E85 consumption falls.

The new National Oil Plan mentioned that the government will focus and promote electric vehicles ahead of biofuels. Biofuels will still get government support, but not from the oil fund price mechanism, especially after 2027 when only E20 and unblended gasoline are mentioned in the Draft National Oil Plan.

Challenges For the Ethanol Industry

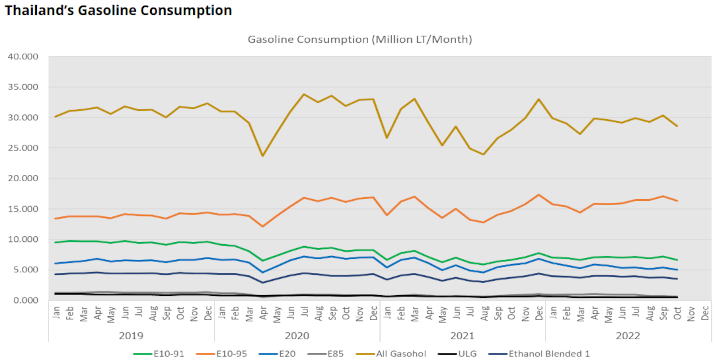

Before COVID, Thai ethanol consumption was around 4.5m litres per day. The Thai ethanol blending program was seen as a success, with the fuel indsutry balancing the gasoline and ethanol price so that demand remained firm, which in turn benefitted Thai sugarcane and cassava farmers who supplied the feedstocks to distilleries.

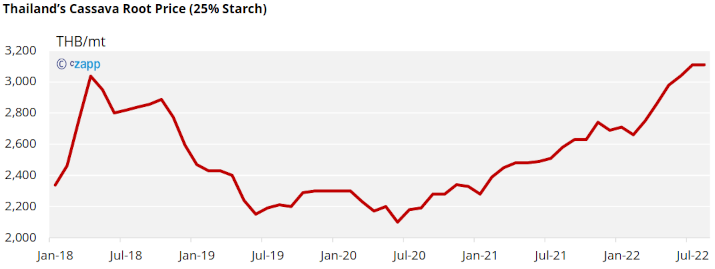

But the COVID pandemic changed everything. Lockdown measures reduced mobility and therefore fuel consumption. This meant less ethanol usage. By 2022 the COVID pandemic was easing, but the Russian invasion of Ukraine played havoc with the world’s food and energy markets, sending most prices higher. Ethanol producers struggled to manage the price volatility: rising sugar and cassava prices meant that ethanol costs of production rose.

Consequently, Thai gasoline and ethanol prices both rose, putting consumers under inflation pressure. Since April 2022, Thai ethanol consumption has fallen, yet overall fuel consumption is growing. Faced with higher prices, motorists have been using lower ethanol blends. From April to October, ethanol consumption dropped from 4.0m litres per day to 3.5m litres per day.

The government tried to intervene by using its Oil Fund to slow the price increases, but the Fund itself ran out of money and needed a loan to continue to function. This may now be the reason why the government is scaling back support for E85, so that it can concentrate on other fuel products.

While the government is therefore aiming to phase out E85 by 2026/27, the decline in ethanol usage may mean E85 ceases before this time, especially if prices continue as they are. Meanwhile, ethanol producers need to find a way to cope in 2023 with consumption declining futher to 3-3.5m litres per day, versus production capacity at 7m liters per day.

New Markets for Ethanol

The Thai Prime Minister declared his vision for Thailand at the APEC meeting in November 2022: to create a Bio-Circular Green economy for the country. This has several implications for the Thai ethanol industry.

One is that ethanol might be allowed to be sold to other industries apart from for road fuel.

Another is that new industries might be incentivised to invest in Thailand to use ethanol to make bioplastics, sustainable aviation fuel, cosmetics, pharmaceuticals, herbal extracts and disinfectants.

The ethanol industry requires clear policies and practical permissions/regulations from the government to move forward. While the fuel blending program reduces, priducers will need to fight for survival until other ways to promote ethanol become viable. The government should ensure no-one is left behind.