Insight Focus

- Raw sugar futures briefly reached a 2022 high last week.

- Raw sugar speculators remain conflicted, adding equal volumes of long and short positions.

- Raw sugar consumers continue to add new hedges at a higher price level than earlier in the year.

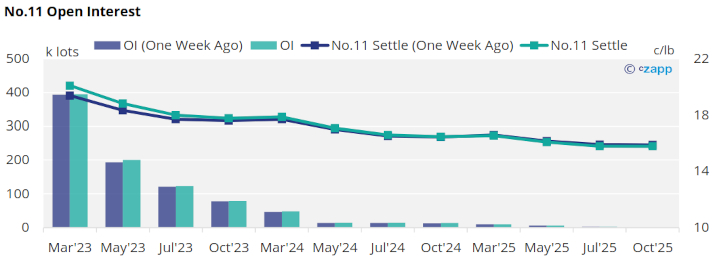

New York No.11 (Raw Sugar)

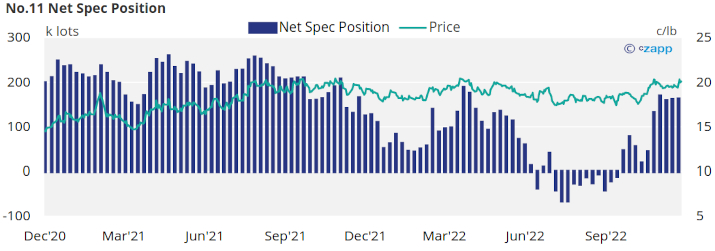

Following two weeks of tightly trading sideways around 19.5c/lb, No.11 raw sugar futures briefly rallied through 20.7c/lb toward the end of last week, closing close to 20c/lb by Friday.

Even if not for long, this represented a new high point for the No.11 in 2022.

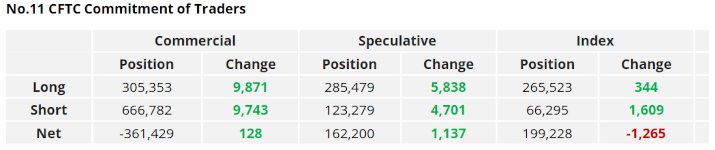

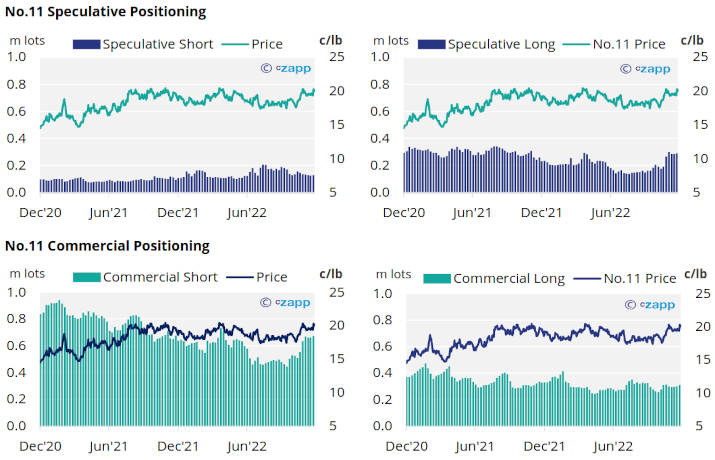

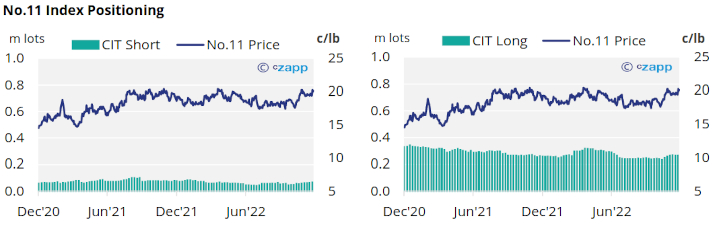

By the 13th of December (latest CoT CFTC), just prior to this rally, speculators added almost equal volumes of new long and short positions, 6k and 5k lots respectively. This could suggest a lack of clear direction for price movement amongst speculators with the raw sugar market trading sideways at the time.

As such the net spec position remains largely unchanged from the previous few weeks at around 160k lots long.

On the commercial side, both raw sugar producers and consumers added new hedges, with the commercial long and short positions extending by 10k lots each.

With the No.11 fluctuating very little over the last few weeks, trading toward the top of the 18-20c/lb range, raw sugar consumers have not had the same opportunity to add new hedges as they had done earlier in the year (when the market offered opportunities around 18c/lb).

New hedges being added despite this could signal a return to hand-to-mouth buying for raw sugar consumers.

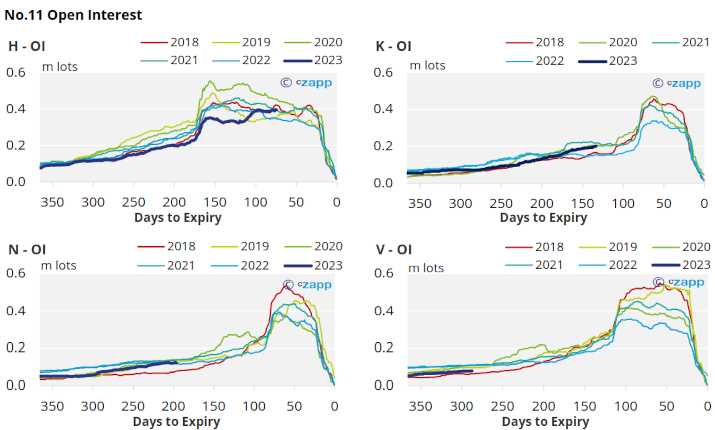

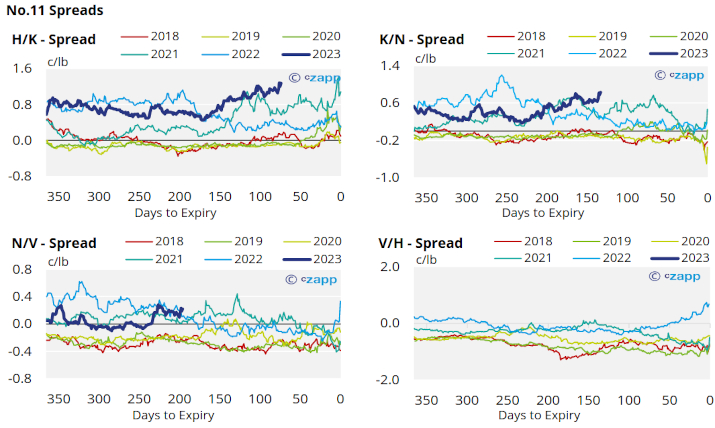

The No.11 forward curve has become increasingly backwardated over the last week, particularly in the nearby contracts, this reflects current tightness in the raw sugar market.

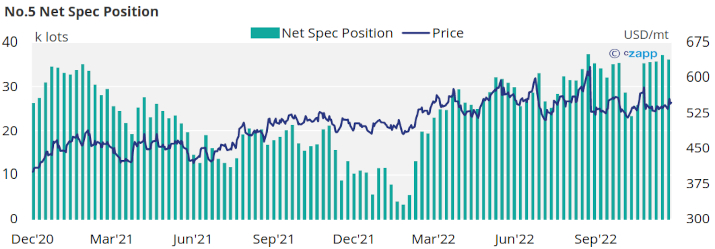

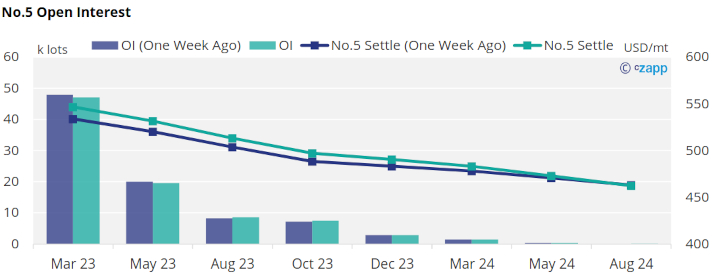

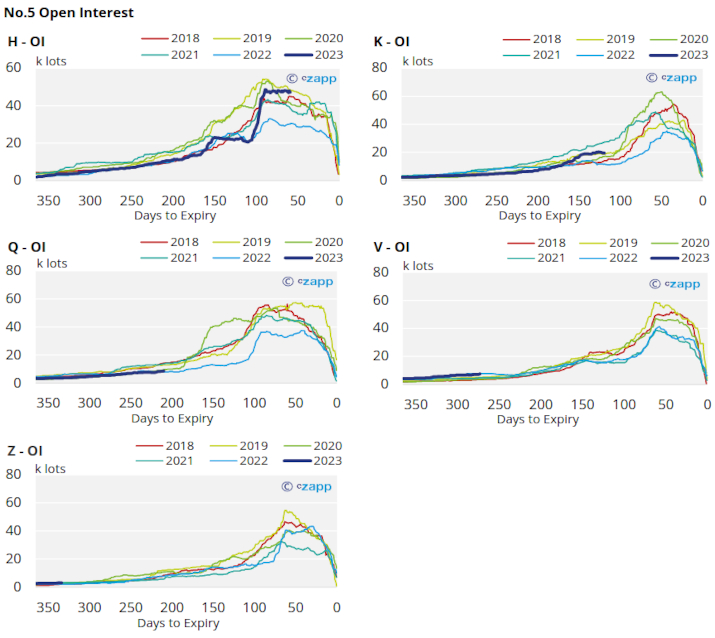

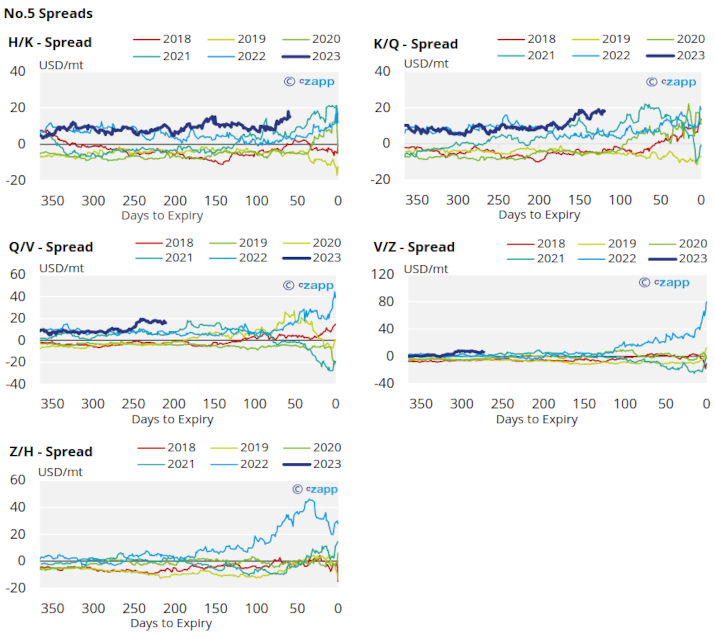

London No.5 (Refined Sugar)

No.5 refined sugar futures also strengthened over the last week briefly breaking through 550USD/mt mark before falling back to 546USD/mt by Friday.

By the 13th of December just before this rally, the net spec position retreated slightly but remains close to 2022 highs.

The No.5 forward curve remains strongly backwardated as far ahead as Aug’24, suggesting a slowly easing market tightness over the next few years.

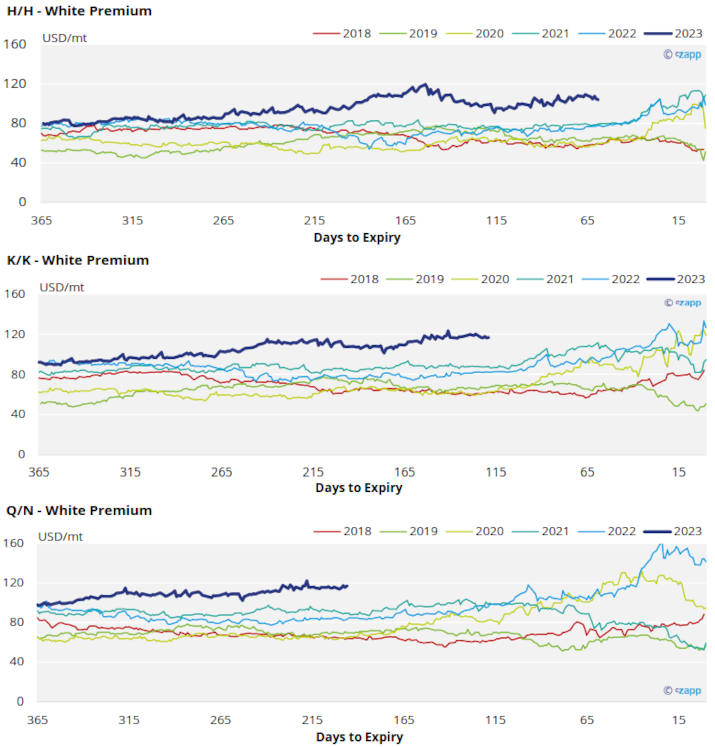

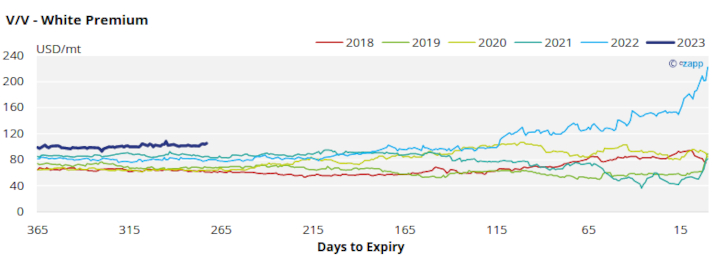

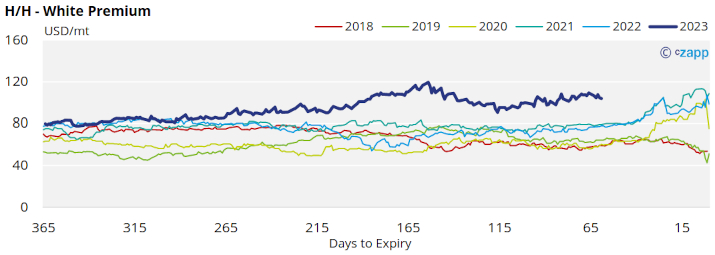

White Premium (Arbitrage)

The H/H sugar white premium has weakened slightly over the last week, falling below 104USD/mt.

We think re-exports refiners need around 120-130USD/mt above the No.11 to profitably produce refined sugar, therefore the current white premium is not strong enough to incentivise this.

The refined sugar market is likely to be slightly undersupplied for the majority of 2023 and this is reflected in comparatively strong K/K and Q/N white premiums which remain stable above 115USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix