Insight Focus

- Indian defaults have pushed the raw sugar market higher.

- This highlights how little spare sugar there is around the world.

- Higher prices are needed to encourage investment in sugar production.

Hello everyone, it’s Stephen from Czapp with an update on the sugar markets for November 2022. Sorry if I sound croaky, I’ve got a cold.

Source: Refinitiv Eikon

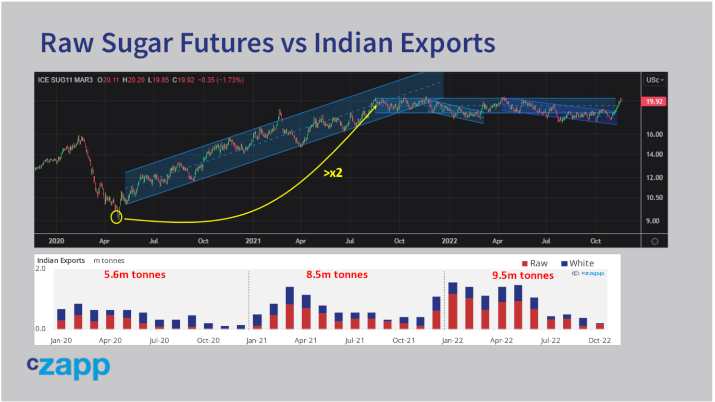

I’ve been scaring people recently by reminding them that raw sugar futures have more-than doubled from 2020 lows of 9c and this was during a time when India has exported more than 20m tonnes of sugar to the world market.

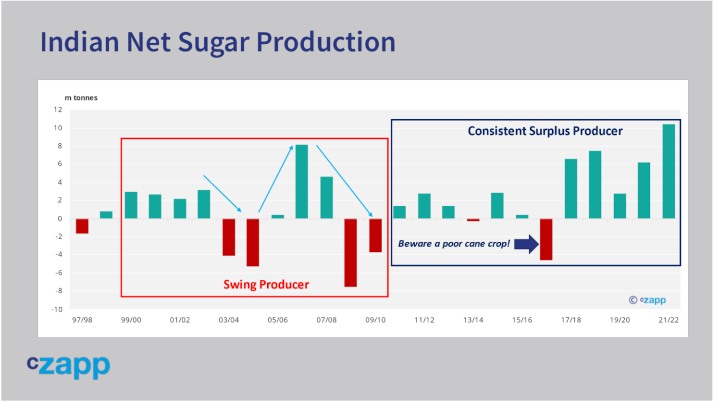

Old-timers in the sugar market will tell you that India used to be famous for swinging from sugar exporter to sugar importer every few years.

Here’s a chart of net Indian sugar production, that is their production with their local consumption subtracted.

India went from sugar exporter in 2000 – 2002 to being an importer in the middle of the decade, then back to being an exporter in 2007 and 2008, before again becoming a sugar importer in 2009 and 2010.

In other words, in the past it’s not always been a reliable exporter.

I can already hear some of you protesting that this time it’s different. India has produced surplus sugar in 10 of the last 12 seasons and so can at last be considered a reliable exporter. It’s doing this without needing subsidies too, finally.

My point about the price doubling just as Indian sugar exports become consistent is to remind people just how vulnerable the sugar market is if there’s a bad sugar crop, not just in India, but among any of the world’s large sugar producers.

Source: Refinitiv Eikon

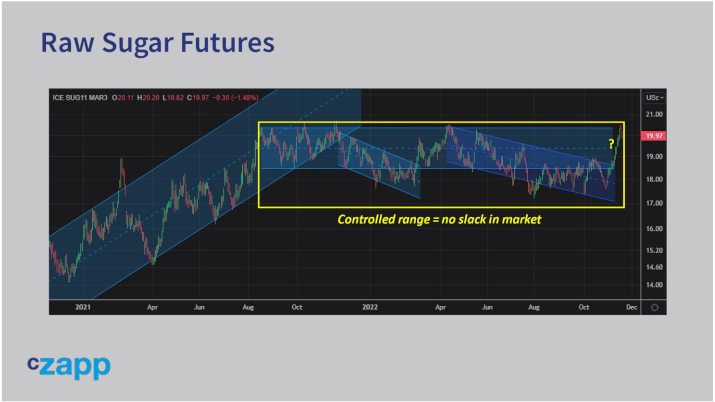

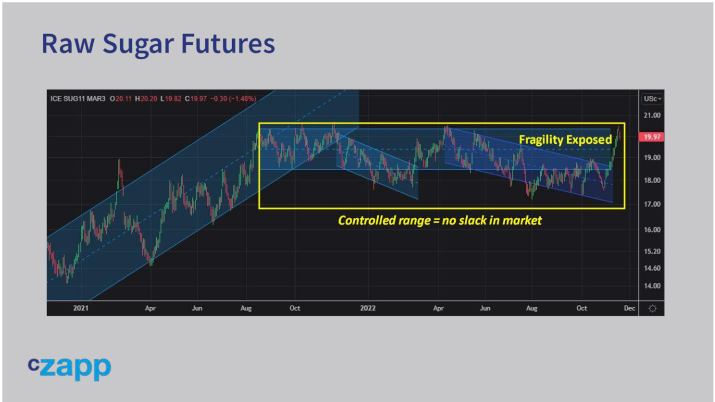

Prices holding between 17c and 21c for the last 15 months are telling you there’s not much slack in the market. But India has just reminded the sugar market that it can be unreliable in other ways.

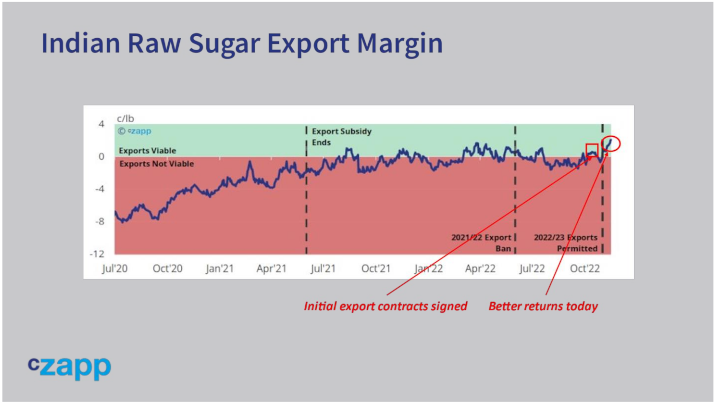

The government control almost all of the sugar sector in India; they recently announced that 6m tonnes of exports would be allowed at first this coming season. That was largely as the market had expected.

But when the announcement was made, some traders started to default on export contracts they had signed in Q3’22 as returns have moved higher since.

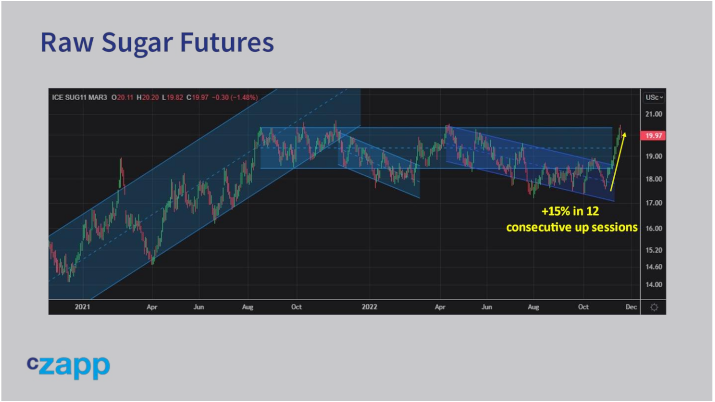

Hedges were lifted in the raw sugar market and this gave the market the kick-start it needed to climb from below 18c to above 20c in a stunning move of 12 consecutive up sessions, the first since 2015.

Source: Refinitiv Eikon

We now think India has only contracted 3.5m tonnes out of the 6m it can offer today. Those trade houses that have been defaulted on are now seeking other sources of supply rather than go back to their original counterparties. But it’s hard to find other sources of supply in the market today.

Spot Brazilian VHP is valued at around 100pts premium to the futures market. Central American raw sugar for January shipment is also at a premium to the futures market, which is rare; it often trades at flat to a discount. Thai raw sugar is indicated at more than 100 points over the futures. Basically, the market needs Indian sugar to be available because there’s not much else around, but is wary about contracting again because of the default risk.

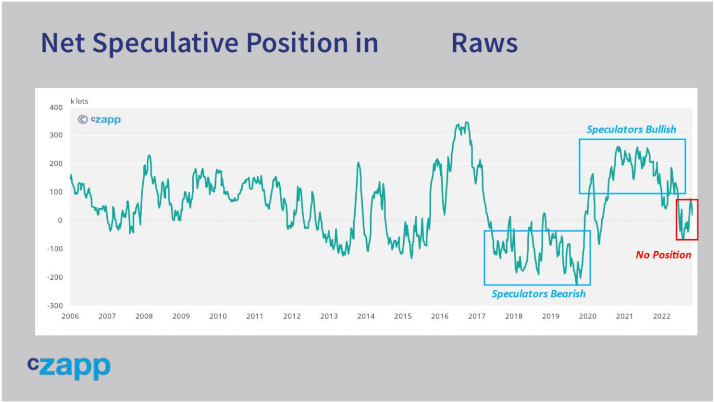

Futures prices are higher as a result. All of this has been achieved without speculative involvement.

Source: Refinitiv Eikon

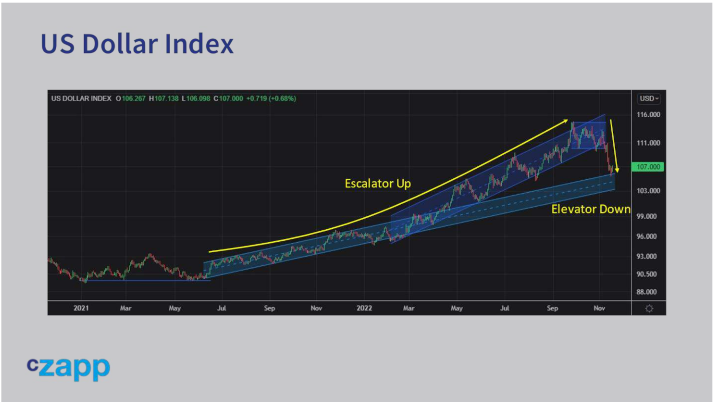

Despite the collapse in the US Dollar, which would normally be positive for commodities, all other things being equal, most other commodities are rather unmoved for the time being.

Source: Refinitiv Eikon

It’s hard to believe they’ve taken outsized positions in sugar in this environment. For a start, given the moves in the Dollar and interest rates, no-one in the world has a good idea about what the value of money is right now. But given the right trigger it’s easy to see how speculators might become interested in commodities once more.

Source: Refinitiv Eikon

This all makes the sugar market look a bit more constructive in the future. The Indian shenanigans have exposed quite how fragile sugar supply around the world is.

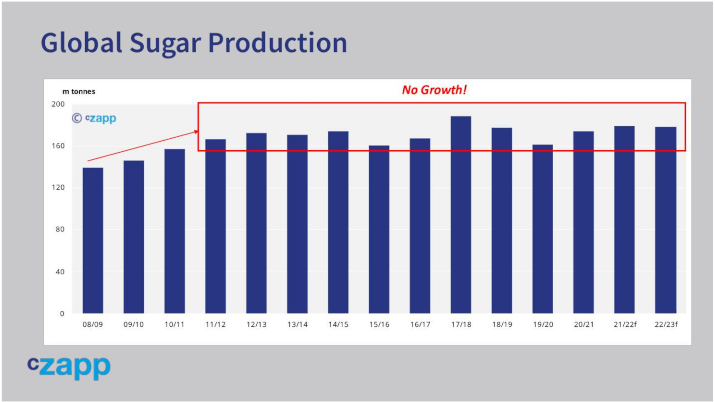

This is a consequence of a decade of low investment in sugar production around the world.

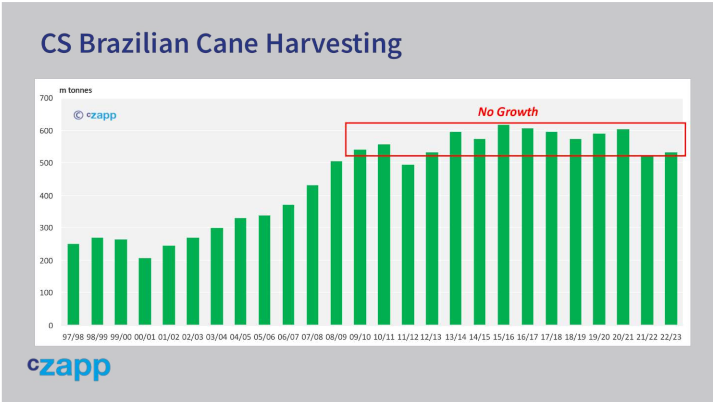

The world’s largest cane region is Centre-South Brazil and here the amount of cane harvested each year has been flat for 14 years. Falling sugar prices and a weakening Real have made it impossible to attract investment in the sector.

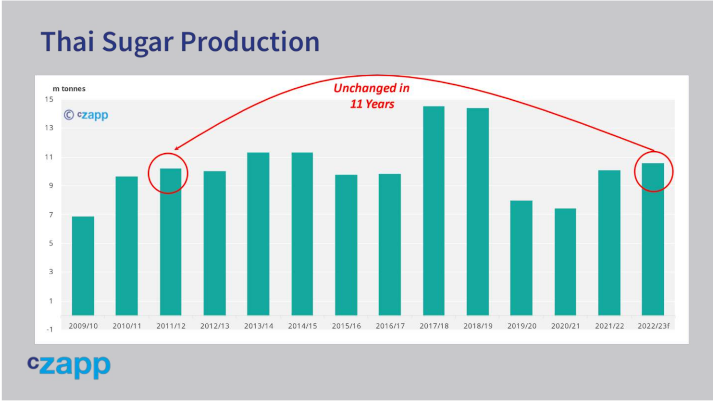

Likewise in Thailand, one of the world’s largest sugar exporters, the industry is making as much sugar now as it did 10 years ago.

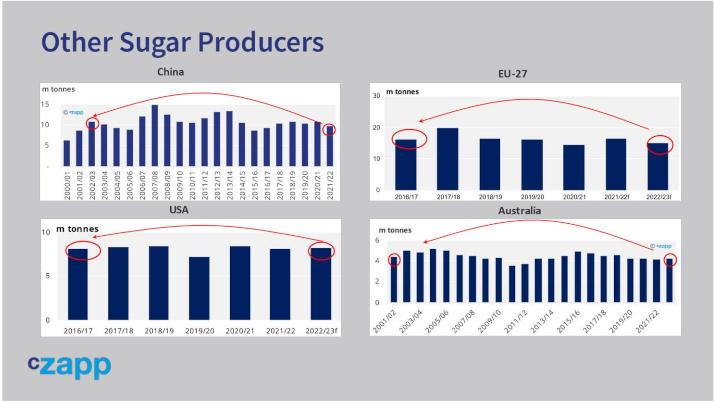

It’s the same story in China, and in Europe, and in the USA, and in Australia.

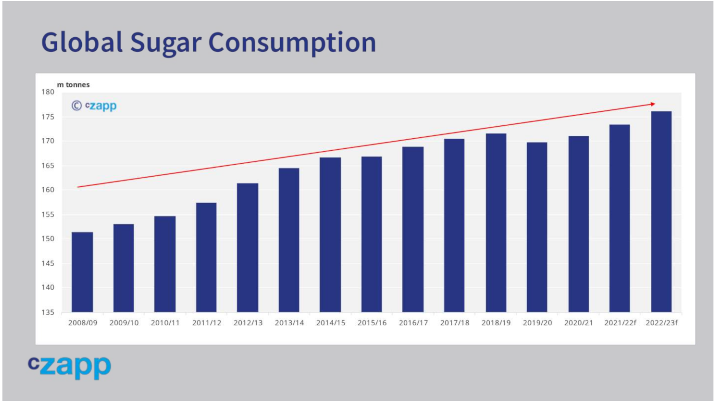

In this past decade sugar consumption has been creeping higher with each year, and there’s now newfound appetite for using sucrose to make ethanol, notably in India.

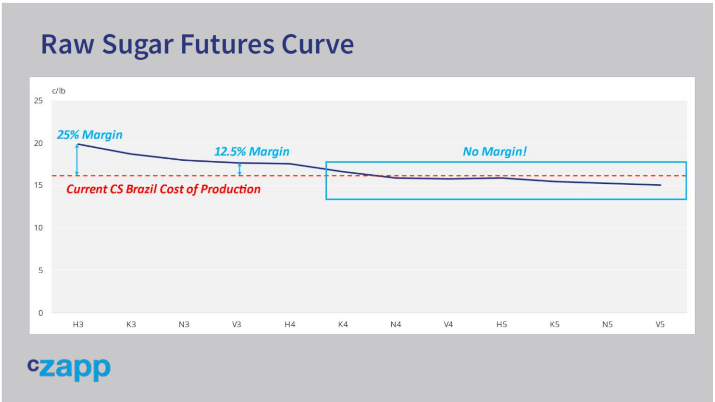

I think this means that the sugar market will need to be higher at some point in 2023, that it’ll break out of the top of 2022’s range. It needs to sustain higher prices for a long enough period of time to attract new investment in cane fields and cane crushing facilities. 18c doesn’t really do it when the cost of sugar production in Centre-South Brazil is close to 16c.

Who is going to invest for a 12.5% return when the local benchmark interest rate is 13.75%? 20c might start to tempt investors if it can be sustained for long enough. This means getting the back of the curve above this level and in an undersupplied market the curve is likely to be backwardated, meaning the front of the curve needs to be higher still. The amazing strength of the past two weeks is just a little warning of what’s likely to come.

That’s everything for this month. Feedback I’d received was that people would appreciate shorter videos that still tried to put the current market into context, so that’s what I’ve tried to deliver this time around. Please let me know what you think. Your comments are really helpful for me.

Finally, remember that we publish a lot of stuff on Czapp.com about many different foods markets, including sugar. Take a look to see how we can help you. Take care.

Other Insights That May Be of Interest…

Frost Risk Alert in CS Brazil Cane Fields

Could US Beet Planting Delays Mean Repeat of 2019 Supply Gap

Explainers That May Be of Interest…

Czapp Explains: The Impact of El Niño and La Niña in Each Region of Brazil