Insight Focus

- Indonesia’s President has announced a plan to become self-sufficient in sugar by 2028.

- It’ll be tricky to achieve; consumption is growing rapidly and the cane sector needs heavy investment.

- Can it succeed?

Ambitious Plans

Politicians frequently question why Indonesia spends so much on importing sugar when the money could be spent on expanding the domestic cane milling sector to make Indonesia self-sufficient. This usually happens when sugar prices are high or the local economy is under pressure.

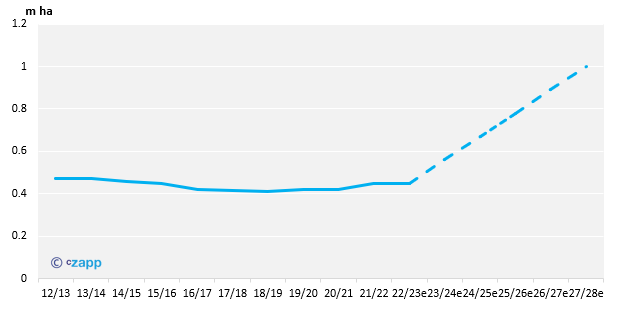

This week President Widodo has announced that Indonesia will become self-sufficient in sugar by 2028 by expanding cane acreage. Indonesia is proposing to expand state-run cane area to 700k ha from 180k ha, not just in the traditional sugar heartland of Java, but also in other regions across the country. This would take total cane acreage in the country to around 1m ha if successful.

The Government is Proposing Major Cane Area Growth

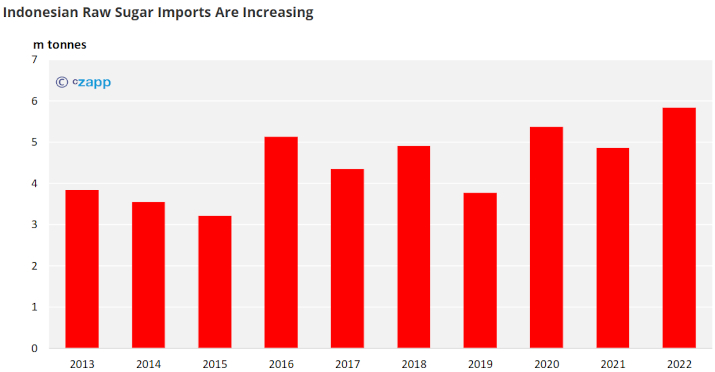

It could have far-reaching effects on the sugar market: Indonesia is one of the world’s largest importers of raw sugar. Each year it takes in around 5m tonnes (12% of world raw sugar trade) to its refineries for conversion to high quality refined sugar for food and beverage companies. It also has a cane milling sector, predominantly of state-run mills built during the Dutch colonial period.

However, each previous attempt at sugar self-sufficiency has failed in the past thanks to several major challenges.

The Cane Sector Needs Investment

There are 62 cane mills in operation in Indonesia, of which 43 are state-owned. Many of these state-owned mills were built during the Dutch colonial era and some still operate machinery that’s almost 100 years old.

These mills won’t be as efficient as newly-equipped plants. 19 mills are privately owned, and this is where the industry’s capacity growth has been in recent years: 7 mills have been built since 2015. But this also shows the scale of the problem: growth in the milling sector has been painfully slow in recent years.

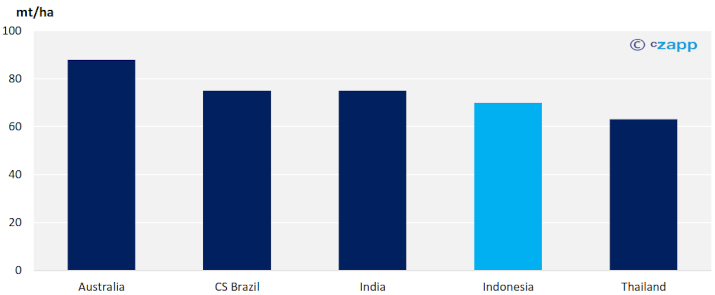

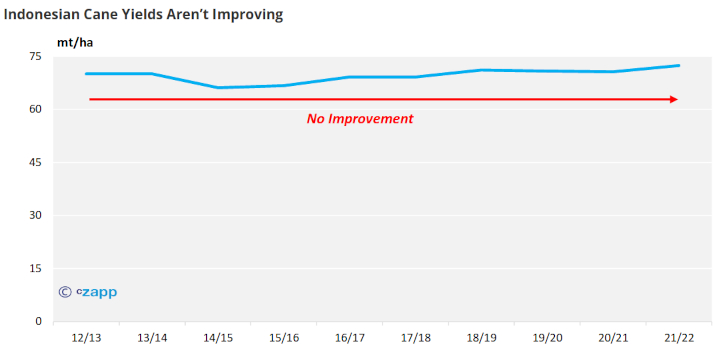

Indonesian Cane Yields Need Improvement

Indonesia typically achieves around 70 tonnes of cane per hectare (mt/ha), which is low compared to other regions like Brazil, India and Australia, where yields typically reach 75-90mt/ha.

One consequence of this is that the cane mills are under-employed. Their nameplate capacity is around 51m tonnes cane per year, yet they only crush around 32m tonnes each year currently. While an increase in cane area could help optimize mill throughput, it might be quicker and cheaper to look to improve cane yields through better land management, cane varieties, field inputs, farming practices and harvest scheduling.

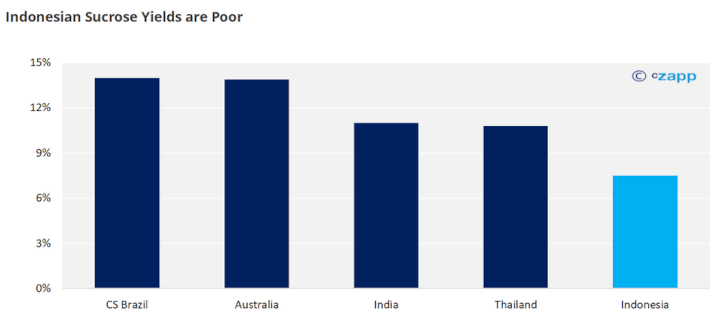

The mills also require investment. They currently make around 2.4m tonnes sugar from 32.2m tonnes of cane, a sucrose yield of just 7.5%. This compares unfavourably with the 10-14% achieved in Brazil, India, Thailand and Australia.

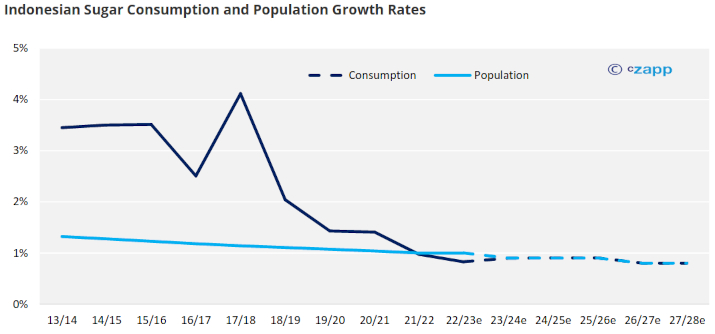

Sugar Consumption Is Growing Quickly

Sugar self-sufficiency isn’t a static target. Today Indonesia consumes around 7.3m tonnes sugar each year. But in the eight years to 2020 (when COVID restrictions disrupted the stats), Indonesian sugar consumption grew at 2.7% per year. This is underpinned by rising wealth. In the future consumption is more likely to grow with population.

This is the Red Queen Effect in action. In Through the Looking Glass, Alice has to run faster and faster to stay in the same place. Likewise with Indonesian sugar production.

If we assume that the UN’s population forecasts to 2028 are correct and also that Indonesian sugar consumption remains at 26kg/person/year at this time, annual consumption will be 7.65m tonnes a year.

Possible Growth Scenarios for Indonesia’s Cane Sector

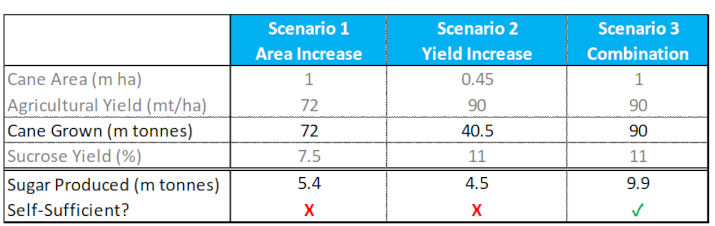

Here are some potential scenarios.

Scenario 1: Cane Area Increase

- Cane acreage increases to 1m tonnes.

- No agricultural yield improvement.

- No sucrose yield improvement.

72m tonnes of cane would be grown, exceeding current milling capacity. The government will need to invest in the mills.

5.4m tonnes sugar would be produced, not enough to be self-sufficient by 2028.

Scenario 2: Yield Increase

- Cane acreage unchanged at today’s 450k ha.

- Agricultural yields increased to 90mt/ha.

- Sucrose yields increased to 11%.

40.5m tonnes of cane would be grown. Indonesia already has the capacity to process this much cane. No further investment would be needed at mills.

4.5m tonnes of sugar would be produced, not enough to be self-sufficient by 2028.

Scenario 3: Cane Area & Yield Increase

- Cane acreage increases to 1m tonnes.

- Agricultural yields increased to 90mt/ha.

- Sucrose yields increased to 11%.

90m tonnes cane would be grown.

9.9m tonnes sugar would be produced. This would make Indonesia a surplus sugar producer.

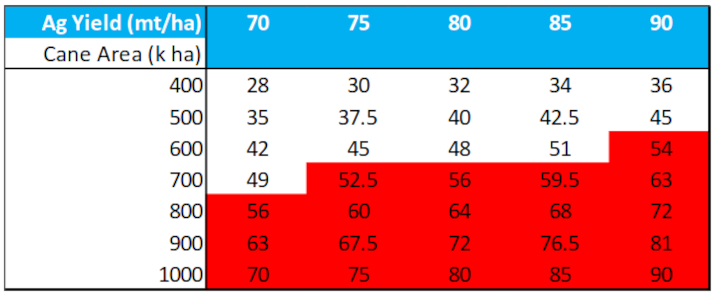

Indonesian Cane Processing Capacity is Currently 51m tonnes Per Year

Matrix shows million tonnes of cane grown under different area and ag yield scenarios.

But the investment required is huge: increasing cane acreage, improving yields and also increasing milling capacity.

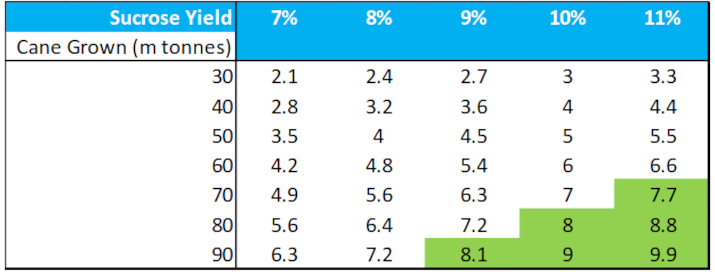

Indonesia Requires Major Yield Increases to Reach Self-Sufficiency

Matrix shows tonnes of sugar produced under different cane tonnage and sucrose yield scenarios

Cz is already helping to modernize the Indonesian cane milling sector, using our consulting and corporate finance expertise. We’re helping the sector increase milling efficiency, generate new revenue from biomass (either through cogeneration or through biomass sales) and to decarbonise.

Talk to Anthony (achase@czarnikow.com) for more information on our biomass and carbon consulting.

Talk to Luis Felipe (Americas; ltrinidade@czarnikow.com) and Stefano (Asia; slavalle@czarnikow.com) for more information on our corporate finance and milling investment capability.

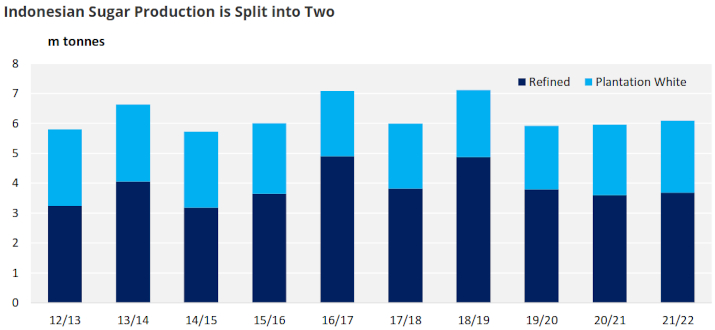

Making Plantation White Sugar or Refined?

The Indonesian sugar market is heavily controlled by the government, who apply strict segregation. Cane mills can only make plantation white sugar for household consumption. Raw sugar refineries can only make refined sugar for industrial food and beverage companies.

This points to a self-sufficiency problem: if refined sugar supply is dependent on imports by law, what does self-sufficiency actually mean? Will mills be allowed to make refined sugar? This would be deeply unpopular with refiners, who might face losing market share. Already the refining sector only operates at around 70% of its capacity.

Consumption growth in Indonesia is stronger in the refined sugar market as the country becomes wealthier and people consume more packaged food and drink. Food and beverage companies are unlikely to want to reformulate products to use plantation whites rather than high-quality refined.

While Indonesia might become self-sufficient in sugar by 2028, this could hide a deficit of refined sugar that will still require raw sugar imports and also a surplus of plantation white sugar which will need to be exported or converted to ethanol. Either way, Indonesia will remain a major raw sugar importer. Plantation white exports will need significant infrastructure improvements from mills to ports to be competitive on the world market given low-cost Thai and Indian regional supply.

None of these challenges are insurmountable if the government is truly serious about reducing its sugar import dependence. But they are significant enough to require real political will. Does Indonesia really have the appetite to modernize the sugar industry so it can compete with the likes of Brazil, India, Thailand and Australia?