Opinions Focus

- Strong Chinese demand for cassava is supporting Thai prices.

- Limited Thai cane expansion means reduced molasses availability.

- This should be supportive for Thai ethanol prices.

Chinese Demand for Thai Cassava Remains Strong

Grains prices worldwide have rallied sharply in the past two years. At first this was thanks to the supply chain disruption following Covid lockdowns, more recently due to the Russian invasion of Ukraine. These higher prices have pushed China to buy more cassava for animal feed and to use as an ethanol feedstock.

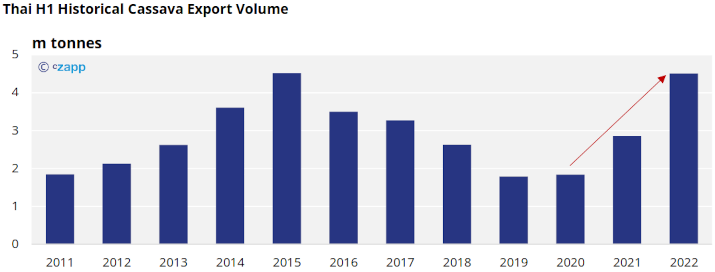

Thai cassava exports have increased as a result. Chip exports stood at 4.5m tonnes in H1’22, up 58% compared to the same period in 2021. Most of these exports are destined for the Chinese animal feed and ethanol industries.

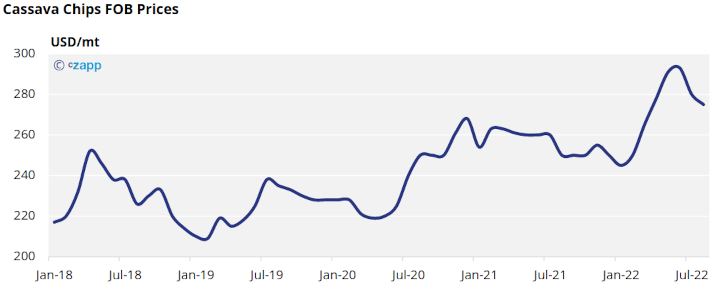

This strong demand for cassava will probably continue, thanks in part to India’s recent decision to ban broken rice exports. Thai cassava chip export prices have been increasing through the year and are currently around $270/mt FOB Koh Sichang. It’s possible prices hit new record levels in the near future.

It’s also possible that Thai cane cultivation doesn’t grow in the coming years. Small farmers have been hit by higher fuel and fertiliser prices, as well as a shortage of farm labour. This could mean that Thai cane harvesting doesn’t exceed 100m tonnes in the short to medium term (down from a high of 135m tonnes in 2017/18). Molasses availability for ethanol production will be lower than hoped for as a result, which potentially means higher molasses prices.

Higher Ethanol Prices in 2023?

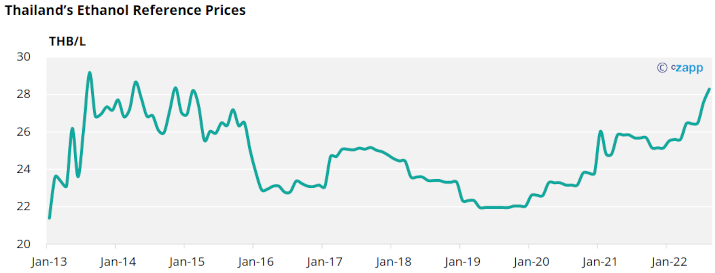

Higher cassava and molasses prices are bad news for Thai ethanol producers, who use both as a feedstock. This will probably support Thai ethanol prices in 2023. We expect the 2023 average ethanol price to range between THB 28-33/litre. A recent tender for Q4’22 closed at almost THB 30/litre. Even at these prices ethanol manufacturers are struggling to break even given high feedstock prices.

The most challenging issue for the ethanol industries in 2023 will be for refineries to accurately predict ethanol consumption and to secure sufficient ethanol at reasonable prices, especially if the Thai government moves ahead with plans to increase the main grade of gasoline from E10 to E20, which could double demand in a short space of time.