Insight Focus

- Refined sugar futures have traded to a 10-year high.

- Demand for refined sugar remains robust.

- Refineries are struggling to find more supply.

….

Refined Market Screams for Supply

The refined sugar market is one of the few commodity markets in the world which is still strengthening.

Source: Refinitiv Eikon

The October’22 contract briefly breached $630/mt just before expiry; hitting a new 10-year high. It seems to be immune from the strength in the US Dollar and rising interest rates around the world, both of which are usually negative for commodity prices.

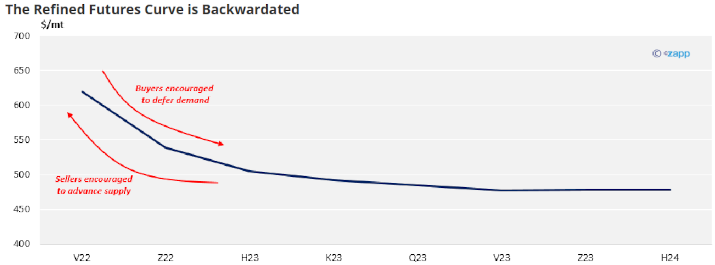

The futures curve is also heavily backwardated, which is a sign of stress in a commodity market. It means nearby prices are more expensive than prices for later on, encouraging consumers to defer demand and encouraging producers to advance supply.

Last night’s October futures expiry was at a huge premium. At time of writing I don’t have details of the expiry itself, but the October/December spread at one point ballooned to +$86/mt.

Source: Refinitiv Eikon

Sugar to be delivered in October and November is hugely more expensive than sugar which could be delivered in December and January. The last time we can recall a refined sugar spread expiring at such a large premium was August 2011, when the futures were above $800/mt. This is a market that’s screaming for supply.

Someone has been caught without deliverable refined sugar ahead of the expiry and so was forced to buy back their futures at huge expense. Perhaps a speculator was late rolling a short spread position or perhaps a trade house/refiner was unexpectedly short physical sugar. The stress in the market is there for all to see.

Refined Sugar Demand Stronger Than Ever

High prices usually trigger quick responses from suppliers and buyers. This doesn’t seem to be happening in the refined sugar market today.

Refined sugar is the form that is most commonly used by major food & beverage companies and eaten by final consumers in wealthier countries, so the persistence of problems in this part of the supply chain is important. But high prices don’t seem to have deterred sugar consumption. Sugar is useful: it acts as a preservative, it caramelises and adds bulk. It can’t be easily substituted in many recipes. It’s also cheap and enjoyable to eat.

During the current cost of living crisis it’s more likely people cut back on expensive foods like meat or dairy than cheaper carbohydrates.

Companies are also likely to be moving away from ‘just-in-time’ logistics and stockpiling following the supply chain problems of the last two years. Rebuilding stocks is positive for demand given the refined sugar market is a Free On Board contract, meaning ownership is transferred from buyer to seller at the port of origin.

In other words, refined sugar demand seems to be robust despite the higher cost of living.

Refined Sugar Suppliers Struggle

Refined sugar suppliers have also been unable to adapt to higher prices.

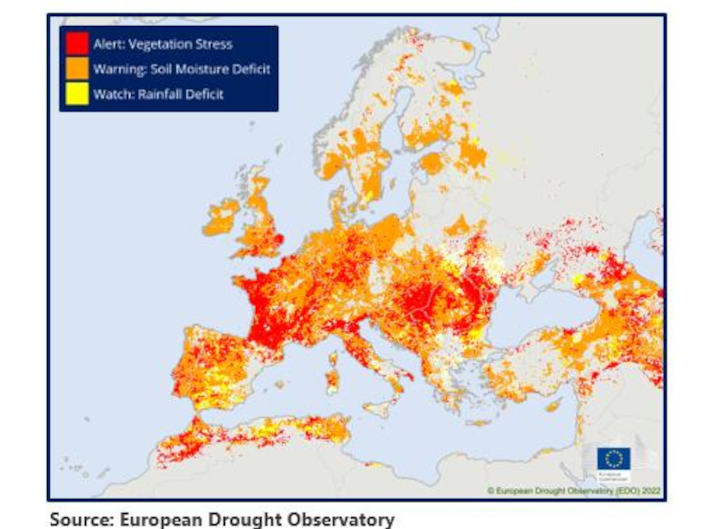

This year’s drought and heatwave in Europe has led to some producers buying back refined export commitments. Europe used to be the world’s largest and cheapest supplier of high quality refined sugar. Today it barely exports any. Local prices are close to levels at which traders can import sugar paying full-duty and producers are grappling with enormous energy bills, so the sugar they make isn’t competitive with other origins any more.

Europe Has Suffered a Drought And Heatwave This Year

These problems won’t be overcome until European energy prices become cheaper, and until we see what European farmers’ planting intentions are in 2023.

Other northern hemisphere refined sugar suppliers tend to make their sugar from cane; northern hemisphere cane harvests won’t begin until Nov/Dec, with the first sugars becoming available for supply at the end of the year.

This means the world is reliant on re-export (toll) refiners in the short term. We need these refiners to respond quickly to higher prices to increase their throughput as far as possible and flood the world with refined sugar supply. Why isn’t this happening? After all, raw sugar prices are falling while refined sugar prices are rising. Cheaper feedstock and more expensive end-products is a refiner’s dream.

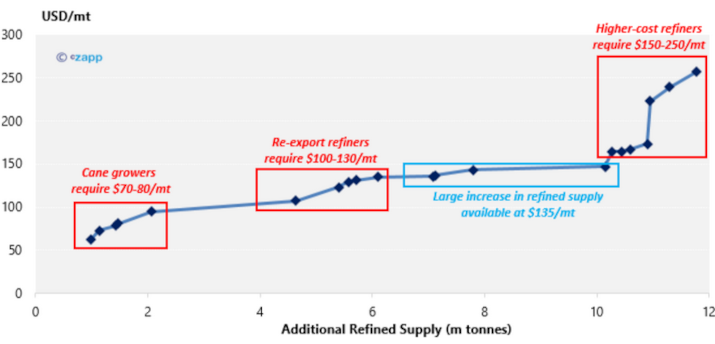

Every refiner is unique: in location, machinery, sugar storage and economics. We calculate for each refiner how much it costs them to convert FOB raw sugar into FOB refined sugar and plot this on a curve to show what price we think is needed to induce more supply. This shows that more and more supply becomes available as refined sugar prices move towards $135/mt over raw sugar prices.

Refined Sugar Supply Increases as Prices Exceed Raw Sugar Values by $135/mt

But getting more supply isn’t just about economics on paper. Events in the real world also count. Today, they are counting against suppliers:

Refiners in Algeria are still unable to operate fully thanks to the government’s ban on exporting sugar. Tunisia is struggling with sugar shortages and so is also unlikely to be prioritising sugar exports. One of the world’s largest sugar refineries is Al-Khaleej Sugars, located at Jebel Ali in Dubai. This is currently operating at a fraction of its export capacity, and has been for much of the last year. Fire damage which affected crystallisation units earlier this year has been fixed, but we are still not seeing much raw sugar being taken into the refinery; it’s clearly not operating at full capacity.

The end result is that neither suppliers nor consumers can respond effectively to the price signals the market is giving. For the time being that means the market will remain stressed in the short term.