Opinions Focus

- Wet weather is affecting New Zealand milk production.

- The USA breaks an 8-month decline in milk production in July.

- European dairy farmers suffer from drought and high energy costs.

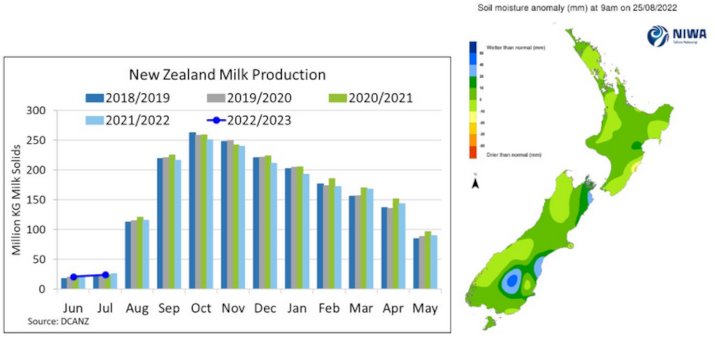

New Zealand: This time last year, the soil moisture map was also very blue, but this season is presenting its own challenges.

Radio New Zealand reported over the weekend that Northland, Tasman/Nelson, Marlborough and West Coast farmers are once again dealing with flooded paddocks, slips, access roads blocked and significant damage following huge volumes of rain falling this week. While the extreme weather has eased, warnings against heavy rain stay in western Tasman and Fiordland on the South Island, forecaster Metservice said on its website. A state of emergency continues in the regions of Marlborough, West Coast and Nelson-Tasman, national emergency officials have said. July milk production was released this week and reported a 5.5% loss on a milksolids basis against a year ago. Given the weather snags throughout August, collections may very well be negative this month as well.

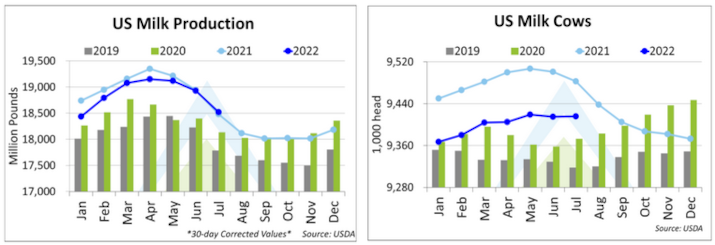

United States: US milk production was higher versus prior year, as expected, but the year-on-year gain was lower than anticipated. Weaker milking herd growth, coupled with several June revisions, meant that July milk output eked out just a slight gain versus one year ago. Critically, June output was revised DOWN by 45 million pounds, making what was initially announced as a 0.2% gain a 0.1% decline after the revision. Given this adjustment, the US actually saw eight consecutive months of weaker milk production, with July marking the first time since October that milk was higher than the previous year.

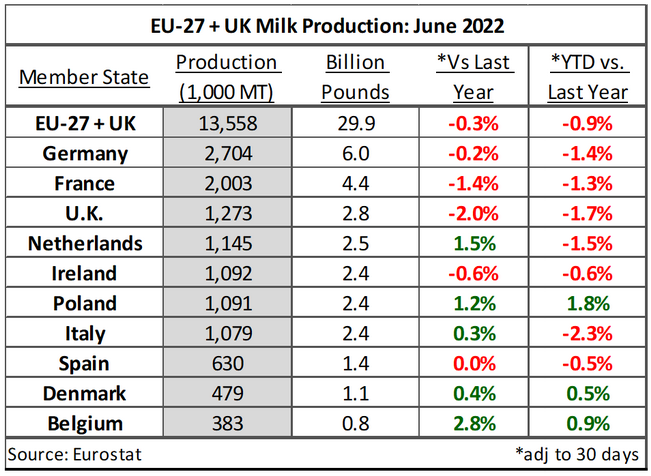

EU27+UK: Losses from Europe have lessened (data remains missing from Sweden and Spain) but still remain negative as key regions continue to struggle with drought and imminent energy restrictions. Even the countries that are reporting year-over-year gains are still experiencing a reduction in milksolids, which will lead to generally weaker commodity production. The Netherlands recorded a 1.5% or +16,900MT milk production gain over prior year, helping to temper overall EU losses during June. Belgium’s milk collections were solid but, in similar fashion to the Netherlands, component levels are well below prior year. Ireland’s milk production is being hampered by rising input prices and Poland’s production figures remain impressive, but the region is not immune to rising costs and incoming concerns about energy restrictions.

For additional comprehensive dairy market analysis, request a free trial at: highgrounddairy.com/free-trial.