Main Points

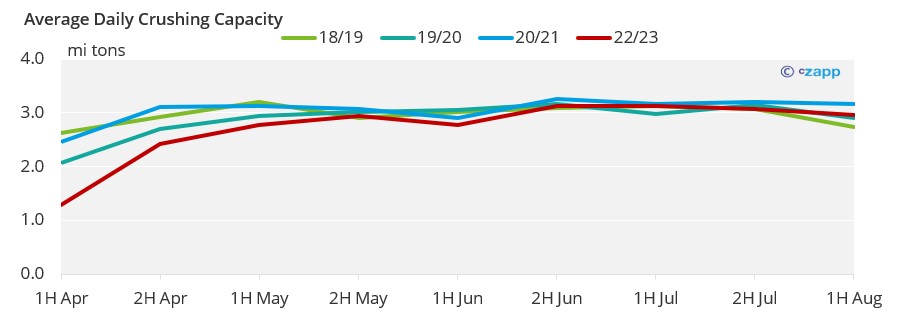

- Crush pace remains below last year.

- So far, cumulative volume cane harvested is 322mmt, 8% below the previous crop.

- Volume of Cane Crush will depend on the number of mills operating from November onwards.

1H August 2022 Production Numbers

Harvest Below Expectations

- 38.62 mmt of cane were crushed in 1Q August – a 13.3% decrease from the previous crop.

- To compare to the previous fortnight, the crushing volume dropped by 10.5mmt.

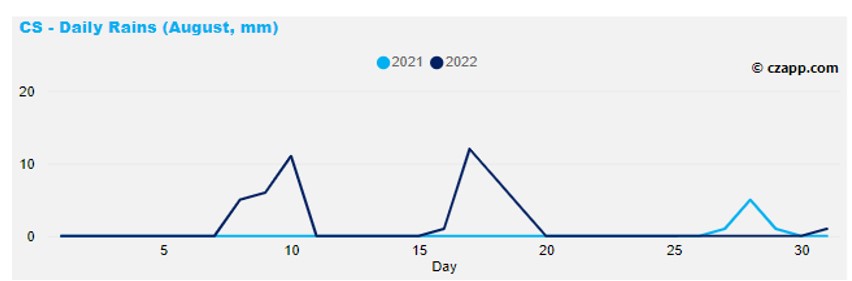

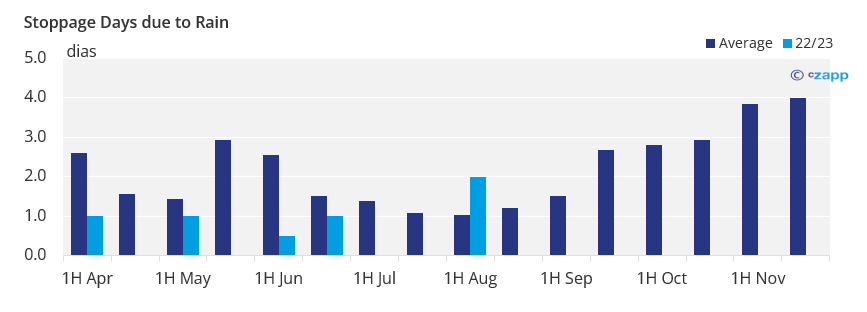

- The lower volume of crushing was a result of the rains registered in the Center South (CS), which disrupted operations, causing up to 2 days of interruptions at the mills.

For more information on rains in sugarcane regions, access our Weather Panel

- Another possible reason for the failure to increase the crushing pace would be logistical congestion.

- We are aware of the unloading difficulties at inland terminals as well as at the ports, and this hinders the flow of sugar withdrawal from the mills.

- For fear of filling their warehouses, they prevent from speeding up the crushing process.

- So far, cumulative harvest volume totals 322mmt – 28mmt less than 2021/22.

- We know some mills already have plans to extend the harvest beyond October.

- And this is necessary for the CS to at least reach the volume equal to 2021/22.

- The problem is that, from September onwards, the rains usually return to impact the region and can compromise the operations of the mills.

- It remains to be seen whether we will see a return to normal weather or another dry year.

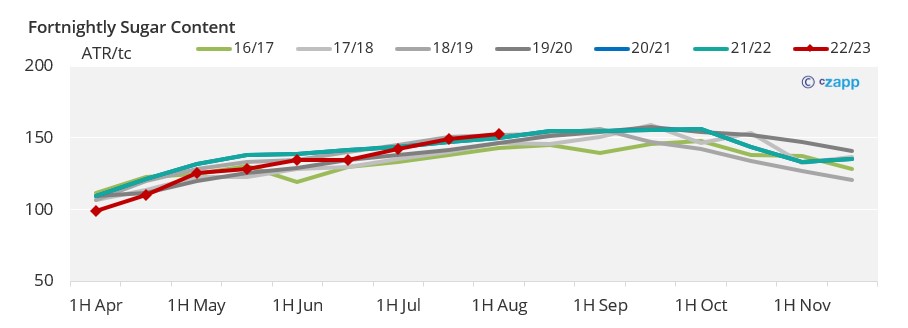

Strong Sugar Content (ATR)

- Even with the rains recorded in recent weeks, the sugar content had a significant increase with 152.5 kg/t.

- Growth of almost 4 kg/tc in relation to the last fortnight.

- Despite the sugar content being above last year, the cumulative value is still 2.8kg/ton below.

- And this can become more worrying as the crop enters the rainy season – when sucrose concentration tends to decrease.

- To have an ideia, for each kilo less of ATR, the expected production of sugar drops by 230 thousand tons.

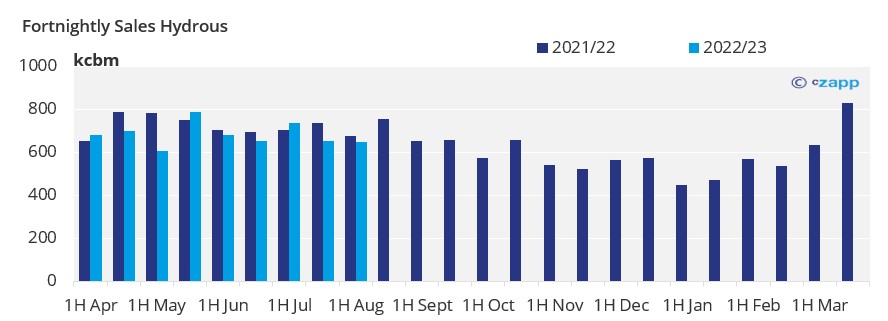

Retraction in Ethanol Sales

- Hydrous sales dropped in the first fortnight of August:

- 645 million litters of ethanol were sold – 6% less than 1Q August 2021

- This move was expected given that the parity at pumps is above 70%.

- With the latest gasoline price reductions made by Petrobras, it remains to be seen whether the response of ethanol at the pumps will be fast enough to bring parity back to competitive levels.

- If delayed, demand should remain weak and below last year’s.

- Which can compromise the view of prices for the off-season.

Other opinions that might be of your interest:

Explainers that might be of your interest: